HDFC Tax Saver

Spotlight - Reviewing the parameters of HDFC Tax Saver Fund

HDFC Tax Saver Fund is an Equity Linked Savings Scheme . It has kept its benchmark as the Nifty 500. It’s performance has not been upto the mark in the recent years. Expense ratio is on the higher side. It has been ranked a 1 star fund in Valueresearch and Moneycontrol It seems that HDFC AMC has had a closer look at this and has made major changes to this fund and is keen to turn this ship around.

Introduction

HDFC Tax Saver fund was started in 1996 and has hung around for more than 20 years .

- This fund belongs to Equity Linked Saving Scheme (ELSS) and therefore you get the 80C tax benefit .

- It has about 60 stocks in its portfolio where close to 70% in large cap stocks .

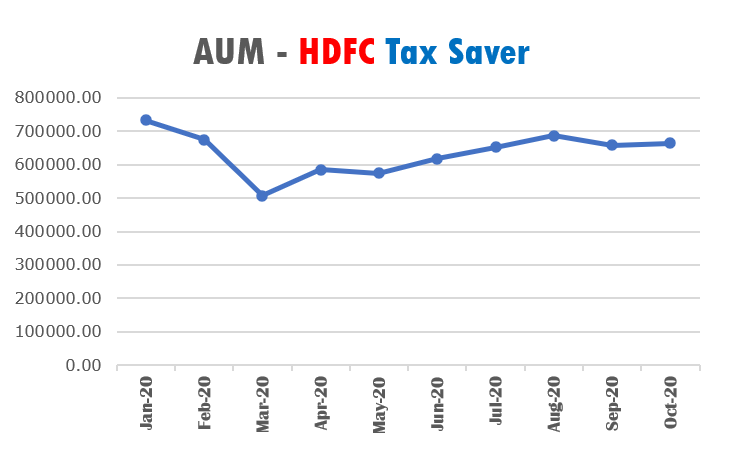

- AUM has fallen from 7326 crores to 6648 crores in the last 10 months.

- Bank, software , pharma exposure has increased in October 2020.

