August 2024 - Market Trends in Mutual Funds

Trending patterns in flow of money in Mutual Funds in last 12 months

AMFI has released the data related to inflow/outflow of funds in various schemes. This article intends to share some insights on this data and you will find it useful to take decisions based on these inputs.

August 2024

The current market data offers a powerful signal for investors to capitalize on the momentum, especially in large-cap and balanced fund strategies. Let’s look at the details:

AMC Market Outlooks: Midcap and Smallcap Trading at a Premium

Many Asset Management Companies (AMCs) are advising caution on midcap and smallcap exposure, as these segments are currently trading at a premium compared to large-cap stocks. This creates an opportunity to capitalize on large-cap investments, which remain more attractively valued.

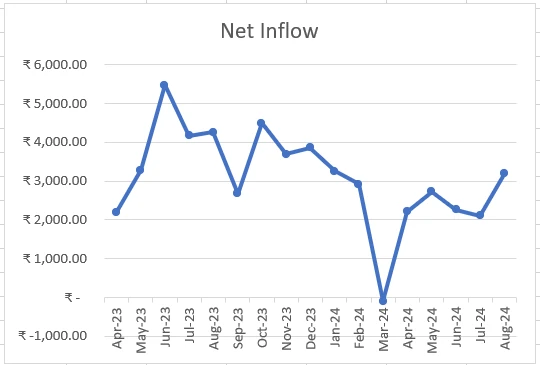

Record Net Inflows into Midcap and Smallcap Funds

Despite warnings about premiums, investor sentiment in August 2024 has been extremely positive for midcap and smallcap funds. Midcap funds recorded a net inflow of Rs 3,054 crore, the highest ever, while smallcap funds saw a net inflow of Rs 3,209 crore, the highest in the last eight months. Although this reflects strong retail enthusiasm, the elevated valuations in these segments mean investors should approach cautiously.

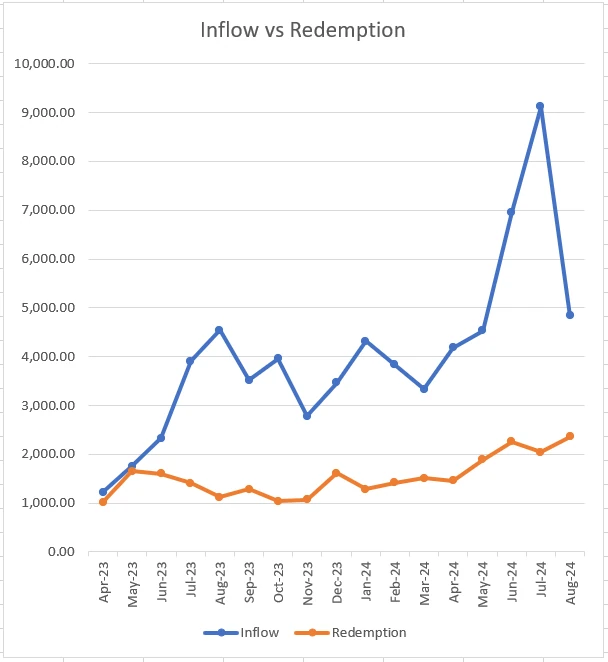

Decline in Multicap Fund Net Inflows

Multicap funds, which offer diversified exposure, saw a drop in net inflows from Rs 7,084 crore to Rs 2,475 crore.. Inflow in multicap funds has dramatically reduced to less than Rs 5000 crores. The rising redemptions in this category suggest that investors are moving toward more focused strategies, underscoring the need for careful fund selection.

