Unveiling the Untapped Potential: Why Investors Must Embrace Mutual Funds Now

Compelling reasons to invest in mutual fund !

In the vast realm of investment opportunities, there is one that stands out but often goes noticed but sometimes overlooked by investors: mutual funds. It is high time to explore the compelling reasons why you, as an investor, should seriously consider embracing mutual funds. By thoroughly examining data related to passports, mutual fund holders, car sales, GDP, and more, we can present a vivid picture of the immense potential waiting to be seized. Recently, I had the privilege of attending a meeting hosted by HDFC Mutual Fund where they shared impressive data emphasizing the untapped opportunity for investors to engage with mutual funds. With this message, I aim to reach potential investors like you and encourage you to seriously consider investing in mutual funds.

Dear Potential Investor,

I want to bring your attention to an investment opportunity that often goes overlooked but holds immense potential: mutual funds. In this letter, I will highlight compelling reasons why you should consider embracing mutual funds and the benefits they offer.

Why are retail investors failing to harness the power of mutual funds ?

1. Passport, F&O , Crypto Accounts and Mutual Fund Holders

-

India has 10.5 crore passport holders. However, there are only 3.8 crore individuals who are mutual fund investors. A vacation outside India costs no less than Rs 2 lakhs. Perhaps , the passport is used for identity proof, though a very costly identity proof.

-

There are many who are speculating their money in stock market.

In a recent report by SEBI, it is noted that 90% of the losses are suffered by individual investors and yet we continue to receive tips on how do we go about entering the derivative market.

- Cryptocurrency is another place now where individuals are putting their money in to gain quick money. I am also informed that there are 11 crore crypto accounts.

2. Rising Demat Accounts

The steady surge in demat accounts, with numbers increasing from 1.8 crore in 2019 to 3.08 crore in 2023, reveals a rising interest in financial investments. However, it was also during the time, when Work-From-Home was the norm, IPO was the season and everyone wanted to make quick money. We should transition from seeking immediate satisfaction in making quick money to focusing on long-term investments that allow for the creation of genuine wealth. Mutual funds provide a gateway to diversification and professional management, empowering you to make informed decisions while maximizing your returns.

I urge you to stay away from get rich quick schemes and choose mutual funds for building long term wealth.

On average, when a retail investor such as yourself chooses to invest independently, they tend to remain invested for no longer than two years. Despite numerous articles suggesting that investors can handle their investments alone, not every investor possesses the same level of expertise as the individuals providing such advice, nor do they have sufficient time to fully comprehend the market. Additionally, the fear of missing out (FOMO) often leads investors to continually chase returns, resulting in frequent changes to their mutual funds, shifting from the previous year’s high-performers to the current year’s potential multi-baggers.

Many retail investors hold the belief that a 100% riskier return is superior to a 12% average return due to the influence of their friends, relatives, schoolmates, or social circle who have achieved such returns and thereby assume they can replicate the same success.

By investing in mutual funds, you can tap into the vast potential that lies within your reach.

3. 73% of mutual fund redeemed within 2 years

During FY 2022-23, 73% of mutual fund was redeemed within 2 years. It is known that long time investment creates wealth. The reasons could be many for redeeming within 2 years, but for wealth creation, one needs to hold their investment for a long period of time. It is perhaps that they have been misdirected by the distributor or it was DIY investor, but with the right assistance one can create long term wealth. An individual in the path of creating wealth requires guidance and reassurance of his investment.

Economic Times - 73% redeem within 2 years

Why do I believe that the equity market will rise ?

As a potential investor, I will give you a few proxy indicators which gives you a good indication that for the next decade our country should do well.

1. Car Sales as an Indicator of Economic Activity

The roaring success of the automotive industry, with approximately 37 lakh cars sold in 2022 and Maruti commanding a 41% market share, signals a thriving economy. Embracing mutual funds enables you to ride this wave of economic growth and translate it into substantial returns.

