Case Study - Growing Annuity with mutual funds

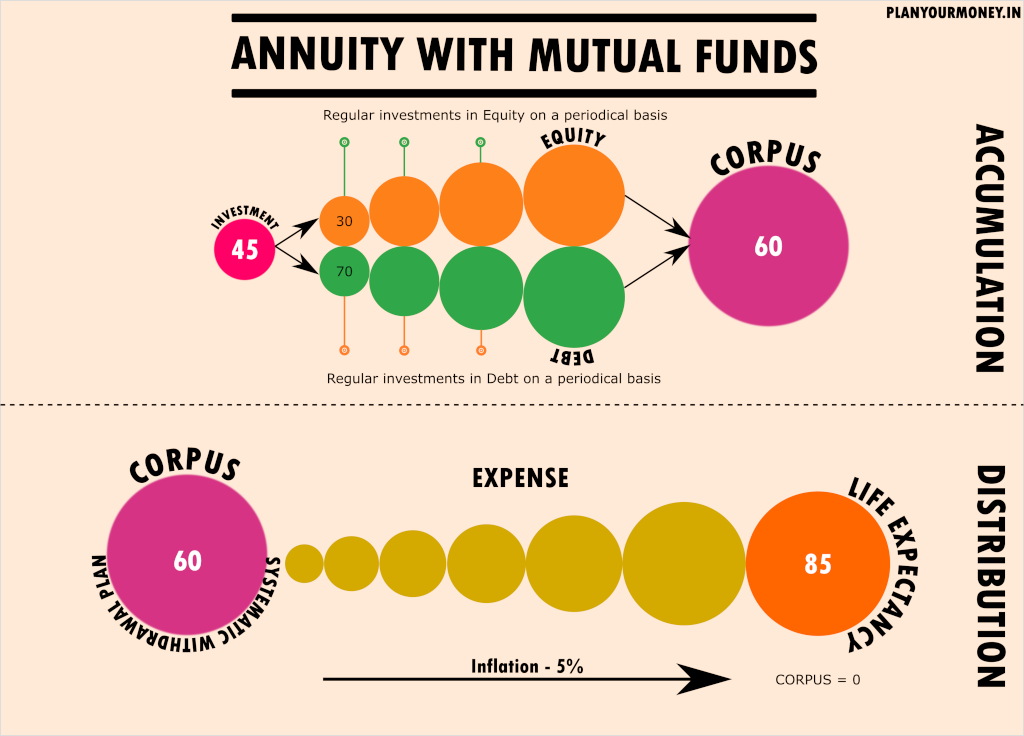

How to construct an annuity with mutual funds ?

