Mutual Fund Transmission

The Hidden Struggles of Mutual Fund Transmission

The Shock and the Start

In January 2025, a woman suddenly lost her husband. Grief aside, she was soon faced with the daunting challenge of claiming her late husband’s mutual fund investments—worth approximately ₹50 lakhs. What followed was a journey filled with administrative hurdles, emotional fatigue, and systemic inefficiencies.

The Complexity Unfolds

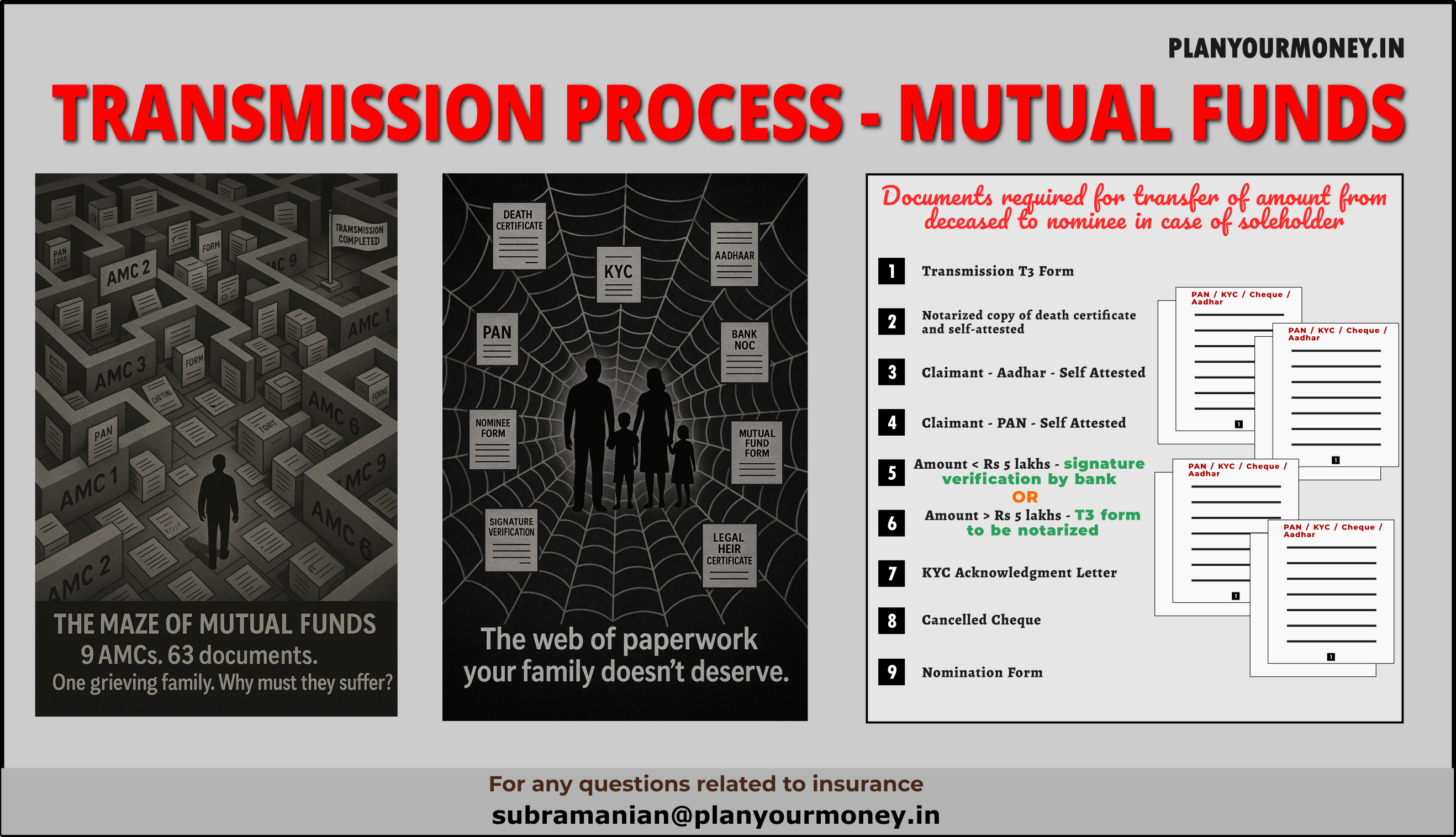

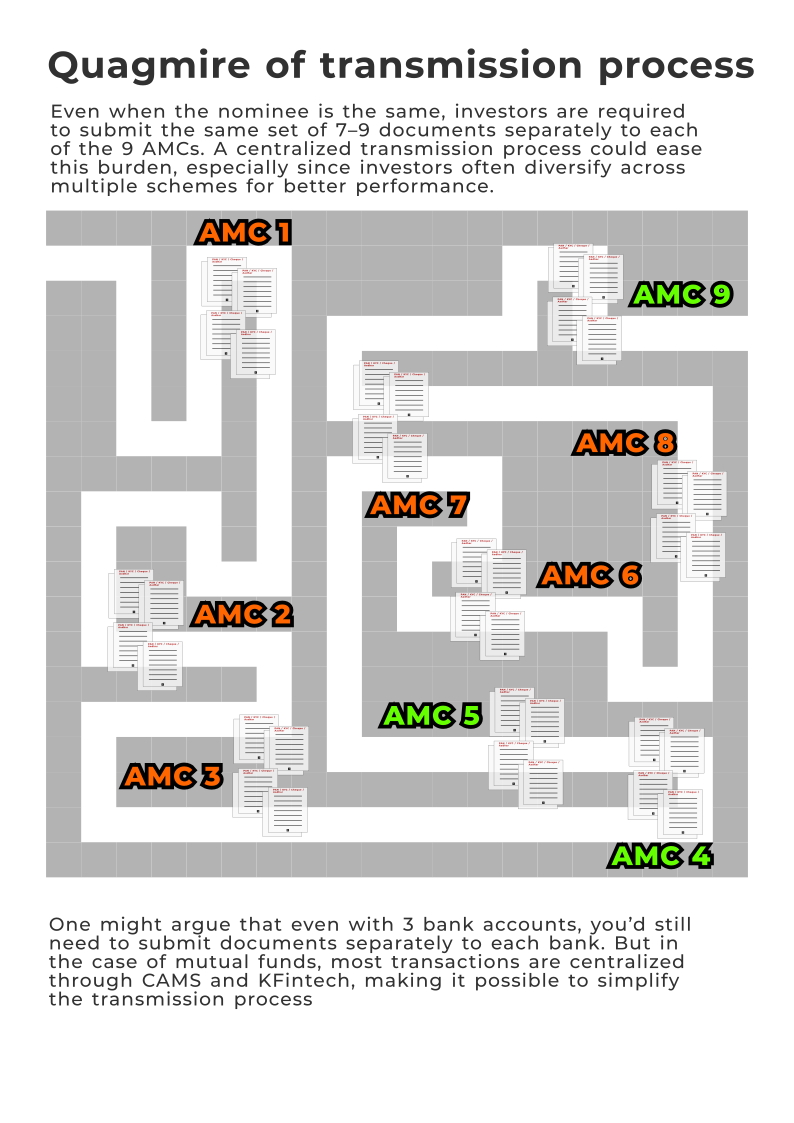

The deceased had 23 mutual fund schemes spread across 9 different Asset Management Companies (AMCs), sourced through 4 different distributors—including a few direct schemes. Additionally, two of the schemes were in demat mode. Despite having nominated his wife in all schemes, the process wasn’t as smooth as expected. The AMFI guideline (available here) spells out the transmission procedure. For each AMC, the following 7 documents had to be submitted:

- Transmission Request Form (T3)

- Death Certificate (notarized and attested by claimant)

- Self-attested copy of nominee’s PAN

- Nominee’s KYC acknowledgement (status must be registered/validated)

- For claims up to ₹5 lakh: Nominee’s signature attested by bank manager (Annexure-Ia)

- For claims above ₹5 lakh: Signature attested by notary public or Judicial Magistrate First Class

- Additional ID proof (PAN/Aadhar) of the deceased, notarized and attested

Due to minor name mismatches, even the same RTA—serving two different AMCs—insisted on two separate affidavits to confirm that the deceased’s name, though consistent across PAN, Aadhaar, and death certificate, didn’t match their records. One AMC went a step further and demanded an indemnity bond.

In total, I made nearly 70 phone calls—repeating the same explanation over and over—hoping for a quicker resolution. Same documents had to be re-sent to the same office which would again process from the beginning. What should have been a simple, compassionate process stretched over three exhausting months, from March to May 2025.

The Hurdles Faced

1. Spouse – Not KYC

I first had to ensure that spouse PAN card is KYC Validated and all the documents were submitted. Without this no AMC will even entertain your document.

2. No Acknowledgment

No acknowledgment was provided when the documents were sent via Speed Post or any courier as confirmed by the investor. It required several follow-ups or in case of a success or rejection, the customer came to know that her documents are getting processed.

3. Signature Mismatch

Even though the nominee signed all forms carefully, some AMCs claimed signature mismatches. In 3 instances, the transmission was rejected until escalations and follow-ups led to resolution.

