Goal Planning - Goal - Part 6

Identify your goals and prioritize them

What are goals ?

As an individual / family, you have a vision or a personal objective/s that you would like to meet in your lifetime .

Identify your goals and prioritize them

As an individual / family, you have a vision or a personal objective/s that you would like to meet in your lifetime .

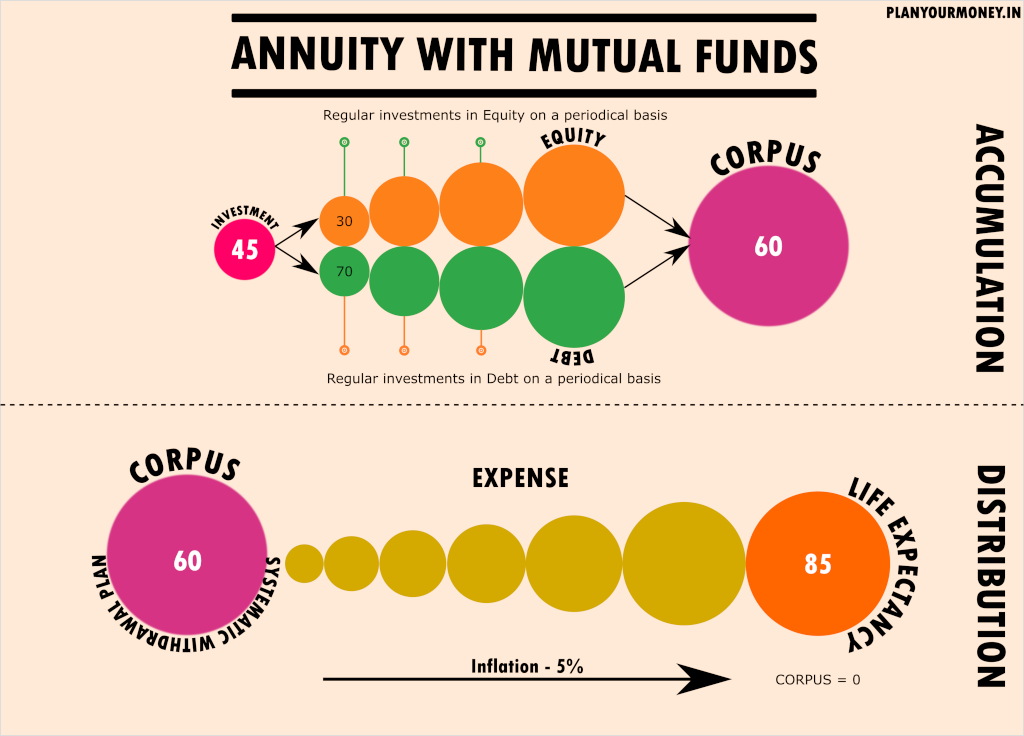

How to construct an annuity with mutual funds ?

Mahesh is 45 years old and his current expenses are Rs 75,000/- per month . He plans to retire by 60 and would like to have an annuity which would pay him enough for his current expenses. He would like this annuity to increase by 5% every year considering inflation in mind. How much should he start investing now so that it takes of my retirement till 85?

Spotlight - Reviewing the parameters of HDFC Tax Saver Fund

HDFC Tax Saver Fund is an Equity Linked Savings Scheme . It has kept its benchmark as the Nifty 500. It’s performance has not been upto the mark in the recent years. Expense ratio is on the higher side. It has been ranked a 1 star fund in Valueresearch and Moneycontrol It seems that HDFC AMC has had a closer look at this and has made major changes to this fund and is keen to turn this ship around.

What all do I own ?

Emergency fund as the name suggests is the money that you would touch when you have an emergency.

Emergencies could be :

Should I rent or buy a house ?

Before I bought my house in 2010, I was grappling with this thought whether to buy or rent ? . I was living in a rented house and was paying Rs 8000/- as rent. My parents insisted on buying a house and the EMI was Rs 14,000/- per month. I argued that the rent amount was much lesser and insisted that we live in a rented house as the EMI is much higher than the rent. As with any middle class family, my parents had their way and we eventually bought the house.