Debt Mutual Fund

What is Debt Mutual Fund ?

When we buy a house loan from bank,

- Bank provides us money

- We need to return the money after fixed number of years

- Bank charges a fixed interest rate for the money that it has lent

However, we also lend money to banks. In case of a fixed deposit, we lend money to the bank.

In FD’s, you would see a similar resemblance as that of a house loan:

- You have lent money to the bank

- Banks will return the money after fixed period

- Bank will provide you a fixed interest after a specified period

Therefore, FD is a debt instrument where you receive a periodical amount of interest for a specified period.

What are debt mutual funds ?

Debt mutual funds participate in secondary bond market where they trade government bonds, corporate bonds, public sector bonds anticipating risks like interest risk, credit risk etc…

What should I look for in debt mutual funds ?

There are mainly two things that you need to look for in debt mutual funds:

- What kind of papers does the debt fund have ? Is it heavy on sovereign, AAA, AA funds? I would strongly recommend not to go for riskier debt funds as you already have equity funds for that.

- Your investment horizon should match the maturity period of your debt fund.

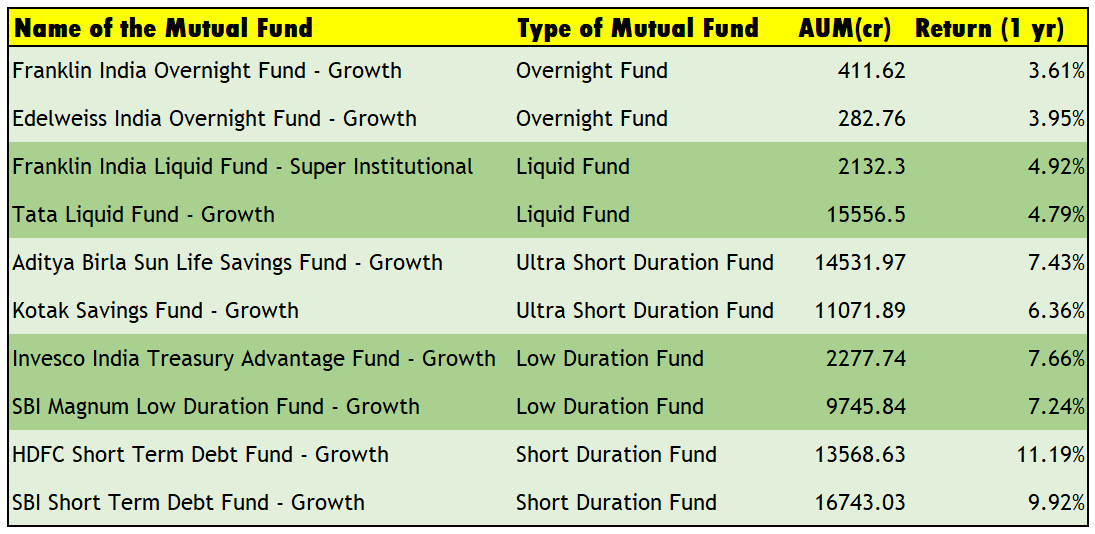

I find that funds as stated below serves the purpose of retail investors :

- Overnight Funds (maturity in 1 day)

- Liquid Funds (maturity in 1 to 3 months)

- Ultra-Short-Term Duration Funds (maturity in 3 to 6 months)

- Low Duration Funds (maturity in 6 to 12 months)

- Short Term Duration Funds (maturity in 1 to 3 years)

The returns do not fluctuate much based on interest rate.

Benefit of Debt Mutual Funds

There are multiple benefits of debt mutual funds

- Tax is not deducted at source

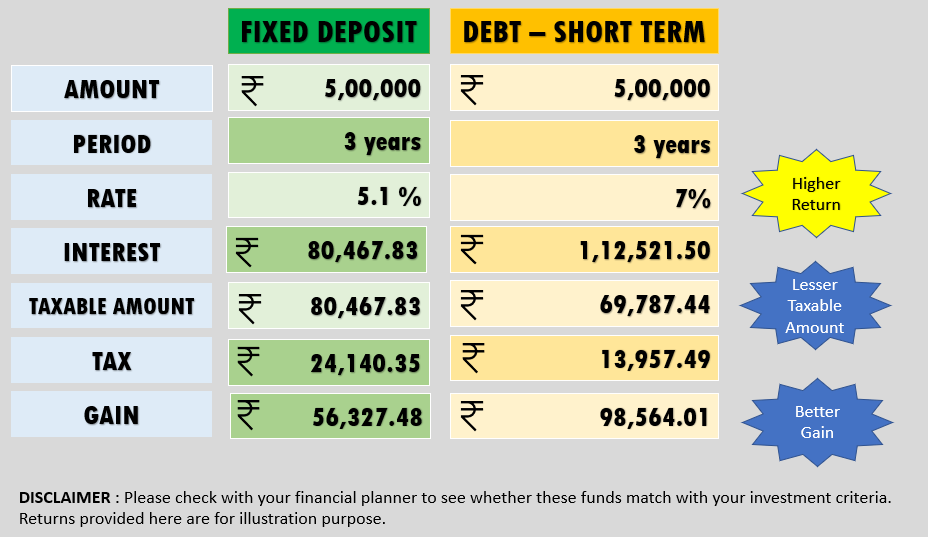

- If you keep the debt fund for a period of 3 years, you only need to pay a tax of 20% with indexation benefit

- More likely than you know, debt funds gives better return than FD

Asset Classes

Debt Mutual Funds - Recent Times

See the performance of debt mutual funds in the last 1 year.

In fact, in the recent times, there are few debt funds which have given much better return than equity funds.