Growing Annuity @ Retirement

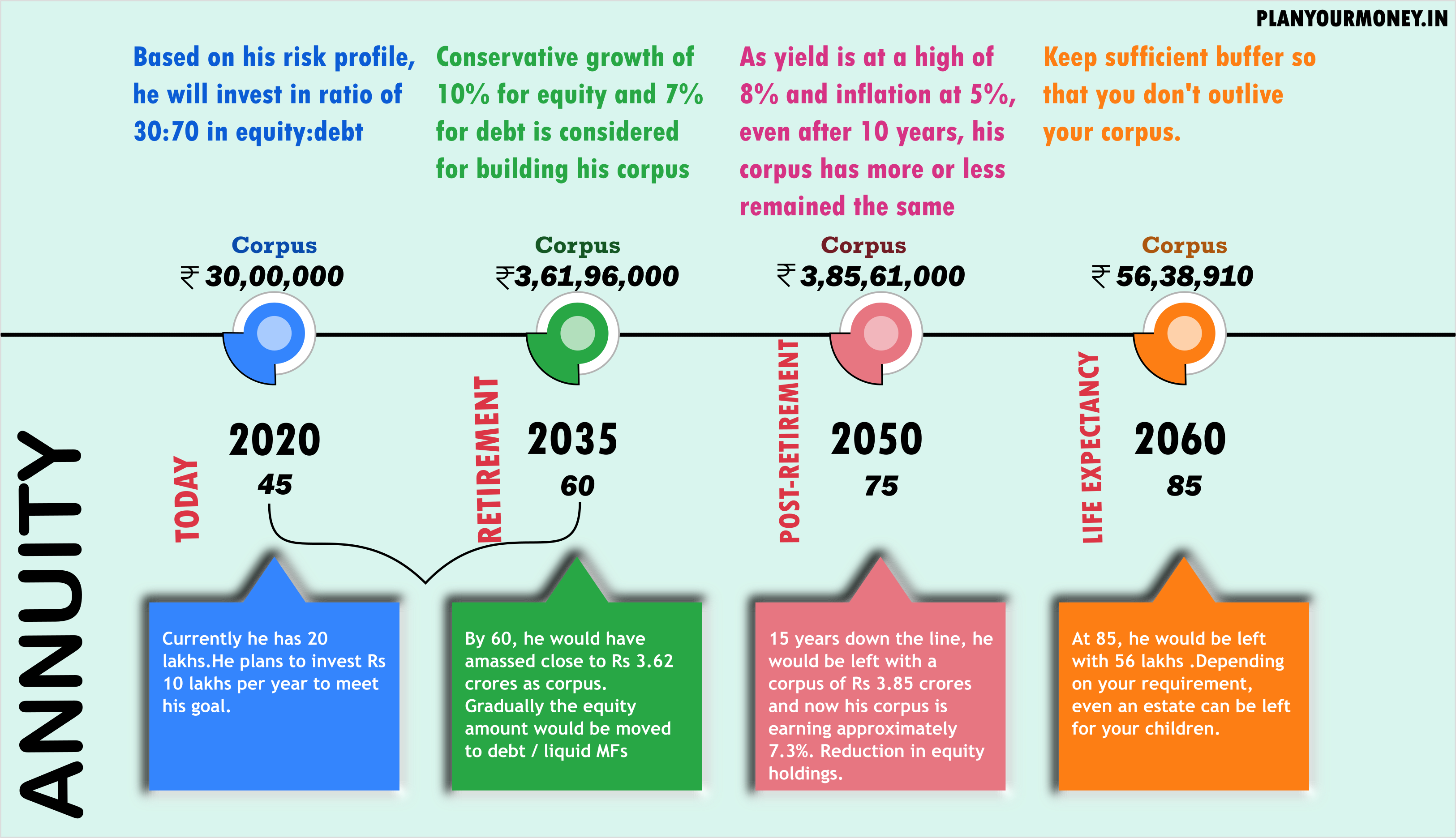

Mahesh is 45 years old and his current expenses are Rs 75,000/- per month . He plans to retire by 60 and would like to have an annuity which would pay him enough for his current expenses. He would like this annuity to increase by 5% every year considering inflation in mind. How much should he start investing now so that it takes of my retirement till 85?

Assumptions

- Inflation is assumed at 5%

- Annuity is required from 60 to 85

- Assume that he gets a return of 8% from 60 to 85

- Equity would provide a conservative return of 10% over the long term (CAGR)

- Debt would give a return of 7% CAGR

What will be my expense at 60 ?

We need to keep in mind the current expenses and inflation to find out his probable expense at 60.

- Mahesh has informed that his current expenses are Rs 75,000 per month

- He is considering an inflation of 5% which is reasonable.

Therefore by 60, his expenses would be approximately Rs 1,55,920 per month which will rise by 5% year on year .

What is the corpus he would require for retirement ?

Mahesh would require a corpus of Rs 3.41 crores considering that he would receive a yield of 8% after retirement and an inflation of 5%. His expense at 60 as we found out earlier will be Rs 18,71,040 annually .

What does he have now ?

- He has about 20 lakhs ready to invest and

- He can put approximately 10 lakhs surplus on a yearly basis till 60 .

What is the required rate of return ?

With the commitment that he has shown that he has ready to invest Rs 20 lakhs and a yearly investment of Rs 10 lakhs, he would require a return of 7.52% post-tax to achieve his corpus.

Annuity - Plan - Mutual Funds

So what next ?

Based on his risk profile, it was suggested that

- He invest in 30:70 ratio in equity and debt respectively.

- This will augur well for him as he would receive an average return of 7.9% pre-tax

- There would be enough room for any tax payments that is required to be made.

- Over a period of 15 years , he would approximately make Rs 3.61 crores

- As he reaches 60, he would stop making investments and initiates a Systematic Withdrawal Plan with the mutual funds

Systematic Withdrawal Plan(SWP) allows an investor to withdraw a fixed or variable amount from his mutual fund scheme on a preset date every month, quarterly, semi annually or annually as per his needs.

- His yearly expense would be credited to his bank account which could be used for his monthly expenses

- As he turns 60, some of his equity investments would slowly be moved to liquid / debt funds

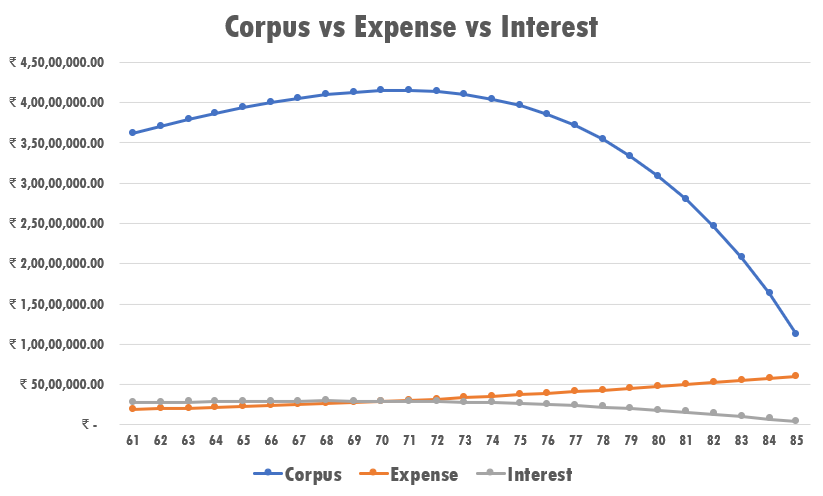

Corpus vs Expense vs Interest

Takeaways

- With the advances in medical science, our lifespan has increased as well. Be prepared for extended life. Ensure you lead a healthy lifestyle.

- Periodically assess where you stand with your finances and see if it is sufficient

- Keep aside a buffer on the corpus that you require , this will help your extended life

- While considering return on debt and equity , be conservative and use conservative numbers

- Medical expenses increases, you may require additional help. You need to consider these expenses as well

- Remember, you can’t earn money easily, when you are old. Organizations pay you for your time and youth. (of course, the wisdom your bring along)

- If you start early, you could have reduced the huge yearly investment and also reduced the amount that you put away as an initial amount.