Jan 2020 - 7326.69cr

0%

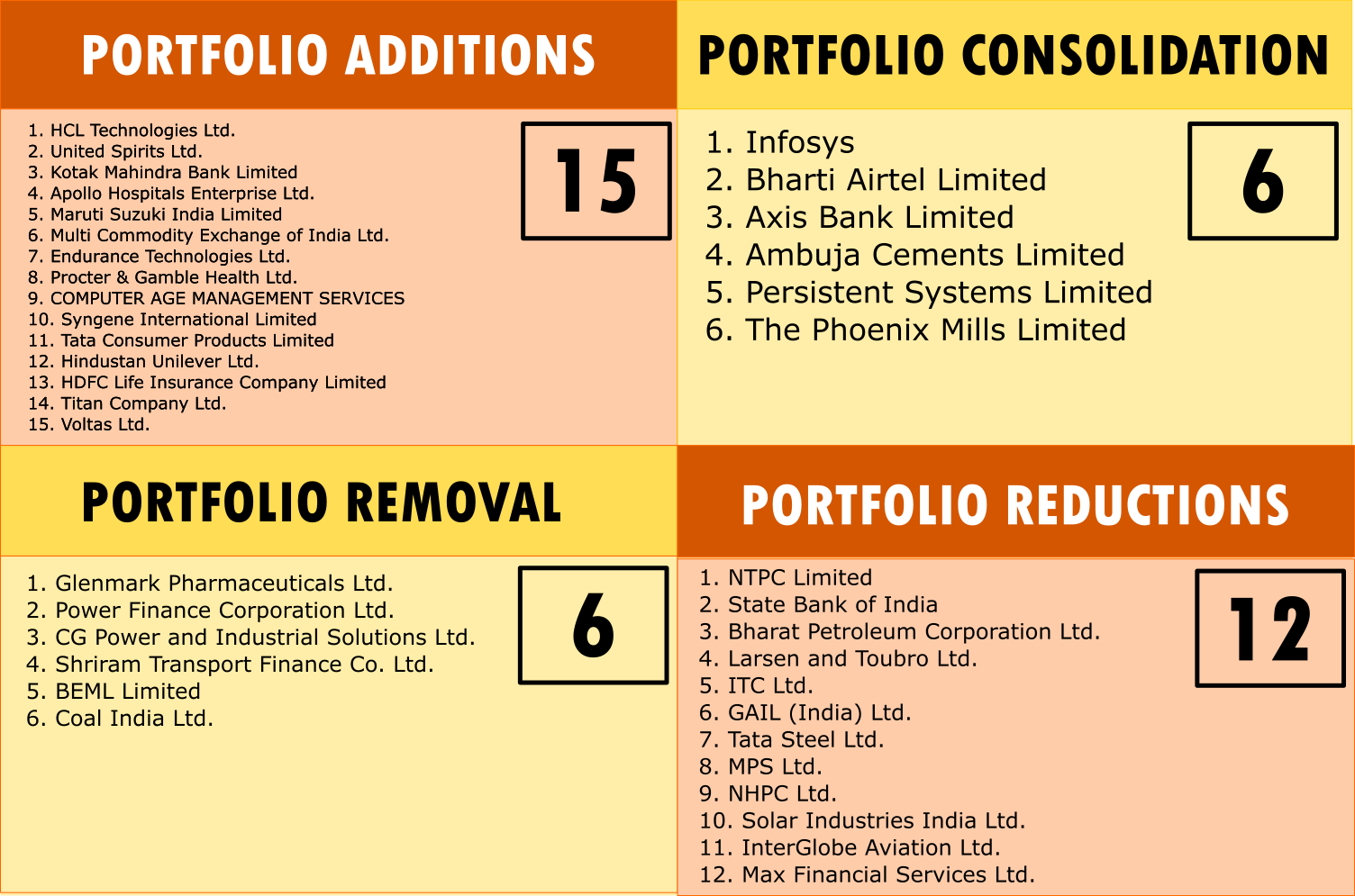

Portfolio Changes

HDFC Tax Saver - Portfolio Changes

- The new fund manager has made major changes to HDFC Tax Saver.

- There has been a portfolio turnover of 29% .

- 15 new funds have been added , 6 funds have been completely removed namely on PSU side

- 6 funds have been consolidated mainly on software and bank and 6 funds have been reduced mainly on PSU, petroleum and infrastructure

AUM Changes

AUM has been fluctuating significantly since January and is yet to reach the peak of January 2020. However, with the recent structural changes in the fund, performance improvement is likely to happen. With increase in performance, AUM is bound to increase.

