Goal Planning - Risk Profile - Part 2

What is my attitude towards money ?

From childhood, we have been raised in a certain way, which shapes our opinion and attitude towards money. Some are conservative with money , some are willing to take risks . It is important to know where you stand and therefore invest your money in instruments which reflect your risk profile.

What is Risk Profile ?

Risk profile determines our attitude towards money and it is best you allow a financial planner , whom you trust, help you determine your risk profile towards money as it is important to have a unbiased perspective (as far as possible).

One of the first activities in goal setting, is to determine your risk profile .

1. Identify your risk profile

Risk Profile is basically your outlook towards money. Are you conservative when it comes to money ? Are you an aggressive investor ?

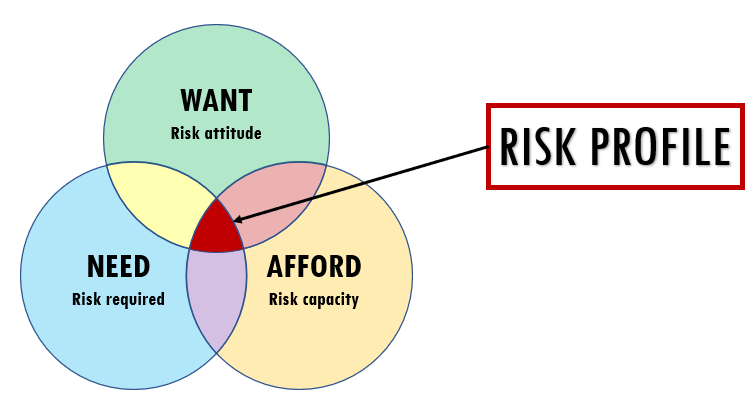

Risk Profile

- Risk Required

- How much risk do you have to take to achieve your goal ?

- You need 6 lakhs to buy a car in 2 years

- You already have 5 lakhs with you

It does not make sense to put 5 lakhs in equity as it means that you are taking a higher risk when the same can be easily achieved if you put it in debt instrument which is of much lesser risk and still achieve your goal. It is therefore important to know the risk required to achieve your goal .

- Risk Capability

- Do you have sufficient money to take such risks ? For e.g.

- You earn a salary of Rs 50,000/-

- You are already putting aside Rs 8,000/- monthly for your emergency goal

- Your expenses are Rs 40,000/- monthly

With such a limited saving, your risk capability is quite low, which means that you cannot afford losses.

- Risk Tolerance

- You may have the capability to take risk, but you may not feel comfortable with volatility.

- You may not For example, you may have a networth of Rs 2 crore but you are not comfortable / feel worried when you see an unrealized loss of Rs 10 in your investment.

- Risk Tolerance differs from person to person .

This will basically help to tell what kind of instruments are you comfortable in putting your money in. For e.g. If you are terrified of the stock market ups and down, EQUITY is not for you, despite knowing the fact that you may withdraw that amount after 20 years.

If your risk tolerance is high, it is possible that you may achieve your target earlier, but also higher the risk, higher the gain and vice-versa.

For each goal, there would be a risk required that one needs to take to achieve the goal

2. Risk Questionnaire

To understand your risk tolerance, there is a Risk Questionnaire that you need to answer. Risk Questionnaire basically helps one understand attitude towards money. It is best to answer a risk questionnaire as quickly and as truly as possible.

Some of the questions could be :

-

What kind of investments have you currently made ? (Tick all the ones that you have made)

- Deposits

- Mutual Funds

- Stocks

- Derivatives

- Commodity trading

-

If you had two investments to put your money in , which one would you choose ?

- 100% chance of getting 6% return

- 60% chance of getting 11% return

-

How do you feel about a 10% unrealized loss on the investment that you have made ?

- It is only notional loss, and my goal is still years away

- I should have never made this risky investment in the first place

- I will call my financial advisor and check with him

Each questionnaire has points and in the end your points are summed up and your profile is determined. This profile is NOT free from bias and therefore will be revised every year based on your behaviour. Based on your behaviour , your risk profile will be tuned and therefore your investments will be tuned accordingly.