Journey towards financial independence

My personal journey towards financial independence

I have been recently reading this book called Power of Habit which gives great insights on human psyche. Habits have a profound say in our day-to-day lives :

- The decisions we take,

- How and why small wins matter ?

- The cue, the routine, the reward

- Can we change our habits ?

Michael Phelps, Tony Dungy, Claude Hopkins all have something in common. They all created habits which made them successful.

Similarly, I believe, that if we create financial planning a habit, we all will succeed immensely.

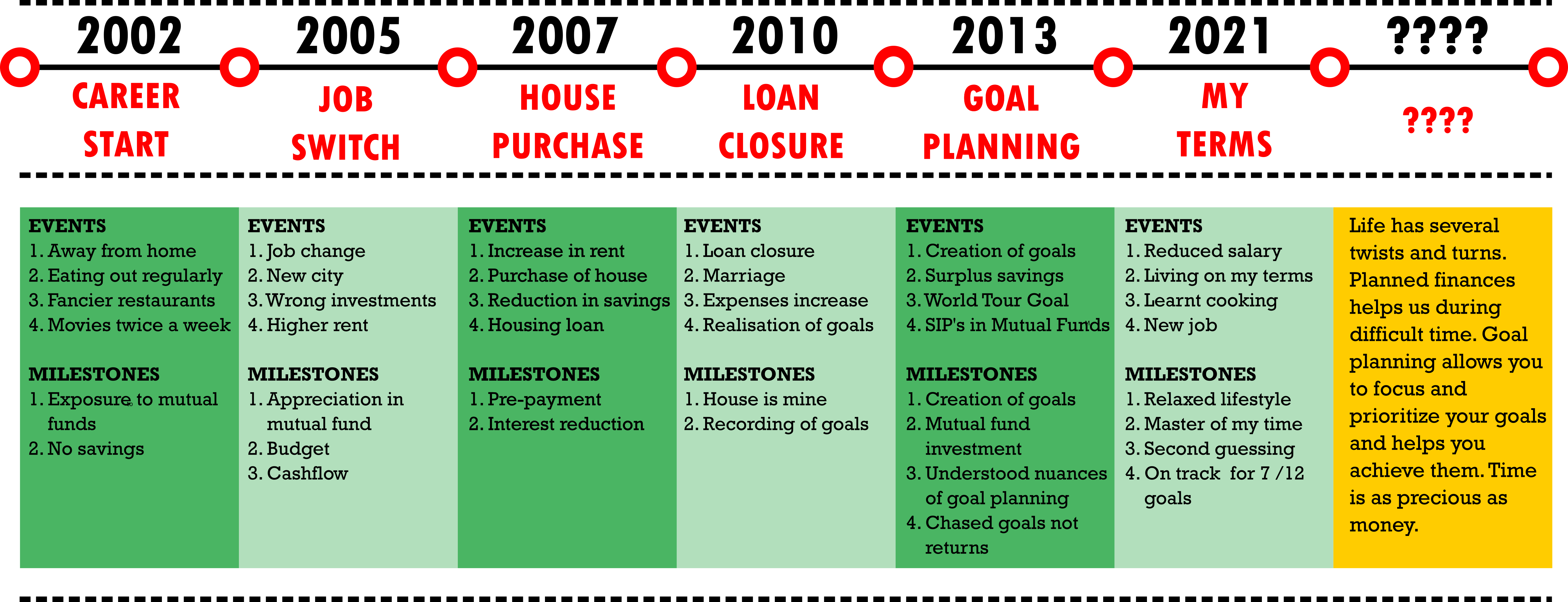

In the below section, I talk about my journey and hope you find something useful. If there was something that I would take away from my journey would be, I should have started financial planning much earlier than I actually did.

2002 - Career started

I got my first job in Nov 2002 at one of the reputed technology (service) companies in Pune. It was my first job. In the initial days, I used to make a meticulous note of my expenditure. This lasted for not more than three months. I shifted my house for a better social interaction and significant changes happened :

- Eating outside was a regular activity

- Eating in fancier restaurants now became a weekly activity

- Movies which was non-existent was happening twice a week

- Frequent purchase of clothes

Milestones

- I invested in a mutual fund for Rs 25,000/- despite having no idea.

- After 2 years of service, I had approximately Rs 10,000/- in my account, lesser than my monthly salary.

