Goal Planning - Emergency Fund

What all do I own ?

Emergency fund as the name suggests is the money that you would touch when you have an emergency.

Emergencies could be :

- Medical Emergency

- Job loss etc…

What is an emergency fund ?

Emergency funds help you take care of the financial aspect of the emergency. During COVID-19, there were many people who have lost jobs. Job loss could be reasons out of your control and therefore it is imperative that you are prepared for it. Medical emergencies do not come announced and therefore always be prepared for it. For medical emergencies, your first choice should be health insurance and even after health insurance covering the amount, there will be some bills which your emergency fund can cover.

How do you build the emergency fund ?

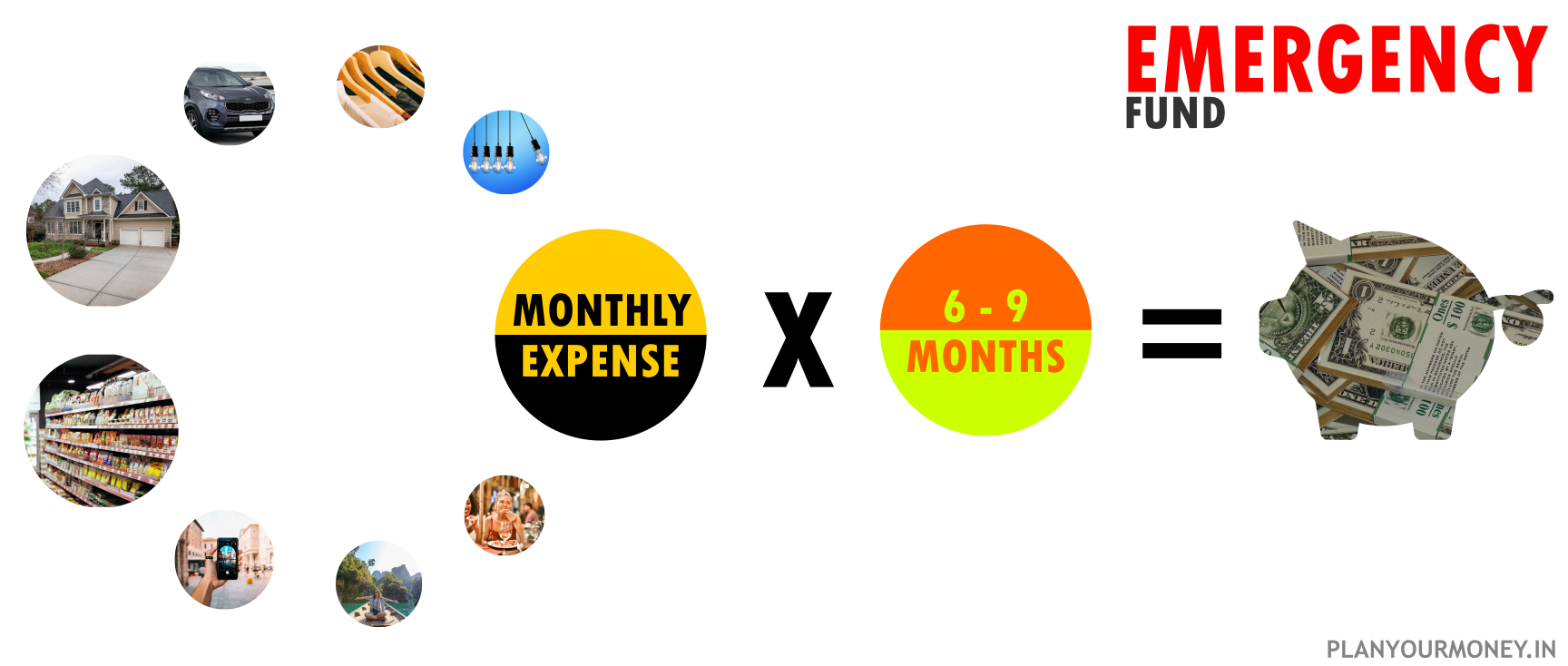

Emergency fund typically is 6 to 9 months of your monthly expenses .

Monthly expenses includes ALL expenses.

A typical family would have the following expenses , but not limited to :

- Rent / EMI

- Groceries

- Utility - Electricity / Water / Gas etc…

- Dining out

- Clothing

- Entertainment - Movies / Travel / Hobbies

- Insurance - Auto / Health / Life

- Medical Expenses

- Phone - Landline / Mobile

- Apartment Maintenance

- Automobile - Maintenance / Petrol etc…

- Education Fees

Emergency Fund Calculation

Once you have ascertained your expenses, multiply this by 6 or 9 , to obtain the amount for emergency fund .

Why do you suggest 6 or 9 months ?

Let us assume that you are between 24 to 35 and you are among the lower layer of the pyramid structure in the organization and for whatever reasons, you have lost your job. You should be able to find a job within the next 6 months. As you move higher up the ladder, the number of jobs which are open are lesser and therefore it could take sometimes close to 9 months to find a job.

Assuming there is a medical emergency and the average cost to be around Rs 3 lakhs and your current net salary is Rs 50,000/- (assuming you have no health insurance), once again this amount should suffice.

As you can see, 6 to 9 months of your daily expenses, takes care of your job loss , medical expense. Contingency plan, if you will !

Where should I park my emergency fund ?

Emergency fund should be liquid in nature. It means that you should be able to use that money as quickly as possible. You should be able to convert your emergency fund into liquid cash in a day. You could keep these funds either in savings account, fixed deposit, overnight / liquid mutual funds.

Should I keep more than 6 to 9 months in emergency fund ?

In the previous section you have noticed that you would park your funds in savings account, fixed deposit, overnight / liquid funds - you would earn very less return and therefore in this regard, if you keep more money in such funds, you would get a lesser return. Therefore choose wisely and 6 to 9 months should generally be sufficient.

I have already used my emergency fund. What now ?

Replenish your emergency fund as soon as you exhaust it. Emergencies, generally, do not come every year but it comes unannounced.

How often should I relook at my emergency fund ?

I would strongly recommend that you look at your emergency fund every year. As our income increases, we tend to increase our lifestyle expenses and it is difficult for us to adjust on the lower side.

Following examples, should help you understand :

- In case you have already paid your loan, remove the EMI from your monthly expenses.

- In case your lifestyle expense has increased , adjust the amount accordingly at the beginning of the new year.

- Your son / daughter has moved from 10th to 11th , fees have changed, you may have to revisit your emergency fund.

Conclusion

Emergency fund is a contingency plan for all your emergencies. It gives a cushion when you are down ! Don’t keep too much money in the contingency plan, it impacts your other goals.