November 2024 : Why Now is the Time to Invest

A Story of Growth: Why Now is the Time to Invest

Let me tell you a story of how things have changed in the world of mutual funds—and why this is the perfect time for you to start your investment journey. The Rise of SIPs: A Transformative Decade

Back in FY 2016-17, the total amount invested in Systematic Investment Plans (SIPs) over a whole year was Rs 44,000 crores. But here’s the twist—fast forward to FY 2024-25, and that same amount is now being invested every two months. Yes, every two months!

What’s driving this incredible growth? Post-COVID, people have seen firsthand the kind of returns equity markets can generate. It’s like a wake-up call—money isn’t just sitting idle; it’s working harder for them. In November alone, investors poured in a record ₹25,000 crores into SIPs.

Nudge: Isn’t it time your money joined the wave?

Equity Mutual Funds: A Steady Giant

Equity mutual funds have never been stronger. As of November, they held about ₹1.74 lakh crore in cash—around 5.8% of their total equity assets. While this cash level dipped slightly due to recent market corrections, it’s stayed remarkably stable, reflecting the resilience of these funds.

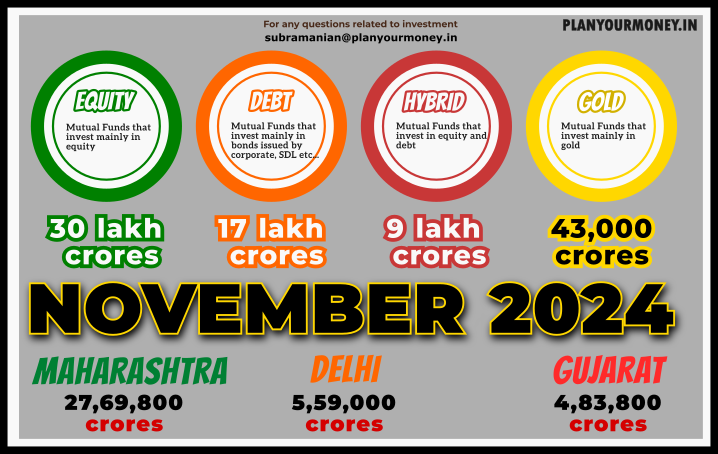

And here’s the big picture: equity funds now command ₹30.4 lakh crore in assets, up from 55% of the total mutual fund market last November to 59.7% today. It’s clear—more and more people are trusting equities to grow their wealth.

Nudge: Why wait when equity funds are setting the pace for wealth creation?

The Source of Wealth: Where Is the Money Coming From?

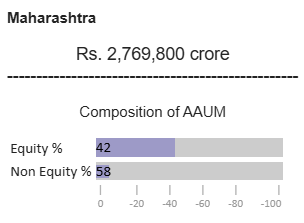

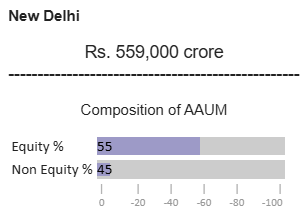

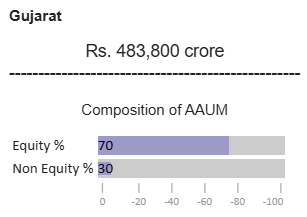

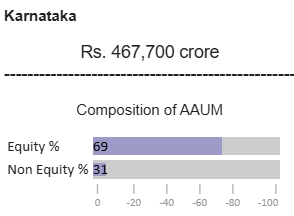

Most of this growth is driven by just a few states — Maharashtra, Delhi, and Gujarat — which together contribute 56% of the industry’s total Assets Under Management (AUM). The top 8 states make up over 80%.

What does this mean? Mutual fund adoption often mirrors the economic strength of a region, and while some states lead the charge, there’s untapped potential across the country.

Nudge: You can be part of this financial revolution, no matter where you are.

Diversification Opportunities: Gold ETFs and Hybrid Funds

It’s not just equities making waves. Gold ETFs have seen 49 consecutive months of inflows, even during volatile times. In November alone, ₹7,061 crores flowed into gold and other ETFs, with index funds leading the way. This shows that even during geopolitical tensions and market swings, investors are diversifying into safe-haven assets like gold.

Meanwhile, hybrid funds, which blend equity and debt, saw positive inflows of ₹4,124 crore in November, bringing their total AUM to ₹8.77 lakh crore. These funds are perfect for navigating uncertain markets.

Nudge: Why put all your eggs in one basket when diversification can secure your future?

The Debt Fund Boom

Debt mutual funds are also hitting record highs. In November, their AUM rose 1.3% to ₹16.86 lakh crore, with ₹12,916 crore in fresh inflows. These funds are ideal for those seeking stability and steady growth.

A Growing Investor Base

Did you know that over 29.57 lakh new equity accounts were added in November alone? Mutual funds are becoming the go-to choice for people across the country, with total folio accounts crossing 22 crore.

Nudge: If millions are already on this journey, what’s holding you back?

Your Turn to Act

The story is clear—mutual funds, whether equity, hybrid, or debt, are growing stronger and more accessible than ever. The question isn’t if you should start investing, but when. And the answer to that? Now.

Let’s make your money work for you. Are you ready to take the first step?

References

Disclaimer: Please reach out to your financial advisor before making any investments