HDFC Tax Saver - AUM Changes

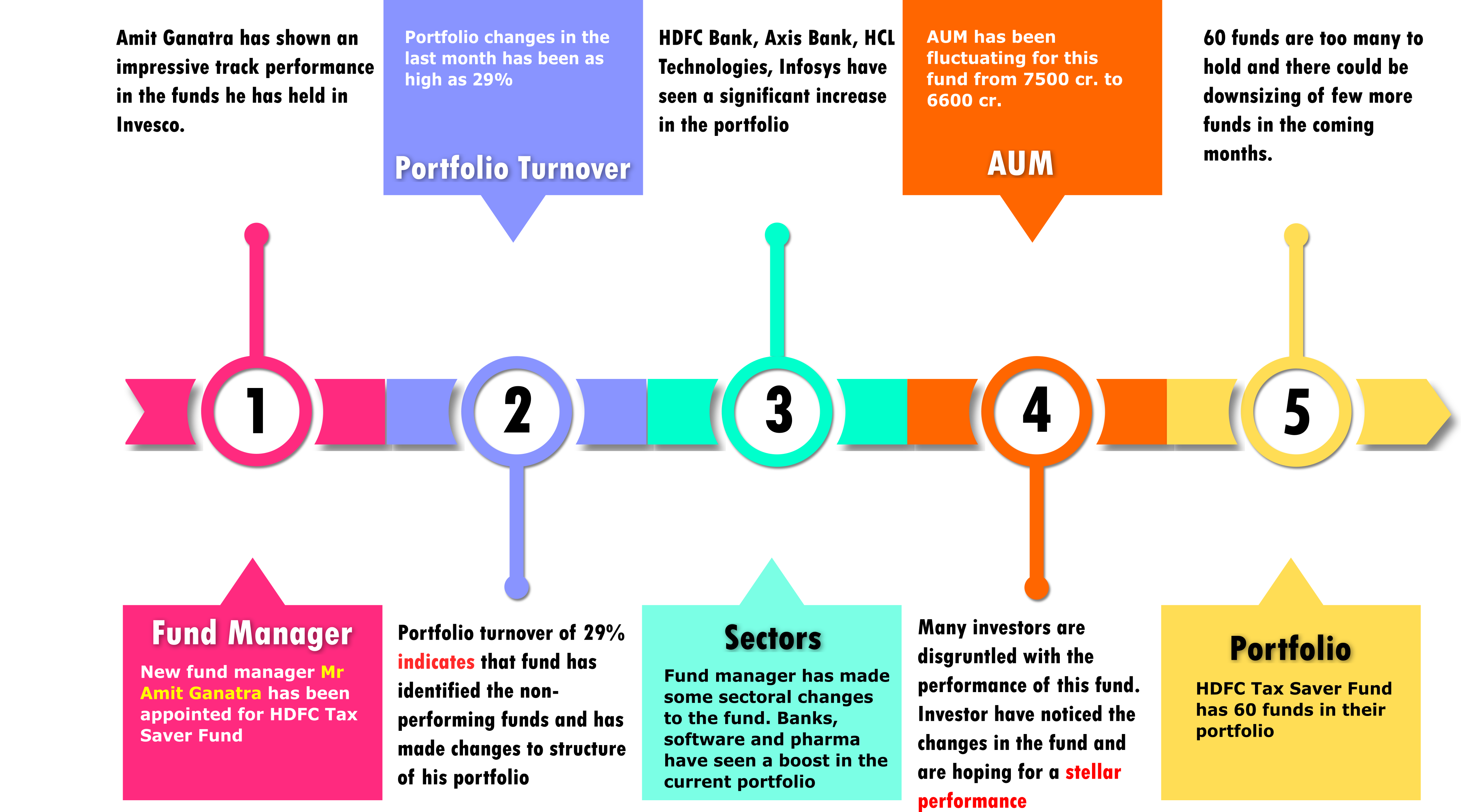

Fund Manager

Mr. Amit B Ganatra has joined HDFC AMC Ltd. in May 2020. He has over 17 years of experience in equity research and close to 10 years in fund management. Earlier he has been with Invesco Asset Management and was managing

- Invesco India Growth Opportunities Fund

- Invesco India Contra Fund

- Invesco India Largecap fund

- Invesco India Tax Plan

- Invesco India Financial Services Fund

Amit has good track record and his performance in the above funds speaks volumes.

Indicators

- There has been intent from HDFC to turnaround their ship of non-performing mutual funds

- New manager has been appointed - Mr Amit B. Ganatra who has an impressive track record

- In the monthly call , Mr Amit has clearly indicated the path going forward and has made major changes to HDFC Tax Saver portfolio accordingly

- Investment in sectors like Banks, Software and Pharma is up and therefore an uptick in performance is expected in the coming months

- There are a few concerns

- Too many stocks in their portfolio

- SBI and ITC are poised to do well, but we have seen reductions

- Wary about increase in auto-exposure, though they have recently done well in the last quarter

Performance

Changes to structure of the fund is completed, performance of the fund is to be seen over the next few months. However , positive steps have been taken to give a better performance to the investors of this fund.

Summary

HDFC Tax Saver - Summary

Keep a track of this fund for the next two months and performance of the fund and the fund manager will be quite revealing. The challenge with investors is that we end up sitting on the fence longer. However, in the same breath, be completely convinced that this is the right fund for you.

References

Disclaimer : Past performance is not indicative of future returns. Please consider your specific investment requirements before choosing a fund.