2005 - Job Switch

I moved to Bangalore in 2005, got a better salary. I said to my father, “I would be a rich man”.

I was missold ULIP’s multiple times and unsolicited advice poured left, right and center.

I had no idea about the rentals, or the cost of living or the state of public transport in Bangalore.

They were :

-

Public transport in Bangalore was poor in comparison with Mumbai - you required a bike or a car. Travelling was expensive, autos were charging much higher than other places.

-

Rentals were really high. I paid 4 times the rent that I paid in Pune to get the same type of house.

-

Rentals increased by 10% in 2005 as then the demand was high, unlike now.

Positives

-

I redeemed my mutual fund in 2008 at Rs 75,000/- (this is just before the 2008 crash happened)

-

I also started recording my expenses using a tool called GnuCash

-

I prepared a budget every year and found out how far am I going above this. It gave me a sense of my cashflow - income & expenses. It also provided a glimpse into my savings and networth.

2007 - Bought a house

Frequent changes in house, and rental increases, accelerated my dream of buying a house, although reluctantly . Looking back , seems like one of the best decision, I did take.

- I purchased my first house in 2007 with a loan 4 times my gross salary.

- I was paying 11% for the loan I borrowed.

- I was advised that it would be a good idea to prepay the principal at regular intervals to reduce the interest burden.

- This was also the time when I was jittery about my stability in jobs. “What if’s” - running through your head.

- I took 1 month at a time and every quarter , whatever excess money I had, I paid back the principal.

Positives

- I felt quite happy whenever I saw the principal amount getting reduced and interest expense even more significantly.

- The dream of owning the house without any debt would soon become a reality.

2010 - House is mine

By 2010, I was able to pay back my loan. I paid a foreclosure charge to the bank as well .

I owned the house .

After the loan got paid, the job suddenly seemed “stable” . There was a sense of confidence.

I asked myself - my purpose of earning. As I had already paid my loan, except for day-to-day living, I didn’t see any purpose.

I got married and my daughter was born two years later. There was my purpose.

Positives

- I owned the house

- I was having surplus money

2013 - Mutual Fund Journey

I was introduced to Financial Planning and thanks to this - I found out that we have several goals in life and if we allocate our resources accordingly, it becomes easier for us to track our progress. When we have a goal, we have an unwavering focus which helps in achieving our goal.

Some of the common goals that any family would generally have are :

- Retirement

- Purchase of house

- Graduation / Post-graduation for children

- World Tour

- Purchase a car

- Emergency Goal

However, there are certain things that could wreck our best laid plans. Risks that could become issues. Prevention is better than cure, but despite our caution, we could go sick. I had health insurance from my organization but that would not continue if I left my organization or if I retire. If I had to secure my goals, I was required to buy a life insurance. I also started investing in mutual funds on a regular basis and continued for 7 long years. I increased my investment as my salary grew. Till 2019, I have seen my mutual fund grow at a rate of 8.5% (CAGR) which includes a mix of both debt and equity and I was quite happy with that.

Positives

- I kept an emergency goal and kept 6 months of my expenses in that.

- I invested in mutual fund for my goals

- I achieved our world tour goal - we visited 4 countries

2021 - Journey from here

I am on track to achieve 7 out of my 12 goals. I am quite confident that if I work on my plan assiduously, there is a good probability that I will be able to achieve all my goals. 2020 happened and thankfully I didn’t withdraw my money. However, given the uncertainty in the world, we are better off with a financial plan , rather than having no plan at all.

As it has been periodically said, we need to withdraw our money, only when we near our goal . Keeping track of daily events would only be detrimental to your best laid plans and would make you jittery and vulnerable.

Instead of chasing returns, I am chasing my goals.

Summary

- Financial planning keeps you and your family at the centre .

- It gives you a goal to focus and brings a self-discipline.

- It allows you to determine your goals

- It allows you to prioritize your goals

- It helps you determine how much you would need to achieve your goal

- You are chasing your goal and no longer chasing HIGHEST return

- It has a feedback loop - every period that you fix, you find the mistakes and rectify them.

- You don’t have to work till 60 - it is possible to retire early and do the job that you like

- There are two resources : time and money. With money, you end up buying time .

- Your life’s finances should be planned and with it you achieve confidence