2023-24 - Performance and Flow of Money

Performance and Flow of money in Mutual Funds for FY 2023-24

In the dynamic landscape of equity investments, the allure of high returns can often tempt investors towards greed-driven decisions, potentially jeopardizing their financial stability in the long run.

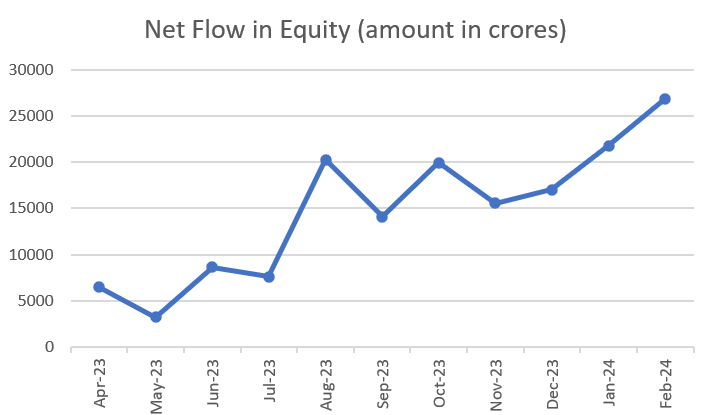

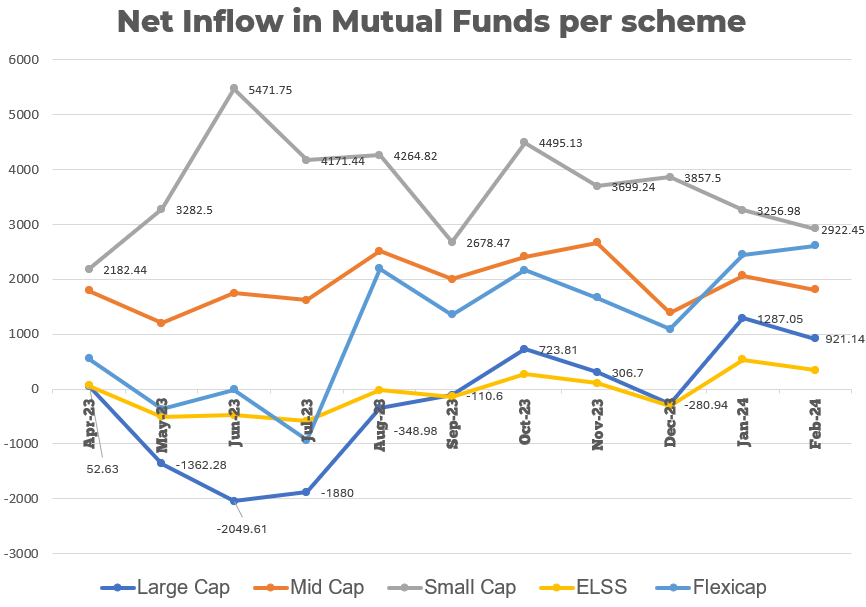

As evidenced by the surge in equity inflows, with a staggering 26,000 crores recorded in February 2024 alone, and the remarkable flow into Midcap and Smallcap segments totaling Rs 61,900 crores, it’s evident that the chase for quick gains is pervasive.

Investments In Equity

Investments in equity have mainly picked up from August 2023 onwards, however, they have been mainly flowing into mid cap and small cap funds.

Net Flow Equity

Source : AMFI

However, a closer examination reveals a cautionary tale. Despite the influx of capital into small-cap funds, the scarcity of quality investment opportunities becomes apparent upon scrutinizing their portfolios. Many such funds have resorted to holding significant proportions of their assets in cash rather than deploying them into promising stocks. This conservative approach underscores the dearth of attractive investment avenues within the small-cap segment.

- HDFC Small Cap - 9.93% - Debt - Highest allocation

- Quant Small Cap - 9.87% - Reliance (LargeCap) - 4.03% - Debt - 2nd highest allocation

- Kotak Small Cap - 5.35% - Debt - Highest Allocation

- Mahindra Small Cap - 6.43% - Debt - Highest Allocation

- Nippon India Small Cap - 4.11% - Debt - Highest Allocation

Moreover, the emergence of a trend where several prominent small-cap funds, including Nippon India, ICICI, SBI, and Tata Mutual Fund, have ceased accepting lump-sum investments, further underscores the challenges plaguing this space. Such actions hint at underlying concerns regarding market valuations and the prudence of deploying capital amidst prevailing uncertainties.

- Nippon India Small Cap does not accept lumpsum

- ICICI Small Cap does not accept lumpsum

- SBI Small Cap does not accept lumpsum

- Tata Mutual Fund Small Cap has stopped lumpsum since July 2023

Meanwhile, AMFI has written to mutual fund houses to take measures to protect the interest of investors of small and midcap schemes.

Investors have predominantly overlooked large-cap mutual funds, ELSS, and even flexicap to some degree. Instead, they have been captivated by the appeal of significant returns within the small-cap and mid-cap sectors.

Net Inflow Mutual Funds per Scheme

Source : AMFI

Performance

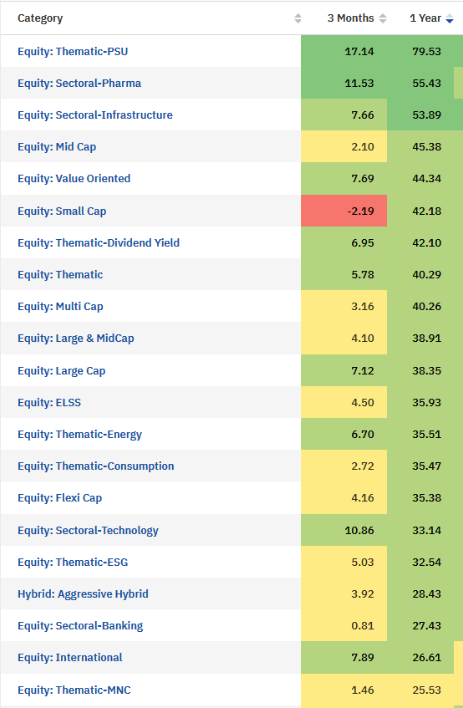

If you look at the performance of equity funds over the last year, had you put your money in any equity based mutual fund, you would have made money. Even the worst return in the category is 25.53% and the best gave nearly 79.53% return.

The subsequent crucial inquiry for investors is whether consistent returns can be expected annually. Yet, I argue that we currently reside in a favorable era, warranting continued investment in mutual funds aligned with our risk tolerance and asset allocation. Remarkably, the compounded annual growth rate for these funds over the past decade ranges between 14-18%, a truly remarkable feat.

Performance - Equity Funds

Source : Valueresearchonline.com

Conclusion

- The pursuit of changing asset allocations solely based on past high returns is a perilous endeavor.

- Investors should prioritize understanding their risk profiles and aligning their investments with their long-term goals.

- By adhering to a steadfast and unassuming investment strategy, one can navigate through market fluctuations with resilience and secure their financial future effectively.

- Remember, investments should be guided by your goals, not by fleeting market trends.

Disclaimer: Please reach out to your financial advisor before making any investments