Parag Parikh Long Term Equity Fund - Revisit - 1

Spotlight - Reviewing the parameters of the fund

In my initial spotlight, I reviewed Parag Parikh and how well it has done giving double digit growth (50%) since April 2020 and 31% since YTD . You would think that it would be quite difficult to keep giving double digit growth. However, since my last review, Parag Parikh Long Term Equity Fund has given a growth of 12%

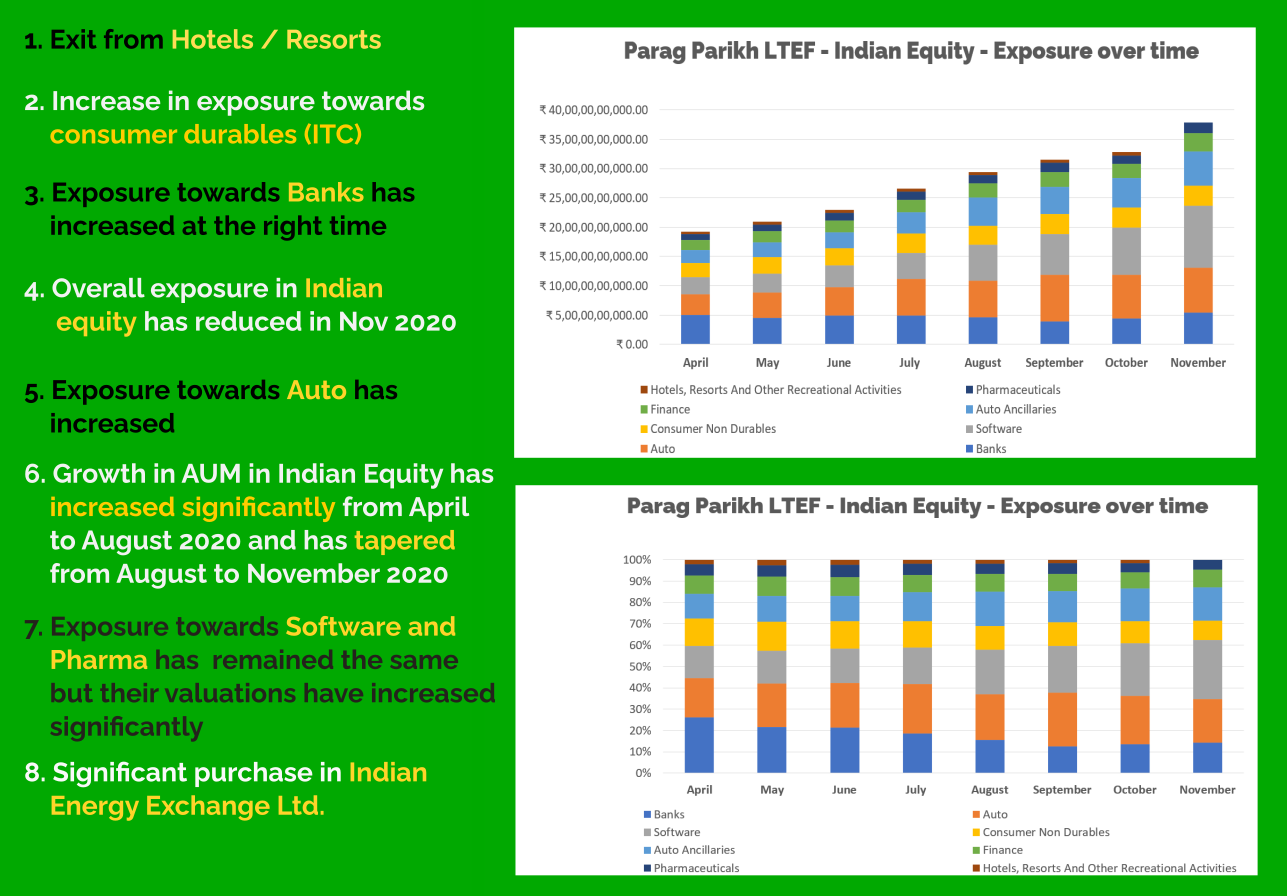

How Parag Parikh LTEF has shifted its sectors ?

Parag Parikh - Sector Exposure

How has the portfolio performed ?

Since the last review,there have been some shifts towards stocks , which I believe will do well in the longer term. The benchmark S&P BSE 500 has given a return of 20% , however, Parag Parikh has lagged at 12% . This being a short term performance is still quite good.

It has picked few winners:

- Persistent Systems - 35.45%

- ICICI Bank - 30.11%

- HDFC Bank - 26.18%

- Balkrishna Industries - 23%

- Mphasis - 22.76%

- Axis Bank - 22.15%

- Indian Energy Exchange - 14.72%

- ITC - 12.05%

- MCX - 7.06%

- Hero Motocorp - 3.89%

It has also increased its stake in Microsoft Corporation and Alphabet (Google) in November 2020.

The gain has also been helped by investments in 4 pharma companies namely :

- Cadila Healthcare (26.91%)

- Dr. Reddy’s Laboratories Ltd. (18.02%)

- Sun Pharma (10.67%)

- Lupin (1.79%)

Completely sold

Mahindra Holidays & Resorts - which it SOLD COMPLETELY in October 2020 has made a 23% gain since April 2020 . This has helped the unitholders as well.

International Stocks

- Alphabet Inc Class C

- Amazon.com Inc. USA

- Microsoft Corporation

- Suzuki

Among the above stocks, Amazon has seen a drop of 10% since September 2020 when it reached it’s 52 week high .Amazon is still the sought after company and given the huge demand in cloud computing, this is still the stock to have. It has recently concluded its AWS:Reinvent Cloud.

Suzuki ADR has also performed really well giving close to 25% .

New Stocks

CAMS has been one of the IPO’s in 2020 and a new entrant in Parag Parikh. As the mutual fund industry grows, this stock is going to grow leaps and bounds .

Arbitrage

There are a special category of funds called Arbitrage Funds which takes advantage of the inefficiencies in spot as well as future. However, this particular fund for November 2020, has taken short position on Infosys and Tata Motors. Moreover, it has also taken short position on currency for December and January 2020.

Name Change

SEBI have laid new regulations for a fund to remain as multicap. Earlier multicap funds only required 65% of the AUM to be invested in equity. However, as per the new rule,

- Minimum 25% should be invested in large cap

- Minimum 25% should be invested in mid cap

- Minimum 25% should be invested in small cap

SEBI on 6th November brought a new circular which had the same requirements of erstwhile multicap with a name change to flexicap .

Thanks to this, Parag Parikh Long Term Value Fund will now be christened to Parag Parikh Flexi Fund .

Conclusion

Short Term performance has been quite good. The fund manager is taking risks to get a better reward. It is to be seen whether these will play out in favour of the fund. This is still a very good fund to be in.

Despite a turbulent year, Parag Parikh Long Term Value Fund (Parag Parikh Flexi Fund) has been doing really well and a good fund to have from a long term perspective .

Disclaimer : Past performance is not indicative of future returns. Please consider your specific investment requirements before choosing a fund.