Inflation

How does inflation affect you ?

Inflation is a measure of rise in the general price level of all goods and services in the country. Inflation is often viewed as the reduction in purchasing power of money.

If you could buy a cup of coffee for Rs 10/- today and after 1 year, you are able to buy a cup of coffee for Rs 12/-, you have experienced inflation. In this case, inflation is 20%.

Inflation

Consumer Price Index

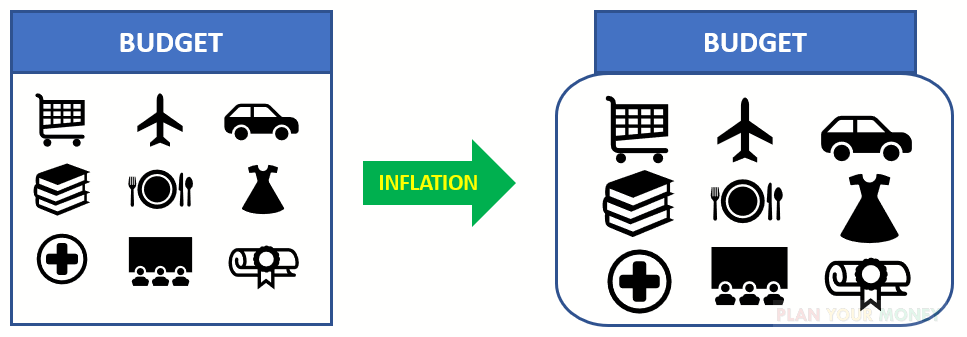

When the government talks about inflation, they take a basket of goods and services. For example, Consumer Price Index (CPI) consists of Food and Beverages, PAN - Tobacco - Intoxicants, Clothing and Footwear, Housing etc… There are various types of Consumer Price Index(CPI) namely

- CPI Rural

- CPI Urban

- CPI Combined

CPI is released by Ministry of Statistics and Programme Implementation(MOSPI) on a monthly basis. Each of these basket of goods have a weightage which change over a period of time.

Why should I know about inflation ?

I presume every year you draw a budget and estimate your expenses based on the categories. These categories are your basket of goods and services. As the prices for goods and services you avail increases, you would have to spend more money to maintain your lifestyle. For e.g. - if you spend Rs 3000 for groceries per month and food inflation has gone up by 10%, you would spend Rs 3300/- per month for the same amount of groceries.

Inflation

Inflation mainly erodes wealth and hence it is important that we make more money than inflation.

As an example, let us assume your budget for groceries is Rs 40,000/- per year and you have assumed that inflation would be 5% y-o-y. So next year you would require Rs 42,000/- per year for the same groceries. You invested that Rs 40,000/- yielding an interest of 4% p.a. and therefore you received Rs 41,600/- at the end of the year. Therefore despite earning interest, your amount is insufficient to cater to inflation and this is what we mean by erosion of wealth.