Monitoring Mutual Funds

Equity - International Funds - Revisited

International funds have been performing exceptionally well 2 years back and I have seen amazing performances from the mutual funds which are invested in international stocks. However, all this changed in February 2022, after SEBI brought the guideline on international investing. This has vexed a lot of intermediaries and investors. Should we continue with international funds or should we look somewhere else ?

How have international funds performed ?

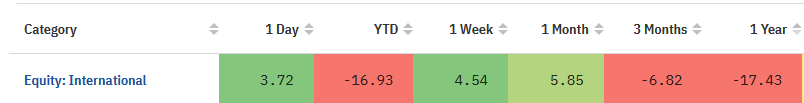

Valueresearchonline.com

International funds till date , since February 2022 have performed poorly. Given that there is a pause in the interest rates, there are reasons to cheer, but is too early to say anything. A mild recession is expected in the new year in Europe and a mild-er recession is expected in USA. There have been huge job cuts across all the IT organizations in USA. This will have a ripple affect across many IT organizations even in India.

What happened ?

In January 2022, SEBI gave an advisory for mutual funds to stop further investments into foreign stocks. Some of the good performing mutual funds were restricted by this advisory. Russia - Ukraine war started around 20th February 2022 and many more events took place whereby international funds took a huge beating. Essentially when you have a good stock, which is dipping in price but have a sound business model, you would buy this stock in regular intervals and average your price. This was now restricted, thanks to the above ruling.

Moreover, now interest rate hikes and layoffs are happening which is going to further exacerbate the situation.

moneycontrol.com

How did this affect investors ?

Till April 2022, we heard assurances that the limit will be increased but this was not happening. Limit will be increased after the budget. Limit will be increased by the FM. Limit will be increased by 1st April 2022. However, we noticed that this was not happening and the performance was dipping across and more pertinent in mutual funds exposed to international stocks. The challenge for the fund manager has been that as mentioned earlier that he cannot even purchase Amazon stock even though it is available at a lesser price. This will affect the performance of such funds. If you notice, the performance of all international funds went down. Performance could go down, but now as a fund manager , I am restricted to buy a good stock at lower valuation.

What was the alternative ?

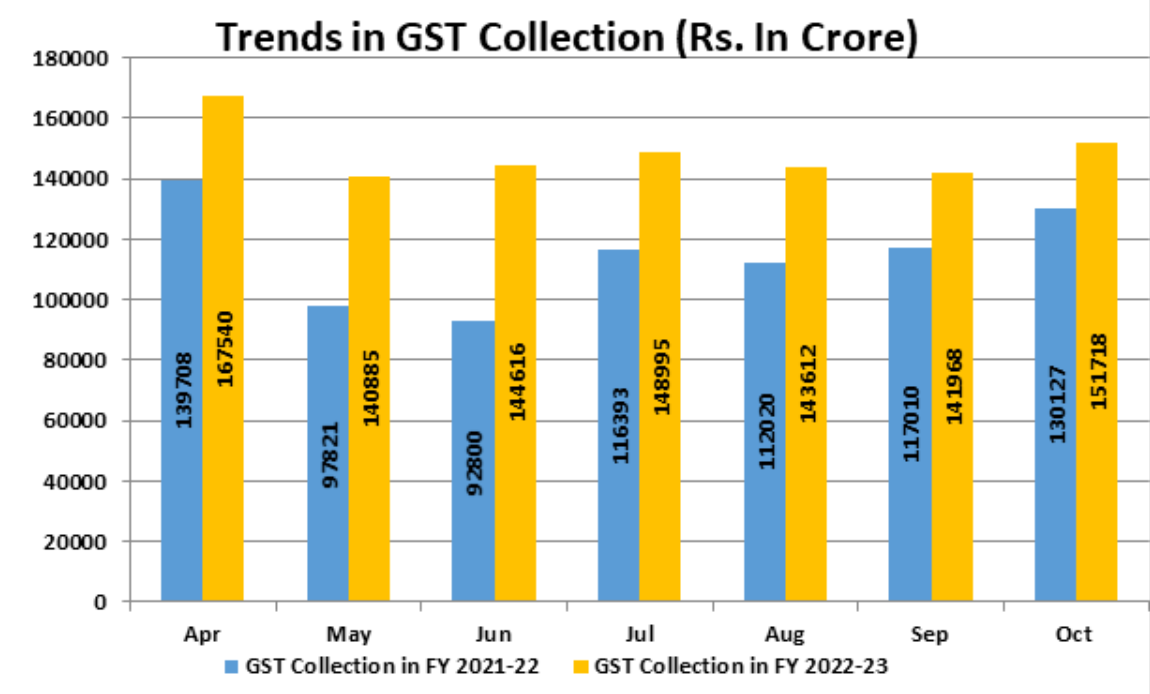

GST collection in India for the year 2022 has been absolutely remarkable. This is a proxy indicator that the businesses have been doing well. Moreover, since the interest rate has been hiked, majority of the banks immediately increased the loan rates and deposit rates were increased only when total deposits were falling. Market forces forced them to increase deposit rates. Banks therefore uniformly have done really well.

GST Collection - GST India website

If you look at it another way, Nifty Bank Index has risen from a low of 33K in June 2022 to a high of 42K by November 2022. All the fund managers that I spoke to clearly indicated that banking stocks will perform well in a quarter.

Banking Stocks - Investing.com

Moreover in PSU stocks have performed significantly well. Coal India has been a standout in my opinion. There have been a sudden move from gas to thermal energy which has also resulted in price increase and volumes have increased significantly.

Therefore in May 2022, I had advised all my clients to move from mutual funds which are exposed to international funds to domestic funds which can perform better and deliver better results. And it did.

What do we learn from this ?

-

We need to monitor our mutual funds on a regular basis and take actions or change our path to reach our desired goal.

-

I am a big fan of these international funds , but at the same time, it was important for me as an intermediary to help my clients achieve their goal.

-

I suggested to all my clients to move from international to a domestic fund and they have reaped the benefits significantly.

-

Some of the domestic funds which has exposure to Banking and PSU have performed significantly. I would have stuck to mutual funds which has international exposure provided they could continue to invest in stocks where the fund manager had conviction and could procure at lower prices.

-

As part of financial planning, it becomes all the more important , if you have a retirement goal and international fund was part of it. If this guideline which was introduced in February 2022 have very less changes, in my opinion, one should avoid it. Moreover, the fund manager’s way of working is restricted and he has to provide better returns with constrained factors.

Even a 1% difference over a period of 20 years makes a huge difference when your investment is in lakhs and therefore the retirement planning which spans for 20 years and more, gets affected even significantly. Hence it becomes important to monitor such funds and choose the right funds for clients

References

Disclaimer : Past returns are not indicative of future returns and this article is NOT suggesting in anyway to buy any of the mutual funds listed in the article.