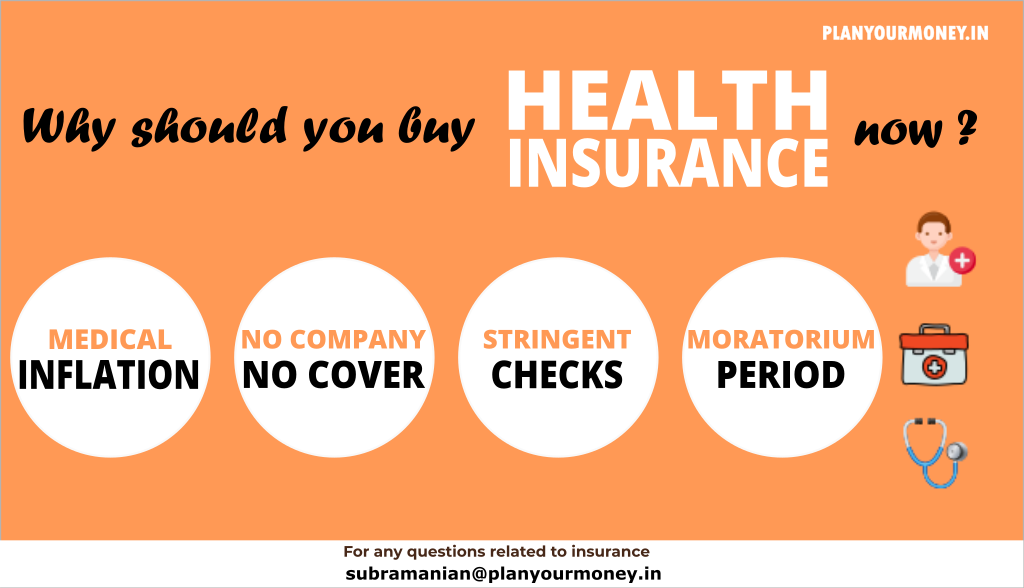

Why should you buy Health Insurance

4 reasons to buy Health Insurance now

Health insurance is crucial for financial protection against rising healthcare costs. It ensures access to quality healthcare, safeguarding individuals and their families during medical emergencies. With health insurance, one can avail cashless hospitalization and receive timely medical treatment without the burden of upfront payments. Additionally, it provides coverage for critical illnesses and offers tax benefits, promoting preventive care and overall well-being. There are many more benefits of health insurance which you will find it below here.