Higher Education Calculator

Planning for Higher Education Expenses: A Calculating Tool for Parents

Investing in a quality education is a dream for every parent, but the rising cost of higher education can be daunting. Whether it’s a graduation course in India or pursuing post-graduation abroad, parents often find it challenging to plan for their child’s educational expenses. To address this concern, a new calculator tool has been designed to provide parents with a clear understanding of the funds required and how to plan for their child’s education.

Understanding the Calculator

The newly developed calculator is a comprehensive tool that takes into account various factors to calculate the current and future amount needed for a child’s graduation or post-graduation. Parents are required to input the duration of the course, the annual cost of the course, inflation rate, and the expected rate of return on investments.

For instance, let’s consider the cost of an M-Tech course in the USA, which ranges from 70 lakhs to 1.3 crores. By using the calculator, parents can get a precise estimation of the current amount needed and the future value required to fund their child’s education.

Benefits for Parents

- Financial Planning Made Easy

- The calculator takes the guesswork out of financial planning, providing parents with a clear roadmap to meet their child’s educational expenses. By knowing the exact amount they need to save and invest, parents can plan better and start early.

- Understanding Inflation Impact

- Education costs tend to increase over time due to inflation. The calculator factors in inflation rates, giving parents an accurate picture of future expenses and allowing them to make informed decisions.

- Tailored to Individual Needs

- The tool is versatile and can be customized for various courses and countries, accommodating different scenarios and providing specific insights into each case.

Education Calculator is available here

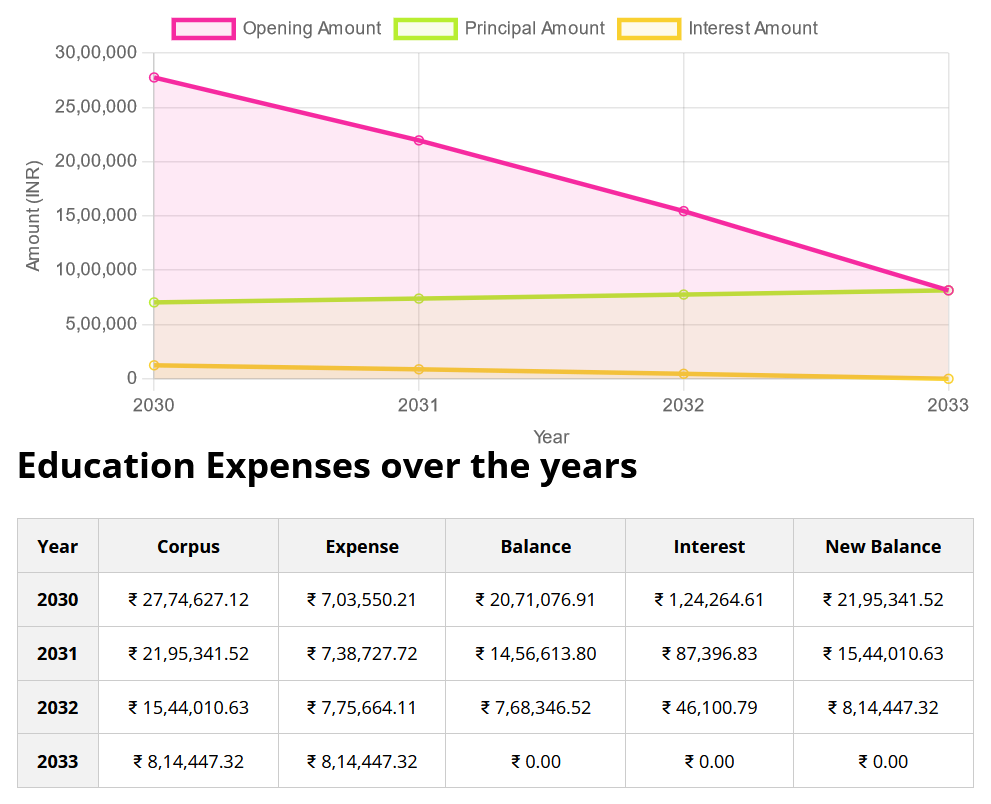

Below is a calculation of the usage of the tool for a course which starts in 2030 and the fees per year is Rs 5,00,000/-. The course fees has an inflation of 5% and if the corpus is invested in an instrument which will give a return of 6%, then the corpus that you need today is Rs 18.45 lakhs and the corpus that you need at the start of the goal is Rs 27.74 lakhs.

Higher Education Calculator

Higher Education Calculator

Conclusion

Investing in education is one of the most significant gifts parents can give to their children. However, it requires careful financial planning to ensure their dreams don’t turn into financial burdens. The newly developed calculator empowers parents with the knowledge and tools to create a robust education fund for their children’s graduation or post-graduation, be it in India or abroad. By taking into account course costs, inflation, and investment returns, parents can now confidently plan for the future and secure their child’s educational aspirations. So, if you’re a parent with dreams for your child’s education, embrace this calculating tool and pave the way for a bright and successful future.