4. Name Mismatch

The name in the AMC folio differed from the name on the PAN, Aadhar, and Death Certificate. Despite Aadhar card linked to PAN, Death Certificate issued only via Aadhar card, and NSDL document showing the entire list of folios under the same PAN and email id, some AMCs demanded an affidavit to prove both names refer to the same individual. Some requested for an indemnity bond as well.

5. Demat vs non-Demat

Mutual fund units held in demat form require a completely different transmission route—handled through the Depository Participant (DP). The AMC rejected those units outright, adding confusion for the nominee.

6. No Nominee? Good Luck!

In another folio, where there was no nominee, the process became significantly more cumbersome. Legal heirship proofs and indemnity bonds are needed, and timelines get extended.

7. Cost of obtaining your money

Death Certificates were about 9 and you need it notarized. Unfortunately, notary charges were about Rs 500 per notary. Moreover, if it goes above Rs 5 lakhs, Transmission request also has to be notarized. There were 2 such documents and therefore add this to notary charges. Then apparent name issues, so Rs 1000 per affidavit. There were 2 such affidavits. We had to send 10 couriers as 1 AMC rejected the documents. Courier charges are Rs 100 and above. This is the transmission cost. Add time to this and you would know where this stands!

8. Emotional & Practical Strain

This wasn’t just paperwork. The widow was tending to two children—one in school and the other in college—while also managing a home and a loss. While a person having no source of income, in such a situation, chasing documents and resubmitting forms was a cruel addition to her pain.

Positive Exceptions

Not all AMCs made the process difficult. A few—such as Mahindra Manulife, Tata Mutual Fund, HDFC, ICICI, Edelweiss, and Quant —handled the documentation efficiently, without unnecessary delays or objections. Their promptness was a welcome relief during a difficult time. I’ve also had the opportunity to build a strong professional rapport with some of them over the years, which made communication smoother and more reassuring.

Regular or Direct

I often wonder about the experience of investors who choose the direct mode—especially in situations where the spouse must initiate the transmission process without any personal point of contact. Imagine handling this across 29 or 39 mutual fund schemes, navigating virtual customer care channels that may treat it as just another transaction, facing signature rejections, and having to prepare affidavits. Regardless of whether one invests through the Regular or Direct route, I sincerely hope all investors receive the same level of support during such critical times.

Key Takeaways for Every Investor

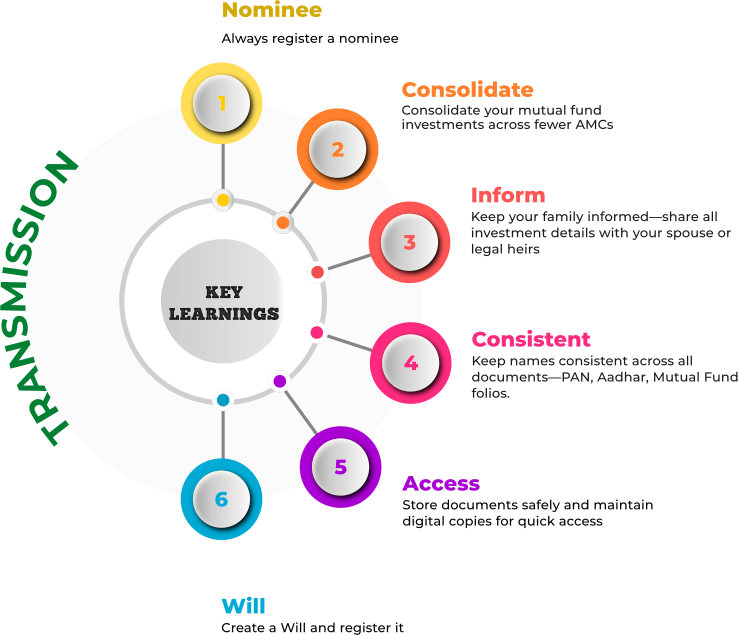

- Always register a nominee for each investment

- Consolidate your mutual fund investments across fewer AMCs.

- Keep your family informed —share all investment details with your spouse or legal heirs.

- Keep names consistent across all documents—PAN, Aadhar, Mutual Fund folios.

- Store documents safely and maintain digital copies for quick access.

- Create a Will and register it

A Larger Concern

This experience raises a critical question: if this is the struggle in an urban area with access to advisors, what happens in rural and B-30 cities? The complexity discourages rightful heirs from claiming their money. Are we heading toward another pile of unclaimed funds like in LIC or EPFO?

It’s time the mutual fund industry walks the talk on investor-centricity.

Let’s make mutual fund transmission simpler, faster, and more compassionate.

A grieving family shouldn’t have to beg for what is rightfully theirs.

In case you would like to understand more about my services , please go through this document or you could email me.