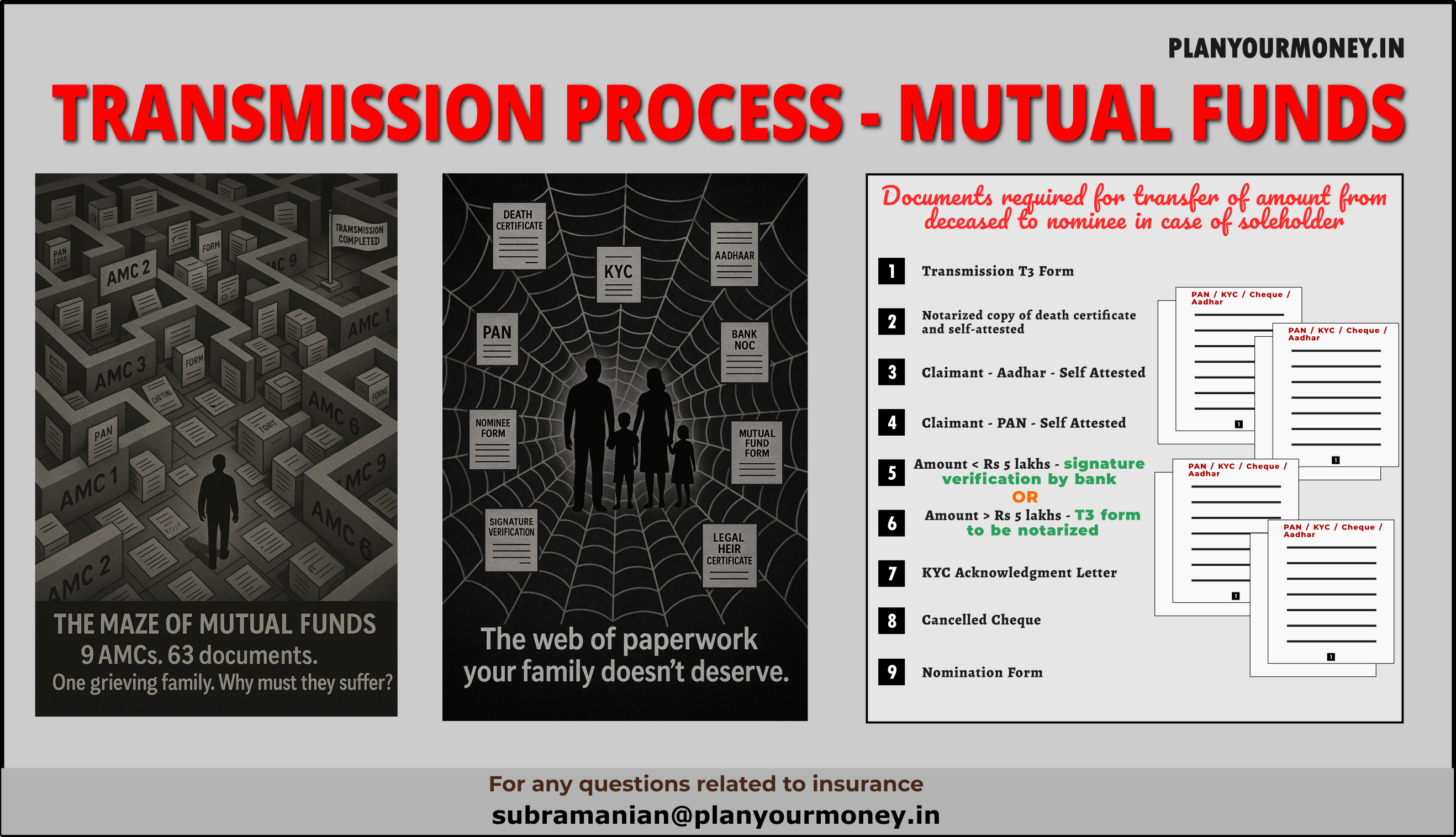

Mutual Fund Transmission

The Hidden Struggles of Mutual Fund Transmission

The Shock and the Start

In January 2025, a woman suddenly lost her husband. Grief aside, she was soon faced with the daunting challenge of claiming her late husband’s mutual fund investments—worth approximately ₹50 lakhs. What followed was a journey filled with administrative hurdles, emotional fatigue, and systemic inefficiencies.