Back to Basics - Mutual Funds

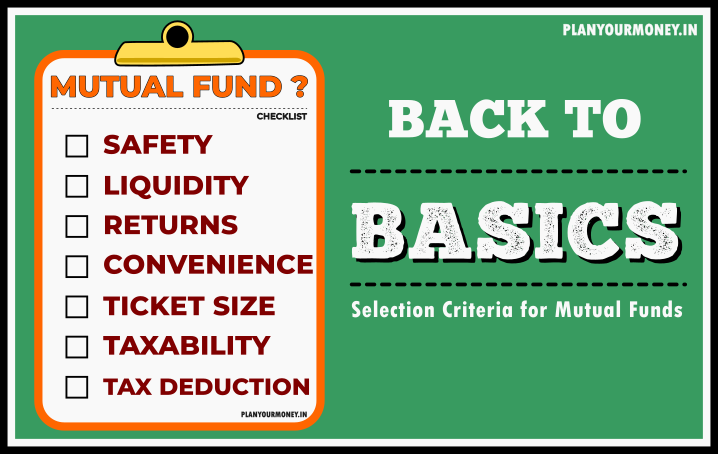

Selection criteria for Mutual Funds

Mutual fund industry has crossed 50 lakh crore mark in January 2024. While it’s common for investors to primarily focus on short-term returns when selecting mutual funds, it’s essential to consider various other factors that play crucial roles in investment decisions.

These include the following :

- Safety

- Liquidity

- Returns

- Convenience

- Ticket Size

- Taxability

- Tax Deduction

Safety

Safety refers to the protection of the capital invested. Investors seek assurance that their investment is secure and not exposed to undue risks.

Liquidity

Liquidity denotes the ease and speed with which an investment can be converted into cash. A liquid investment allows investors to access their funds promptly when needed.

Returns

Returns are a vital aspect of mutual fund selection. Investors analyze the historical performance of funds, typically measured by Compound Annual Growth Rate (CAGR) or Internal Rate of Return (XIRR), to gauge potential returns and compare them with other investment options.

Convenience

Convenience entails the ease of investing and monitoring investments independently, without the need for extensive administrative procedures or third-party assistance.

Ticket Size

Investors consider the minimum investment amount required to participate in a mutual fund scheme. Understanding the ticket size helps investors align their investment capabilities with fund requirements.

Taxability

Tax implications are crucial considerations for investors, particularly regarding the taxation of gains upon redemption. Understanding the tax implications associated with mutual fund investments helps investors make informed decisions.

Tax Deduction

For Equity Linked Savings Schemes (ELSS), which have a lock-in period of three years, investors may benefit from tax deductions under the old tax regime. Evaluating the potential tax benefits of such schemes is essential for investors seeking tax-efficient investment avenues.