5 factors you didn't know about PPF

5 factors about PPF you didn't know

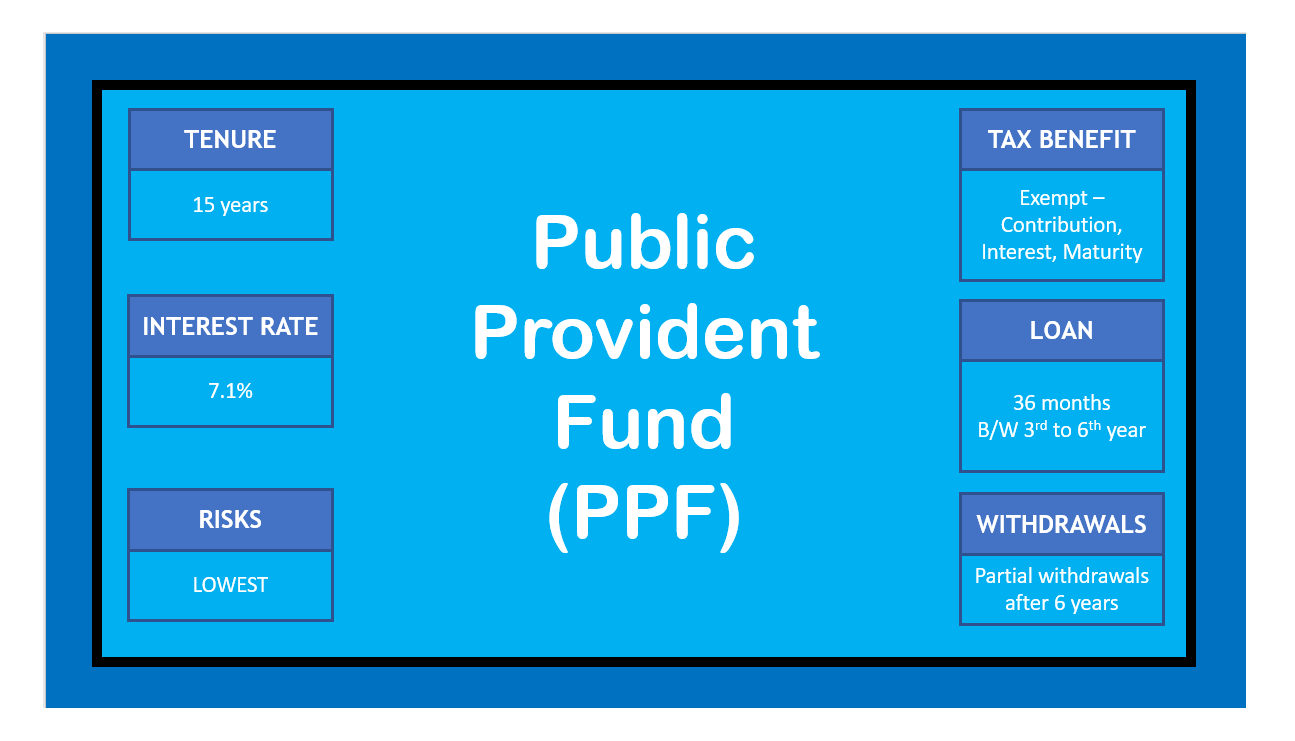

PPF Benefits

1. Loan against PPF

-

If you take a loan against your PPF, this is 1% above the interest that you get in your PPF account. This has been reduced from 2% to 1%.

-

Interest is levied from 1st day of the month in which loan is taken to the last day of the month in which last installment is paid

2. Premature closure of PPF account

- If you would want to close your PPF account prematurely, you need to fill Form 5 for this.

- Premature closure is allowed for serious ailments or life threatening diseases affecting

- Account holder

- Spouse

- Dependent children or parents

- Premature closure is also allowed for higher education

- Account holder

- Dependent children

- Premature closure is also available for change in residency status of account holder

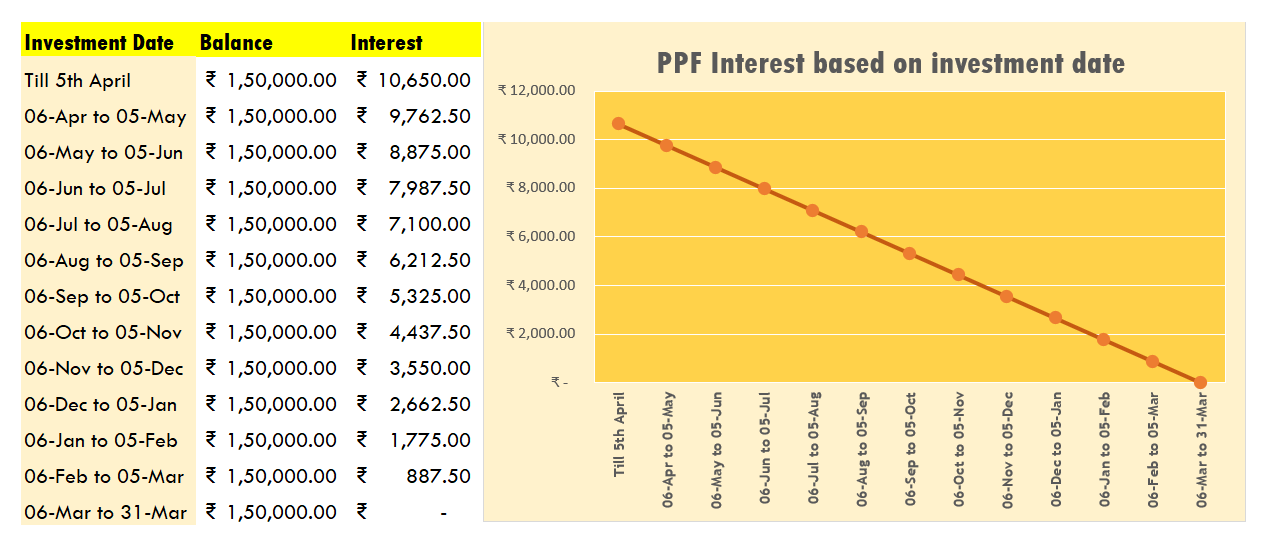

3. Gain maximum from PPF

You can gain maximum benefit from PPF if you invest between 1st and 5th April 2020. If you do this , you will get the benefits of the entire 12 months - you will earn interest for the entire 12 months. In case you invested the money on 6th April 2020, you get the benefit of only 11 months.

PPF - Invest before 5th April

4. Funds in your PPF account cannot be attached

Thanks to PPF scheme, funds in your PPF account cannot be attached by a court order. I hope that you never have to use this clause, but I am sure you feel good knowing this.

5. Government Saving Promotion Act - 1873

On 12th December 2019, Government made changes to PPF Act 1968. It now falls under Government Saving Promotion Act,

1873 - replacing Public Providence Fund Scheme 1968. Public Provident Fund Scheme 2019, the new rules have replaced

all previous PPF rules with immediate effect. In exercise of the powers conferred by section 3A of the Government

Savings Promotion Act, 1873 (5 of 1873), the Central Government hereby rescinds with immediate effect the

Public Provident Fund Scheme, 1968, published vide number G.S.R. 1136(E), dated the 15th June, 1968,

except as respects things done and omitted to be done before such rescission,

says a Gazette notification

issued by the government.