October 2024 - Market Trends in Mutual Funds

Retail investors are betting that markets will do well in long run

Despite a market correction and continued foreign outflows, Indian retail investors showed remarkable resilience in October 2024 by committing substantial funds to equity schemes. The total equity inflow reached a historic level of Rs 74,727 crores, marking a period of steadfast retail engagement even as market volatility persisted. With the BSE Sensex index experiencing a dip from its peak of 85,879 to around 78,000, investors have doubled down, seizing the opportunity to buy into the market at lower levels, confident in the market’s long-term potential.

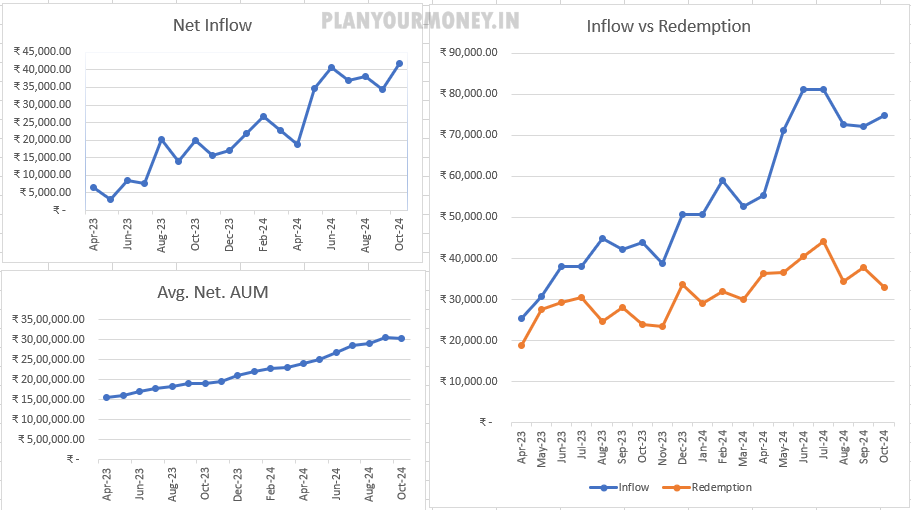

Net Inflow Reaches All-Time High

A standout metric for October was the Rs 41,886 crores in net inflow, the highest net investment recorded, resulting from the difference between new inflows and redemptions. This figure was bolstered by a reduction in redemptions, which amounted to Rs 32,840 crores—the lowest in the past five months. The minimal outflow reflects investor confidence and a “hold” mentality, especially significant given the backdrop of market corrections. Rather than panicking or exiting, retail investors demonstrated a growing confidence in India’s equity markets as a long-term investment vehicle.

Record-Breaking Investments Across Categories

October witnessed unprecedented investment levels across various equity categories. The large-cap category saw inflows of Rs 6,855.49 crores, the highest on record, as investors looked to allocate funds to stable blue-chip companies, viewing them as safer options in turbulent times. Similarly, large and mid-cap funds attracted Rs 7,177.08 crores, while mid-cap funds set a record with Rs 8,946.17 crores. This preference for mid-sized companies reflects investors’ willingness to embrace slightly higher risk, betting on companies with significant growth potential.

Interest in the small-cap segment remained strong, with inflows reaching an all-time high of Rs 8,108.02 crores. This robust participation in the small-cap category signals retail investors’ optimism and appetite for higher returns, despite higher volatility associated with smaller companies. Additionally, flexicap funds, which allow fund managers the flexibility to invest across different market capitalizations, saw their highest-ever inflows at Rs 8,979.60 crores. This flexibility appeals to investors seeking professional judgment in volatile markets, reinforcing trust in fund managers’ ability to navigate the fluctuating landscape.

DII Support and FII Outflows

Domestic institutional investors (DIIs), especially Asset Management Companies (AMCs), have shown strong support for the market, although they appear to be holding back slightly, waiting for what they consider more attractive price points to ramp up buying. This cautious optimism by DIIs has helped stabilize the market to some extent, despite persistent selling from Foreign Institutional Investors (FIIs). FIIs have been net sellers over recent months, withdrawing capital as they realign their portfolios in response to global economic uncertainties. However, the resilience of retail investors and DIIs has cushioned the market from a sharper decline, showcasing the growing strength of India’s domestic investment base.

Confidence Amidst Market Correction

This unprecedented inflow of funds amidst a market decline speaks volumes about the mindset shift among Indian retail investors. Rather than viewing the fall as a reason for concern, many see it as a buying opportunity. This shift towards a disciplined, long-term investment strategy aligns well with the broader theme of India’s economic resilience and the increasing maturity of its equity market participants.

As DIIs hold steady and FIIs continue to recalibrate, the role of retail investors has become even more prominent in bolstering the market. October 2024’s figures demonstrate the strong foundation of India’s equity markets, with retail investors emerging as a stabilizing force and committed stakeholders in the nation’s economic future.

References

Disclaimer: Please reach out to your financial advisor before making any investments