True Cost of Owning a Car

The True Cost of Owning a Car: A Breakdown of Taxes Paid to the Government

Owning a car in India is often seen as a milestone of financial independence and convenience. But have you ever paused to consider how much of the money you spend on your car actually goes to the government in the form of taxes? Let’s break it down in simple terms and see how taxes significantly inflate the cost of owning a car.

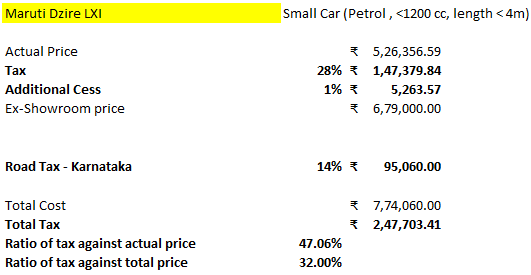

Case Study 1: Maruti Suzuki Dzire LXI

Take the Maruti Suzuki Dzire LXI variant, for instance. The ex-showroom price is Rs 6,79,000. On the surface, this seems reasonable for a small petrol car (engine size <1200cc and length <4m). However, here’s how taxes add up:

-

GST: The GST rate on all cars is 28%. For this car, an additional 1% cess applies, bringing the total indirect tax to 29%. This means Rs 1.53 lakhs of the ex-showroom price goes directly to the government.

-

Actual Car Cost: Without GST and cess, the actual cost of the car would be Rs 5.26 lakhs. That’s the price the manufacturer receives for the car.

-

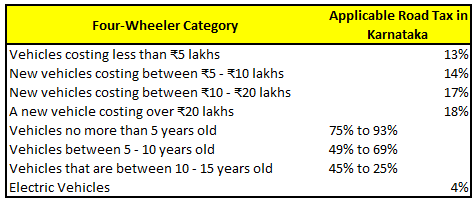

Road Tax: For cars priced between Rs 5 to 10 lakhs, the road tax in many states is around 14%. For the Dzire, this adds another Rs 95,000 to the bill.

Now let’s compute the total:

Total Cost: Rs 7.74 lakhs.

Tax Paid: Rs 2.47 lakhs (32% of the total price).

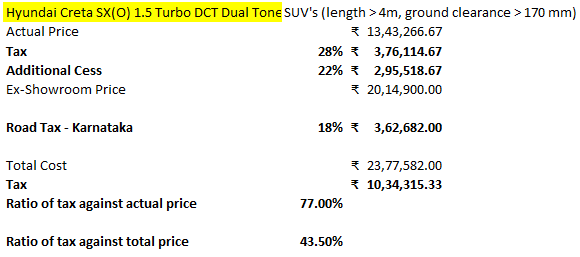

Case Study 2: Hyundai Creta SX(O) 1.5 Turbo DCT Dual Tone

Now consider a more premium SUV, the Hyundai Creta SX(O) 1.5 Turbo DCT Dual Tone. With an ex-showroom price of Rs 20.14 lakhs, it falls into the SUV category due to its length (>4m) and ground clearance (>170 mm). The tax breakdown is even steeper:

-

GST and Cess: This car attracts 28% GST and an additional 22% cess, resulting in an overall tax rate of 50%. Out of the ex-showroom price, Rs 3.76 lakhs goes towards GST and Rs 2.95 lakhs towards the cess.

-

Actual Car Cost: Without taxes, the car would cost Rs 13.43 lakhs.

-

Road Tax: SUVs often have higher road tax rates. For this car, an 18% road tax adds Rs 3.62 lakhs.

Now let’s compute the total:

Total Cost: Rs 23.77 lakhs.

Tax Paid: Rs 10.34 lakhs (44% of the total price).

Hidden Costs: Beyond Ex-Showroom Prices

If the upfront taxes weren’t enough, car ownership comes with recurring tax expenses:

-

Insurance Premiums: Car insurance premiums are subject to 18% GST.

-

Maintenance: Almost every service and spare part replacement involves 18% GST.

