Goal Planning - Assets - Part 3

What all do I own ?

I was so excited! My first job. This actually would mean independence. This would also mean that I would have a bank account and there would be a number bigger than 0 in my account. However, with the uncontrolled expenses, my bank account quickly got depleted as soon as my salary came in. Thankfully maturity came and as years passed by, I started gaining different types of assets including a house, a car, few more savings account, a fixed deposit, mutual fund , stocks etc…

What is an Asset ?

- Investopedia defines asset as an

-

resource with economic value that an individual owns or controls with the expectation that it will provide future benefit.

Your assets could come in various asset classes .

1. What is an asset class ?

There are 5 types of asset class :

- Cash

- Power to buy anything immediately

- Equity

- Ownership of anything

- Fixed Income

- Lending money to someone and receiving an interest therefore

- Real Estate

- Owning land , apartment etc…

- Commodities

- Ownership of natural resources which has use

Asset Classes

2. Identify your assets

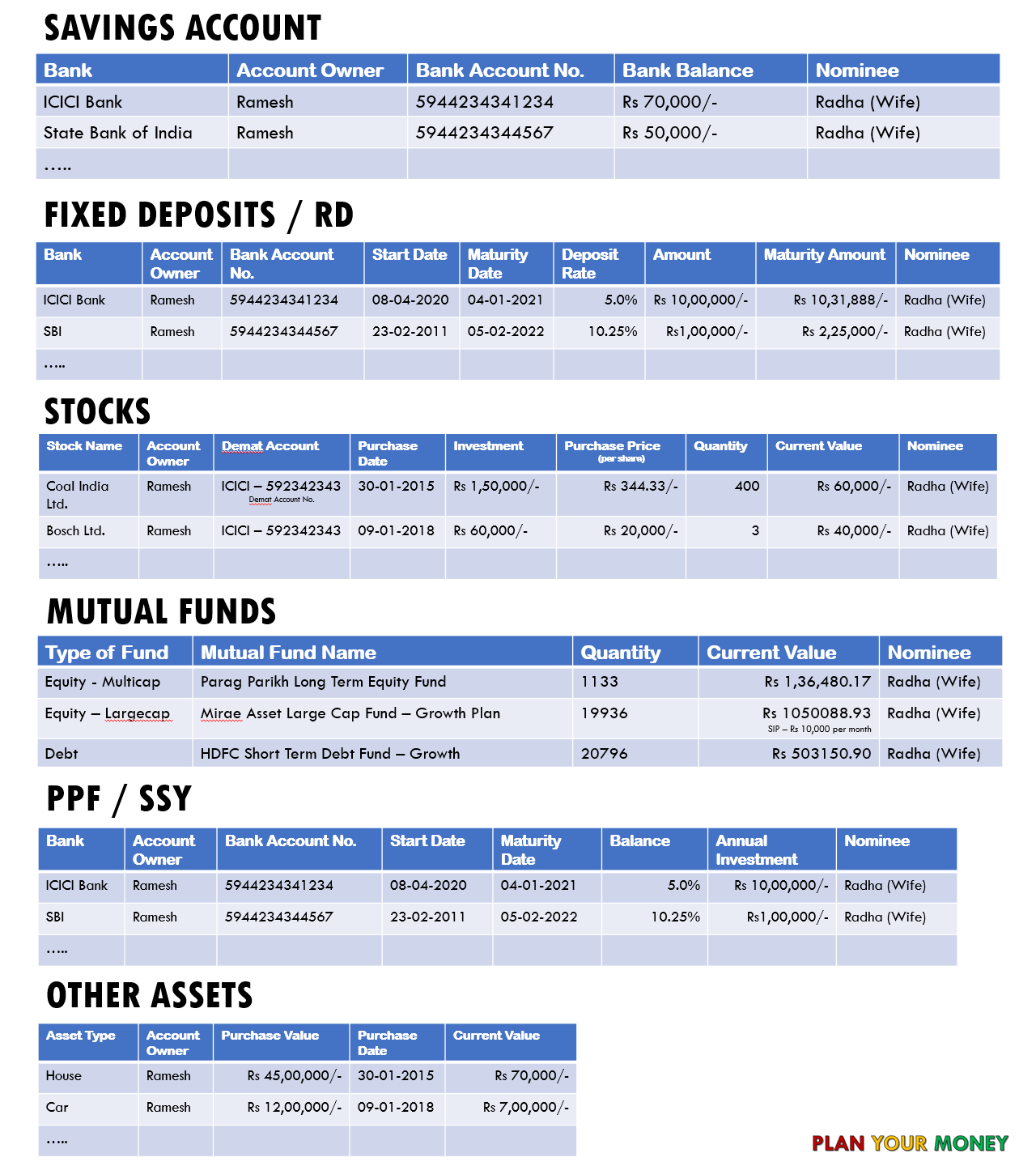

You would be able to identify your savings accounts, mutual funds, deposits, stocks etc… easily. However, you may own many more assets than you may think. In fact, this would also be useful to put it down in your will.

Let me provide a brief idea of things that could come in assets:

- Savings

- Deposits / Recurring Deposits

- Mutual Funds - Debt , Equity, Hybrid, Solution Oriented, ETF, Gold ETF etc…

- Gold

- House

- Valid Insurance Policy

- Others

- EPF (Employee Provident Fund),

- PPF (Public Provident Fund),

- NPS (National Pension Scheme),

- SSY (Sukanya Samriddhi Yojana)

- KVP (Kisan Vikas Patra)

- NSC (National Savings Certificate)

- SCSS (Senior Citizen Savings Scheme) etc…

Start making a list of assets as provided below

List of Assets

3. How could this be useful ?

- You know what you own

- You can track your assets which have matured

- This would help you to create a will easily

- In goal planning, you associate your assets with your goals