Manufacturing - Theme - Mutual Fund

Is this the new theme that will propel our returns ?

A manufacturing theme mutual fund invests primarily in companies within the manufacturing sector, such as those involved in industrial production, machinery, and raw materials processing. These funds aim to capitalize on the growth and profitability of the manufacturing industry, offering investors exposure to the sector’s potential for long-term returns. If you go by the presentation of HDFC or Mahindra, you would note that they are betting on many sectors including Power, Ports, Railways, Defence, Roads etc… The Government vision in terms of Amrit Kaal 2047, Production Linked Incentive, and Make in India getting a fillip are just some of the factors that suggests that manufacturing theme based fund may perhaps do really well.

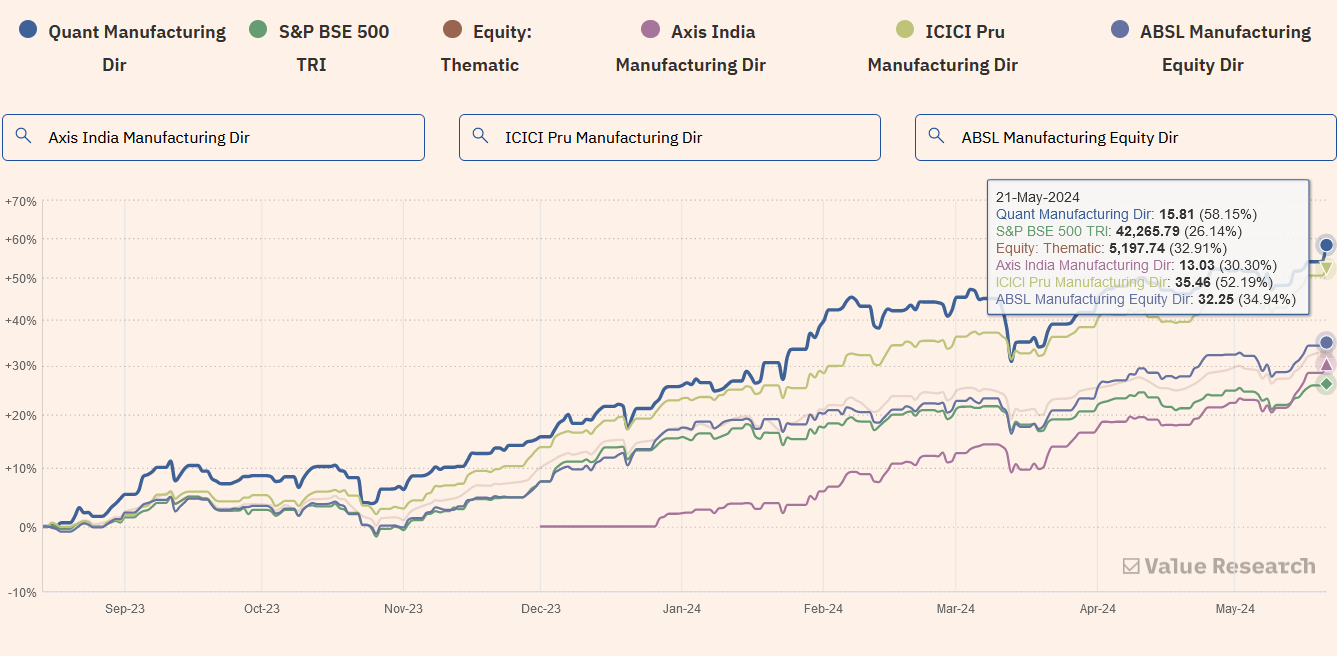

Aditya Birla Sunlife Manufacturing Fund

Launch Date - 31-Jan-2015

AUM - 950 cr

1yr Return - 34.94%

ICICI Manufacturing Fund

Launch Date - 11-Oct-2018

AUM - 3883 cr

1yr Return - 52.19%

Quant Manufacturing Fund

Launch Date - 14-Aug-2023

AUM - 652 cr

1yr Return - 58.15%

Axis Manufacturing Fund

Launch Date - 21-Dec-2023

AUM - 4683cr

1yr Return - 30.30%

Canara Robeco Manufacturing Fund

Launch Date - 11-Mar-2024

AUM - 1242cr

HDFC Manufacturing Fund

Launch Date - 15-May-2024

Performance - Manufacturing Funds

There have been 3 manufacturing fund themes in 2024 namely Canara Robeco Manufacturing Fund, HDFC Manufacturing Fund and now Mahindra Manulife Manufacturing Fund.