-

Fuel: Here’s a rough breakdown of how petrol prices are taxed:

a. Base price: Rs 55.66/litre.

b. Dealer commission: Rs 3.77/litre.

c. Excise duty: Rs 19.90/litre.

d. State sales tax (e.g., Karnataka): 29.84% of the base price, approximately Rs 23.67/litre.

e. Final price: Around Rs 103/litre.

So, for every litre of petrol, nearly 50% of the price is tax.

Income Tax Adds to the Burden

For a salaried individual, buying a car means earning significantly more than its price to cover taxes. For instance, to afford the Hyundai Creta (Rs 23.77 lakhs total), one might need to earn at least Rs 30 lakhs annually. Out of this, Rs 5.9 lakhs would go to income tax. This means a substantial part of your hard-earned money goes to the government before you even purchase the car.

Why Do We Pay So Much Tax on Cars?

Governments justify high taxes on cars as a measure to:

1. Discourage private vehicle use and reduce pollution.

2. Generate revenue for infrastructure projects like road development.

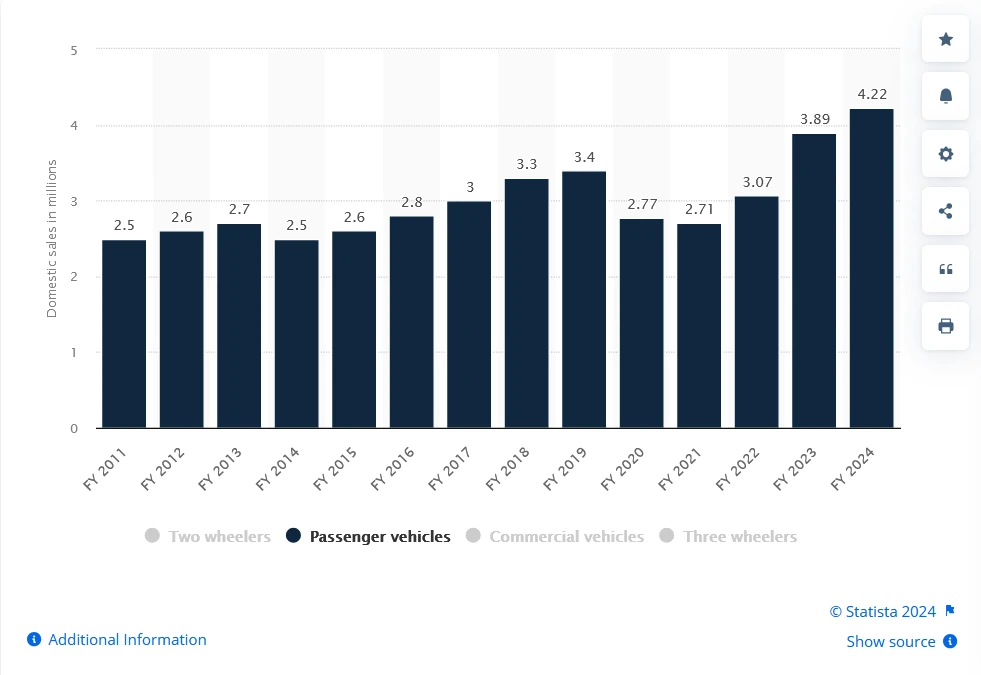

However, the demand for cars tells a different story. Despite the steep taxes, passenger vehicle sales have grown from 2.5 million to 4.22 million annually over the last 13 years. This indicates that for many Indians, owning a car remains a priority despite the financial strain.

The Final Word

When you buy a car in India, you’re not just paying for the vehicle but also contributing significantly to government coffers. From GST to road tax, fuel levies, and income tax, the financial burden can be overwhelming. Yet, car sales continue to climb, reflecting the enduring aspirations of Indian consumers.

While high taxes might seem like a deterrent, they’ve done little to curb the nation’s love for cars. So, the next time you’re eyeing a new set of wheels, remember that the government will also have a significant share in your purchase – a “tax” on your dreams of mobility and freedom.

This entire article was mainly made thanks to a beautiful video which I witnessed in Youtube and I request you to watch this.