Navigating PPF Extension

Navigating PPF Extension : A Tale of Banking Challenges and Client Empowerment

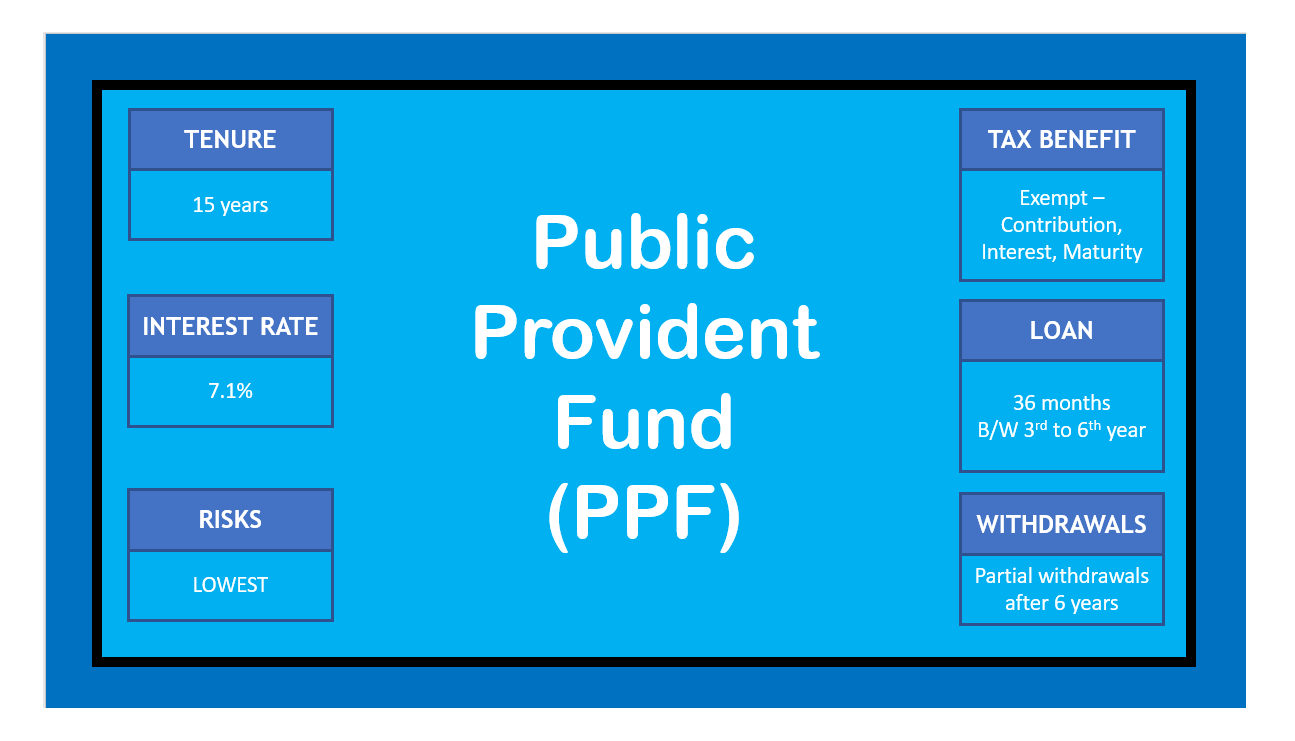

One of my clients initiated their PPF account with a public sector bank approximately 14 years ago. Recently, when they approached the bank for guidance on the next steps, they were informed that the only option was to withdraw the amount and initiate a new PPF account with the same bank.