Manufacturing fund seems to hold promise on the following factors :

- Manufacturing would be a key factor in growth of our country

- Make in India was an initiative to improve manufacturing in India

- Manufacturing as percentage of GDP is only around 13%

- Amrit Kaal Goals - 2047 - expect manufacturing growth to increase significantly

- Government introducing policies like :

- Make In India

- Atmanirbhar Bharat

- Production Linked Incentives

- India is positioned as China+1 model to move away from overdependence in China

- India is working overtime on improving infrastructure - power capacity, metro, cargo railways, new ports etc..

- Capital expenditure planned mainly in the following area:

- Power - 14.5 lakh crores by FY27

- Defense - 1.72 lakh crores by FY25

- Cement - 1.25 lakh crores by FY27

- Semiconductors - 1.2 lakh crores by FY25

- Water - 61K crores by FY24

- Steel - 60K crores by FY25

- Mining - 50K crores by FY25

- Oil & Gas - 50K crores by FY24

- One of the key manufacturing areas is DEFENSE, RAILWAYS

- As the per capita income improves , it will eventually lead to rising consumption demand

How will this benefit you ?

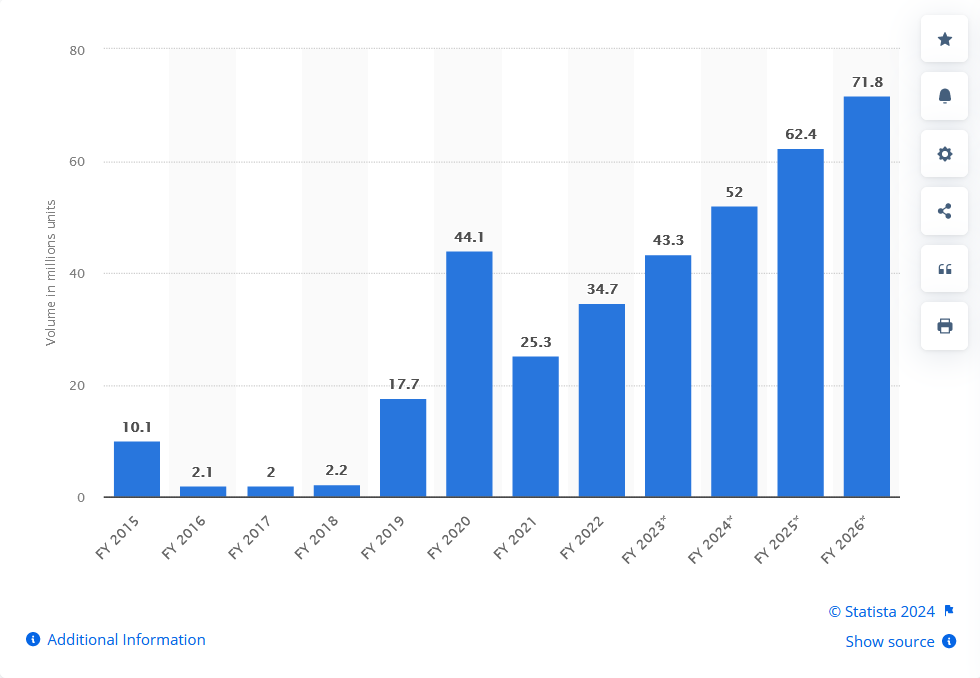

Manufacturing is a theme that will play out for the next few decades. If you look at phone exports, we were at 1.6 billion dollars in 2019 and today we are nearly 31.43 billion dollars.

Export Volume of Mobile Phones

What is the risk ?

This mutual fund has higher risk as compared to your flexi-cap, large-cap funds and will mainly focus on manufacturing theme.

How much should I invest ?

Invest to a maximum of 10% of your entire portfolio. Please understand that this is a thematic fund and therefore you should consider this as part of your satellite portfolio and not necessarily core. Thematic funds are generally more riskier than your diversified funds.

References

For more questions, please feel free to reach out to me