Asset Allocation

Consequences of asset allocation and time on investment

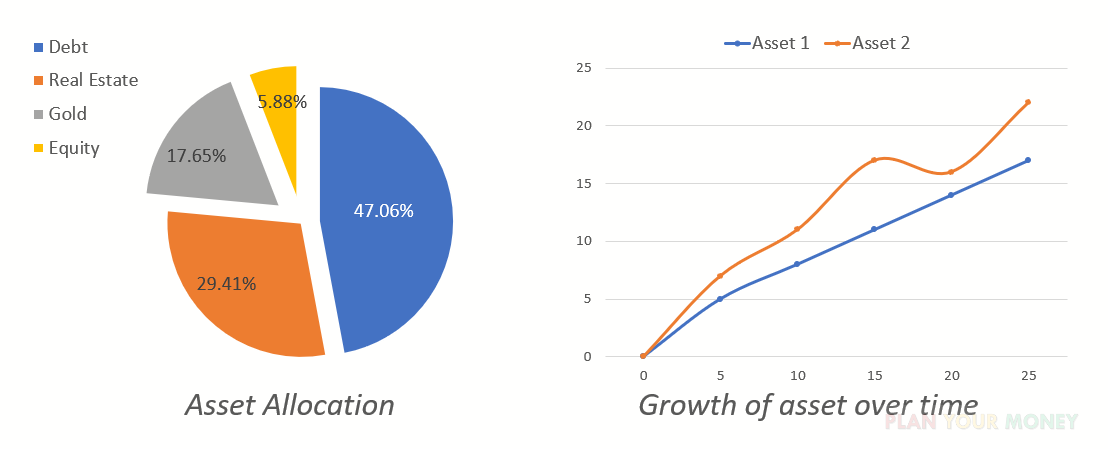

There are two important factors in determining corpus for any goal. These are time horizon of investment and asset allocation .

Time Horizon

Time Horizon is the amount of time from today to your goal start date. Greater the time, lesser would be the investment required, all other things remaining constant. Therefore it is always recommended to start early for your goals when time is by your side.

Asset Allocation

Based on your risk profile and the time horizon, your asset allocation is determined. For e.g. if you plan for your retirement at 30, equity is a great way to achieve your goal. In the long run, equity provides more than 10% return. Asset allocation is basically determining the type of asset for you to invest your amount. Should you put more amount in savings, fixed deposit, corporate bonds, debt mutual funds, equity mutual funds, stocks, real estate ?

In case you get these factors wrong, you may underachieve which could be detrimental in achieving your goal.

Just to illustrate this example, look at Table 1: Effects of time horizon shows what happens when you start 10 years late. In this case, as Shyam has started late by 10 years , he loses 21.44 lakhs and therefore would have to invest more just to achieve that amount.

| Ram | Shyam | |

|---|---|---|

| Age | 30 | 30 |

| Plan to retire at | 60 | 60 |

| Started investing | 30 | 40 |

| Rate of return | 10% | 10% |

| No. of years | 30 | 20 |

| Amount invested | ₹1,00,000 | ₹ 1,00,000 |

| Annual investment | ₹ 10,000 | ₹ 10,000 |

| Value @ retirement | ₹33,89,880 | ₹ 12,45,500 |