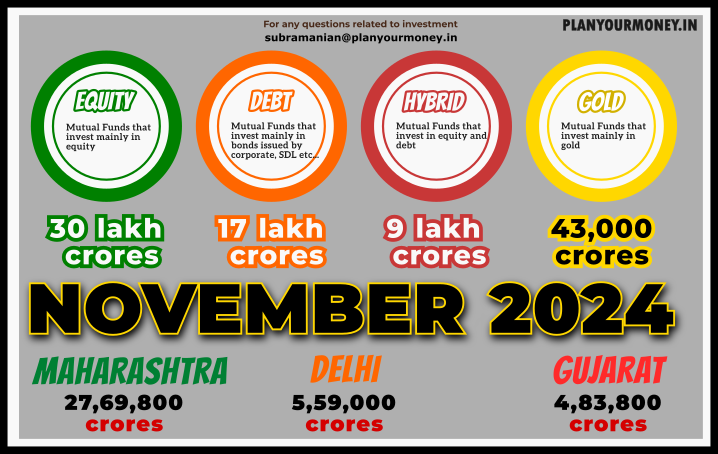

November 2024 : Why Now is the Time to Invest

A Story of Growth: Why Now is the Time to Invest

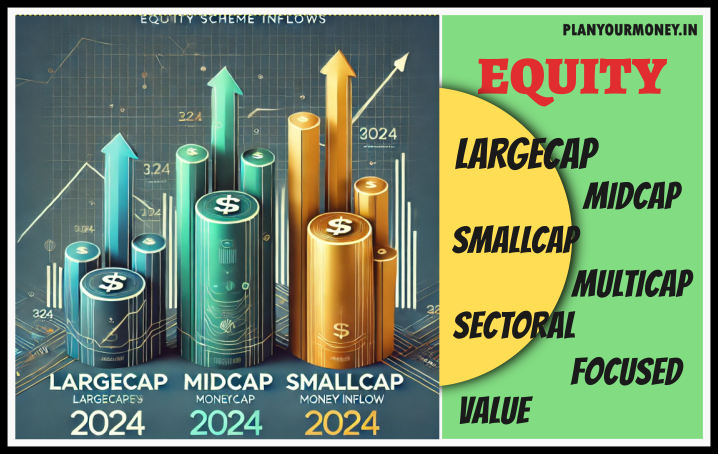

Let me tell you a story of how things have changed in the world of mutual funds—and why this is the perfect time for you to start your investment journey. The Rise of SIPs: A Transformative Decade