Best performing mutual funds in 2020

Best Performing Mutual Funds

Best Performing Mutual Funds 2020

The year 2020 will be long remembered for pandemic , job loss , economic loss , lockdown, disasters etc. It will also be remembered for tenacity, willpower, strength, patience of the common man, companies, institutions, government etc… This year has been a year of extreme volatility . We have seen extreme fear and moderate greed in the same year. Swinging from doomsday to irrational exuberance are all happening at the same time. In this article, the performance of mutual funds are compared from YTD.

Sectors

If you look at the BSE indices which have done since 1st January 2020 are :

Best Mutual Fund 2020

- S&P BSE Healthcare Index (48.48%)

- S&P BSE IT Index (40.05%)

- S&P BSE Teck. Index (29.41%)

- S&P BSE Smallcap (19.91%)

- S&P BSE Midcap (10.00%)

This gives a view that if you had just stayed invested despite the debacle in March 2020, you would have still received a gain of 8 to 10%. Large caps and ELSS have a given a return of 6 to 7%. We have known from history that after every fall, there will be a rise. The difference is that the rise has been within a shorter period of time.

Top 5 mutual funds in 2020 (YTD)

- DSP Healthcare Fund - 66.41%

- Mirae Asset Healthcare Fund - 60.88%

- PGIM India Global Equity Opportunities Fund - 59.67%

- Quant Small Cap Fund - 59.49%

- ICICI Prudential Pharma Healthcare and Diagnostics Fund - 56.74%

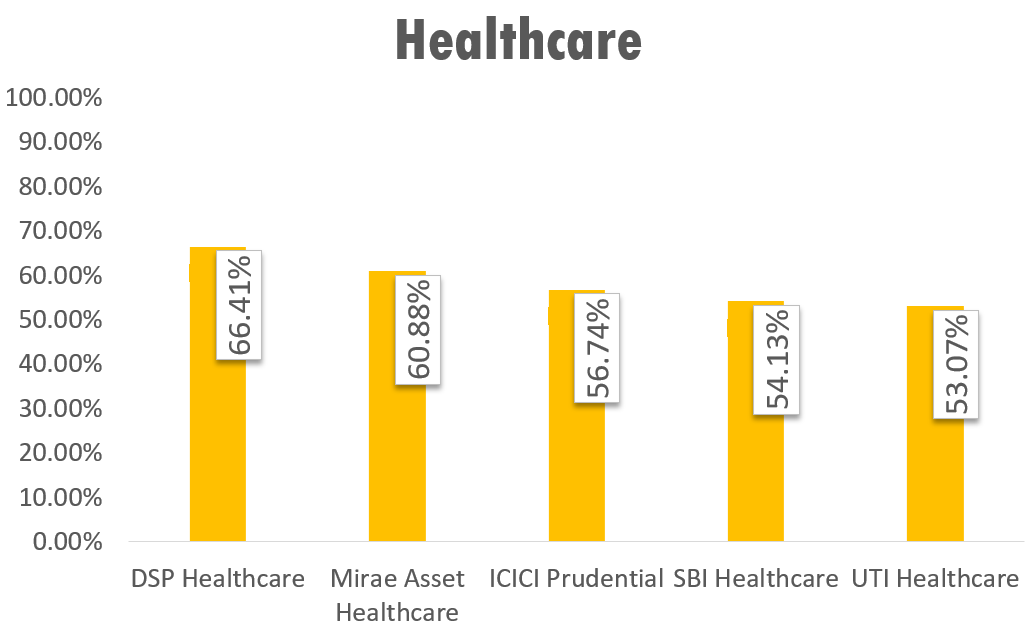

Healthcare Funds

If you had invested in any healthcare fund, you would have received an average of 51% in return.

