Loan Calculator

Simplifying Loan Repayment with Interactive Tools

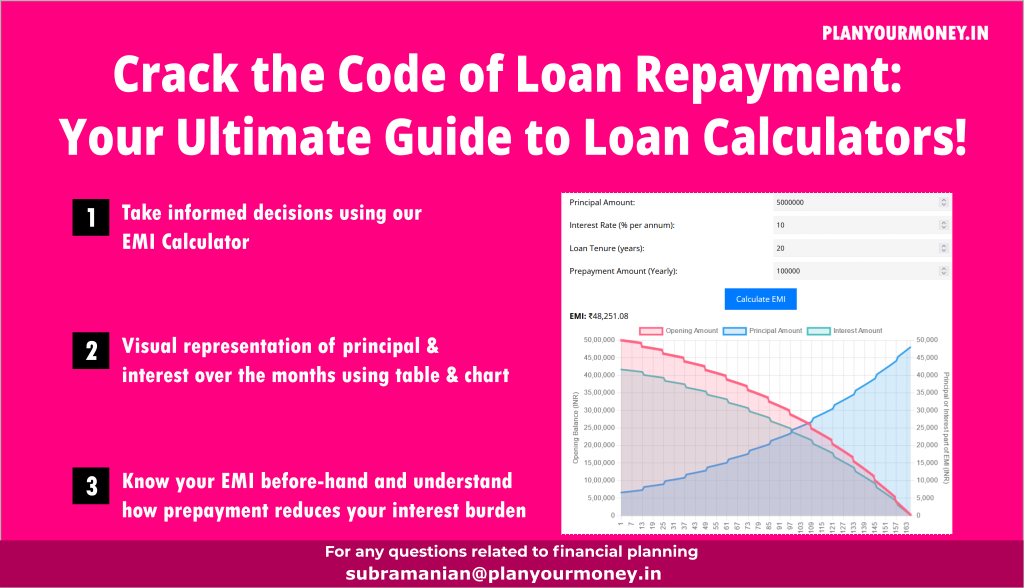

Planning to take out a loan? Understanding how much you’ll need to repay each month is crucial for sound financial management. An EMI Calculator is a powerful tool that simplifies this process and empowers borrowers to make informed decisions about their loans. In this blog, we’ll explore the significance of an EMI Calculator and how it can help you manage your finances effectively.

Why a Loan Calculator Matters?

An EMI Calculator takes the hassle out of loan repayment planning. Whether it’s a home loan, car loan, or personal loan, this nifty tool uses essential inputs like the loan amount, interest rate, and tenure to compute your monthly installments accurately. Knowing your EMIs in advance enables you to budget wisely and avoid any unwelcome surprises down the road.

The EMI Calculation Explained

The calculation behind the EMI is based on a well-established formula that combines both the principal loan amount and the interest component. As you pay your EMIs over time, your outstanding loan balance reduces, bringing you closer to financial freedom.

Table Representation: Visualizing Your Loan Repayment

At the heart of the EMI Calculator lies a user-friendly table that provides a month-by-month breakdown of your EMIs. This table details the installment number, EMI amount, interest component, principal repayment, and the outstanding balance after each payment. The clear and concise layout allows you to track your progress and understand how each payment impacts your loan balance.

Below is a sample table representation of an EMI Calculator’s output:

| Month | Opening Amount | Principal Repayment | Interest Component | Prepayment | Outstanding Balance |

|---|---|---|---|---|---|

| 1 | Rs XXX.XX | Rs XX.XX | Rs XXX.XX | Rs XXX.XX | Rs XXXXX.XX |

| 2 | Rs XXX.XX | Rs XX.XX | Rs XXX.XX | Rs XXX.XX | Rs XXXXX.XX |

| 3 | Rs XXX.XX | Rs XX.XX | Rs XXX.XX | Rs XXX.XX | Rs XXXXX.XX |

| … | … | … | … | … | |

| n | Rs XXX.XX | Rs XX.XX | Rs XXX.XX | Rs XXX.XX | Rs XXXXX.XX |

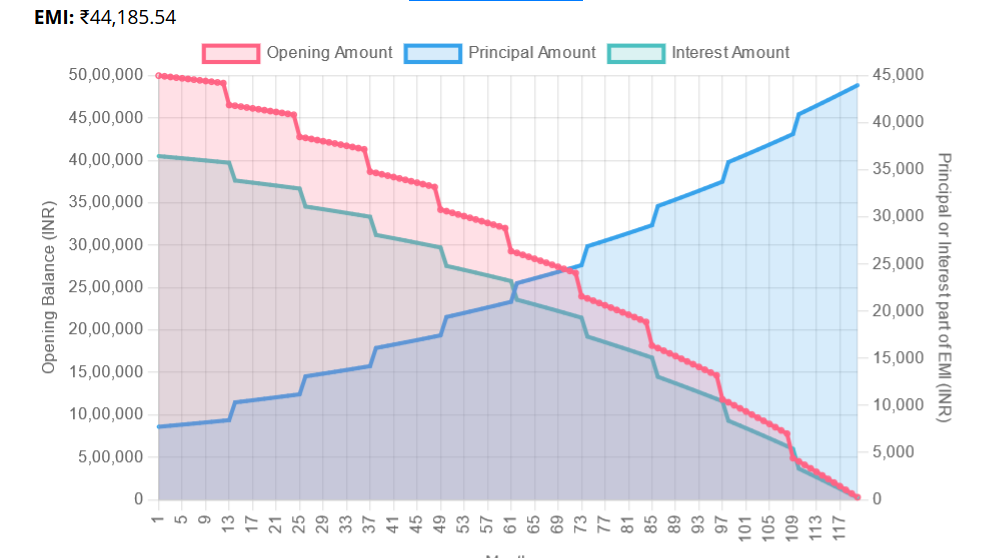

Visualizing Your Journey with Interactive Charts

To complement the table representation, the EMI Calculator features an interactive line chart. The chart visually represents your monthly EMI variations over the loan tenure, allowing you to analyze trends and plan for future financial commitments. This intuitive chart ensures that you stay in control of your finances at all times.

Sample Chart:

Your Feedback Matters!

We believe in continuous improvement, and your feedback is crucial in refining our Loan Calculator to meet your needs effectively. If you encounter any issues or have suggestions for enhancing the calculator’s performance, please don’t hesitate to reach out to us. Your insights are invaluable in making this tool even more user-friendly and reliable. You can reach out to me on my mail or you could leave a comment below.

Conclusion

An EMI Calculator is your trusted companion when it comes to managing loan repayments. With its user-friendly table and interactive chart, you gain a comprehensive understanding of your loan journey and can plan your finances with confidence. Empower yourself with this powerful financial tool and take charge of your loan repayment journey today!

Disclaimer: This blog serves as a general guide on EMI Calculators and loan repayments. For precise calculations and advice, it’s always best to consult with a financial advisor.

| Month | Opening Amount | Principal Amount | Interest Amount | EMI | Prepayment | Balance |

|---|