2. GDP Growth

India’s remarkable GDP growth rate of 8.68% in 2022, propelling the per capita income from $1900 to $2200, showcases a country on the rise. By investing in mutual funds, you align yourself with this upward trajectory, amplifying your wealth creation potential.

Goa boasts the highest per capita among states, while Bengaluru holds the distinction of having the highest per capita among cities.

3. Seizing the Wave of Corporate Earnings

Corporate earnings are skyrocketing, with all profits after tax reaching an astounding 10 lakh crore in March 2023, compared to 4.5 lakh crore in March 2020. Industry giants like Reliance, ONGC, and Tata Steel are driving this growth, providing you with an ideal entry point to ride the wave and maximize your investment gains.

Market is a slave to corporate earnings and therefore the market is at its peak as of today !

How can mutualfunds help ?

As an investor, you may have limited time and knowledge, which can hinder your ability to fully leverage market opportunities. However, mutual funds provide a solution by granting you access to expert fund managers who diligently strive to enhance your investments. By entrusting your funds to these professionals, you can navigate the market with confidence, secure in the knowledge that your financial future is being handled by capable hands.

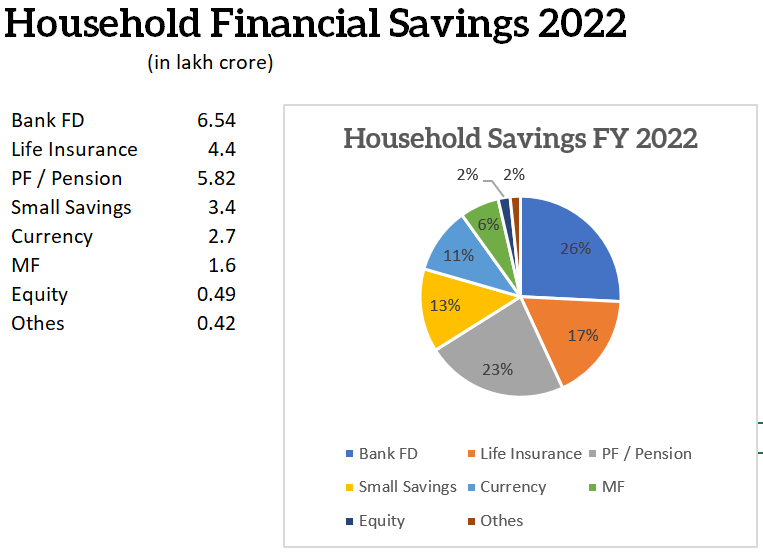

Unleashing the Power of Household Financial Savings

It’s time to revolutionize your approach to savings and investments. By reallocating a portion of your bank fixed deposits, life insurance policies, and small savings into mutual funds, you unlock the potential for higher returns. Embrace this opportunity to harness the power of compounding and make your money work harder for you.

As per the data of Household financial savings 2022, the highest amount of money is still stored in Bank FD which is about 6.54 lakh crore and at the same time only about 1.6 lakh crore is deployed to Mutual Funds. In fact, more money is deployed in Life Insurance, PF / Pension, Small Savings and even in Currency as compared to Mutual Funds.

Household Savings 2022

Conclusion

The time to act is now. As India’s economy surges forward, demat accounts multiply, and corporate earnings soar, mutual funds emerge as the optimal investment avenue. By embracing mutual funds, you position yourself to capitalize on the country’s economic growth, expert guidance, and the power of compounding. Unleash your true investment potential, seize the opportunities that lie before you, and secure a prosperous financial future. Take the leap into mutual funds today and unlock a world of limitless possibilities. To build long-term wealth, it is crucial to recognize the impact of holding investments for extended periods. The alarming trend of early redemptions underscores the significance of seeking guidance from a trusted distributor. With their expertise, you can overcome the challenges of the investment journey, capitalize on the power of compounding, and stay committed to your financial goals.

Stay Invested, Stay Wealthy !

Your benevolent friend,

Subramanian V