- DSP Healthcare Fund - 66.41%

- Mirae Asset Healthcare Fund - 60.88%

- ICICI Prudential Pharma Healthcare and Diagnostics Fund - 56.74%

- SBI HEALTHCARE OPPORTUNITIES FUND - 54.13%

- UTI Healthcare Fund - Regular Plan - Growth Option - 53.07%

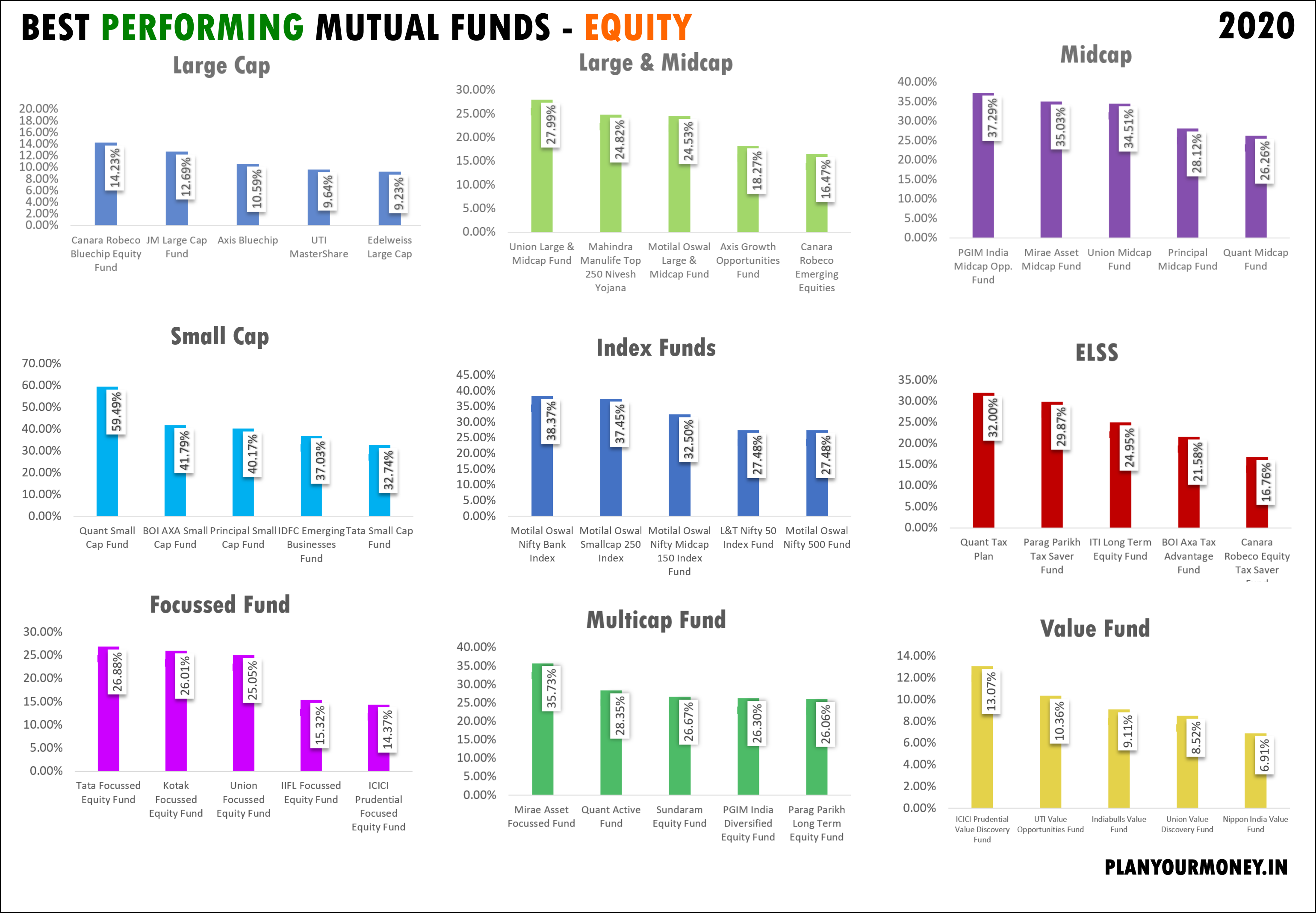

Large Cap Funds

- Canara Robeco Bluechip Equity Fund - 14.23%

- JM Large Cap Fund - 12.69%

- Axis Bluechip Fund - 10.59%

- UTI - Master Share - 9.64%

- Edelweiss Large Cap Fund - 9.23%

Mid Cap Funds

- PGIM India Midcap Opportunities Fund - 37.29%

- Mirae Asset Midcap Fund - 35.03%

- Union Midcap Fund - 34.51%

- Principal Midcap Fund - 28.12%

- Quant Mid Cap Fund - 26.26%

Large & Mid Cap Funds

- Union Large and Midcap Fund - 27.99%

- Mahindra Manulife Top 250 Nivesh Yojana - 24.82%

- Motilal Oswal Large and Midcap Fund - 24.53%

- Axis Growth Opportunities Fund - 18.27%

- Canara Robeco Emerging Equities - 16.47%

Index Funds

- Motilal Oswal Nifty Bank Index - 38.37%

- Motilal Oswal Nifty Smallcap 250 Index Fund - 37.45%

- Motilal Oswal Nifty Midcap 150 Index Fund - 32.5%

- L and T Nifty 50 Index Fund - 27.48%

- Motilal Oswal Nifty 500 Fund - 27.48%

ELSS Funds

- Quant Tax Plan - 32%

- Parag Parikh Tax Saver Fund - 29.87%

- ITI Long Term Equity Fund - 24.95%

- BOI AXA Tax Advantage Fund - 21.58%

- Canara Robeco Equity Taxsaver Fund - 16.76%

Focussed Funds

- Tata Focused Equity Fund - 26.88%

- Kotak Focused equity Fund - 26.01%

- Union Focused Fund - 25.05 %

- IIFL Focused Equity Fund - 15.32%

- ICICI Prudential Focused Equity Fund - 14.37%

Multicap Fund

- Mirae Asset Focused Fund - 35.73%

- Quant Active Fund - 28.35%

- Sundaram Equity Fund - 26.67%

- PGIM India Diversified Equity Fund - 26.3%

- Parag Parikh Long Term Equity Fund - 26.06%

Value Fund

- ICICI Prudential Value Discovery Fund - 13.07%

- UTI Value Opportunities Fund - 10.36%

- Indiabulls Value Fund - 9.11%

- Union Value Discovery Fund - 8.52%

- Nippon India Value Fund - 6.91%

International Funds

For international funds, I already have mentioned it here There are no major changes and many of them are still doing well.