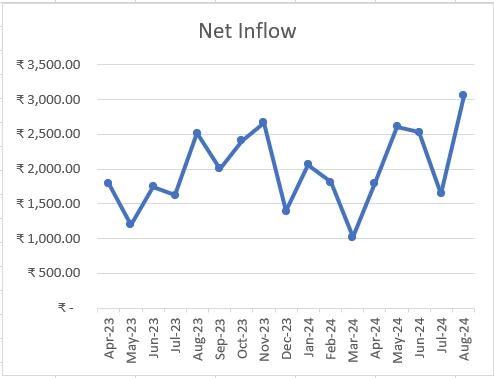

Strong Net Inflows into Large-Cap Funds

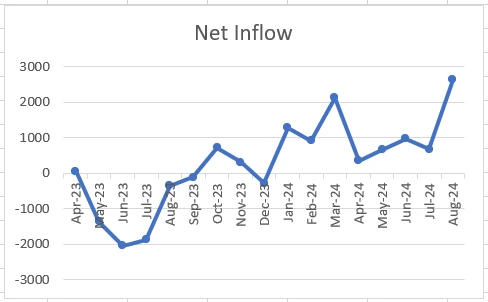

Large-cap funds saw a fantastic net inflow of Rs 2,636 crore, the highest in the last year. Many fund managers recommend continuing to invest in large-caps since these stocks aren’t as overvalued as midcaps and smallcaps, offering a more attractive entry point for long-term growth.

Net Inflow - Large Cap Funds (in crores)

Source : AMFI

Highest Ever Net Inflows in Large & Midcap Funds

Large & midcap funds experienced a record-breaking net inflow of Rs 3,293 crore. This shows that investors are favoring strategies that provide balanced exposure to both stable large-caps and high-growth midcaps. For those seeking a diversified approach, this is an ideal time to invest.

Falling Redemptions in Midcap and Smallcap Funds

While midcaps and smallcaps are trading at a premium, the rate of redemptions in these funds is declining. This indicates that investors are holding onto their positions, betting on further gains. However, with elevated valuations, it’s crucial to remain cautious.

Continued Interest in Sectoral and Thematic Funds

Sectoral and thematic funds, with an average net AUM of Rs 4.25 lakh crore, saw healthy net inflows of Rs 18,117 crore. This reflects strong confidence in specific sectors of the market, providing opportunities for targeted growth.

Robust Net Inflows into Equity Markets Overall

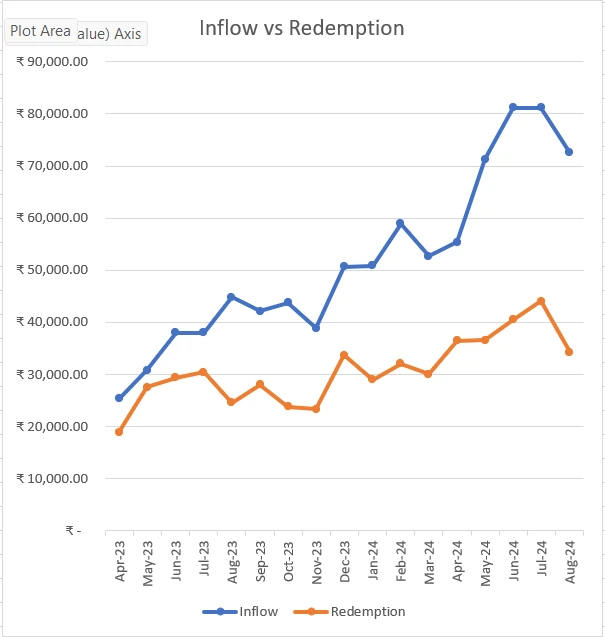

In August 2024, the total net inflow into equity markets stood at Rs 38,239 crore, while the overall inflow reached Rs 72,541 crore. Redemptions have dropped significantly from Rs 44,044 crore in the previous month to Rs 34,303 crore, signaling that investors are staying in the market and betting on continued growth.

Positive Retail Investor Sentiment

Retail investors are driving this wave of enthusiasm, with strong participation in mutual funds and the IPO market. This retail-driven momentum is often an indicator of future market strength.

Why Invest Now?

With large-cap stocks still attractively valued and seeing strong net inflows, this is a golden opportunity to invest in stable growth assets. While midcap and smallcap sectors have shown impressive performance, their high premiums pose a potential risk. A balanced approach through large-cap or large & midcap funds offers both safety and growth potential in the current market climate.

Don’t miss out on the momentum—now is the time to invest and position yourself for future gains!

Conclusion

I shall reiterate my conclusion which earlier appeared in my earlier article

- The pursuit of changing asset allocations solely based on past high returns is a perilous endeavor.

- Investors should prioritize understanding their risk profiles and aligning their investments with their long-term goals.

- By adhering to a steadfast and unassuming investment strategy, one can navigate through market fluctuations with resilience and secure their financial future effectively.

- Remember, investments should be guided by your goals, not by fleeting market trends.

References

Disclaimer: Please reach out to your financial advisor before making any investments