Why should you buy Health Insurance

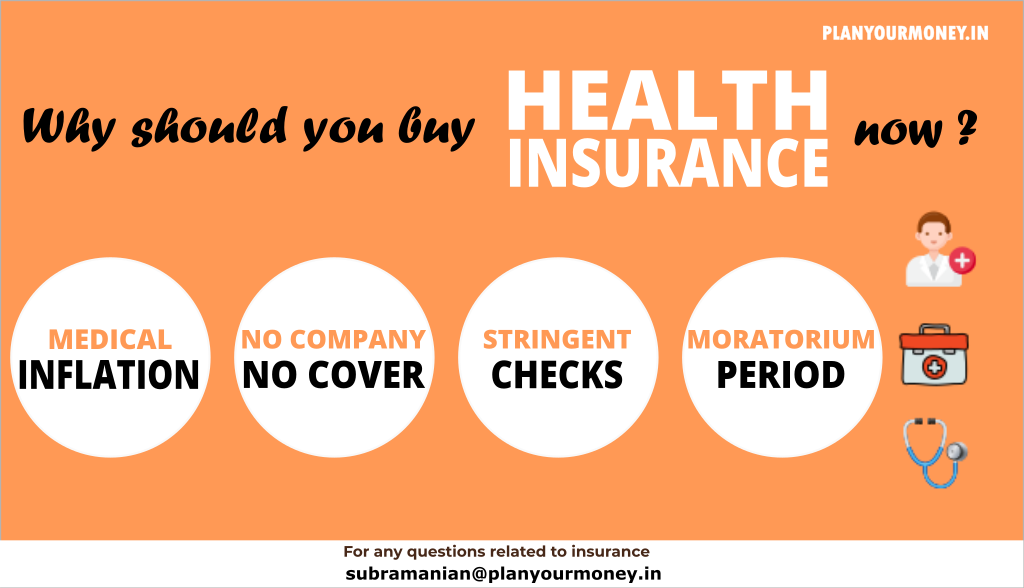

4 reasons to buy Health Insurance now

Health insurance is crucial for financial protection against rising healthcare costs. It ensures access to quality healthcare, safeguarding individuals and their families during medical emergencies. With health insurance, one can avail cashless hospitalization and receive timely medical treatment without the burden of upfront payments. Additionally, it provides coverage for critical illnesses and offers tax benefits, promoting preventive care and overall well-being. There are many more benefits of health insurance which you will find it below here.

1. Medical Inflation

Medical inflation is up by 14% and therefore the rising medical costs. A major surgery could wipe out your entire savings and therefore when you buy the cover ensure that you have considered the medical inflation and the amount of money you may require if you would have to do a surgery in senior years. The other way to think about this is cost of fitness is much lesser than the surgery, so be fit but at the same time insure yourself.

2. No longer in the organization - No cover

Health insurance provided by the company ceases the moment you are no longer employed. As soon as your employment contract ends with your organization, your insurance ceases. It is important that you are protected throughout and your employment choice or your employment doesn’t determine your cover.

3. Insurance checks are stringent

Insurance checks have become stringent. I remember for life insurance, there were no medical checks about 5 years back. However, many of these checks have become mandatory. Please remember the insured gives the proposal to the insurer and the insurer has to accept. For the insurer to accept with these new checks like medical tests etc… , the premium may go up or in some cases, they may not even give an insurance.

4. Moratorium Period

If a policyholder maintains the coverage for 8 years without a break, the health insurance provider cannot deny a claim. These 8 years are called the moratorium period.

Conclusion

Health insurance is an absolute necessity in today’s world. It provides financial security and shields individuals from the skyrocketing costs of healthcare. With access to quality medical services and cashless hospitalization, it ensures timely and comprehensive treatment. Moreover, health insurance covers critical illnesses, reducing the burden of expensive medical procedures. By prioritizing health insurance, individuals can protect themselves and their loved ones, giving them peace of mind in times of medical uncertainty.

References

In case you have challenges in buying the right health insurance, you can reach out to me via email or send a message in LinkedIn