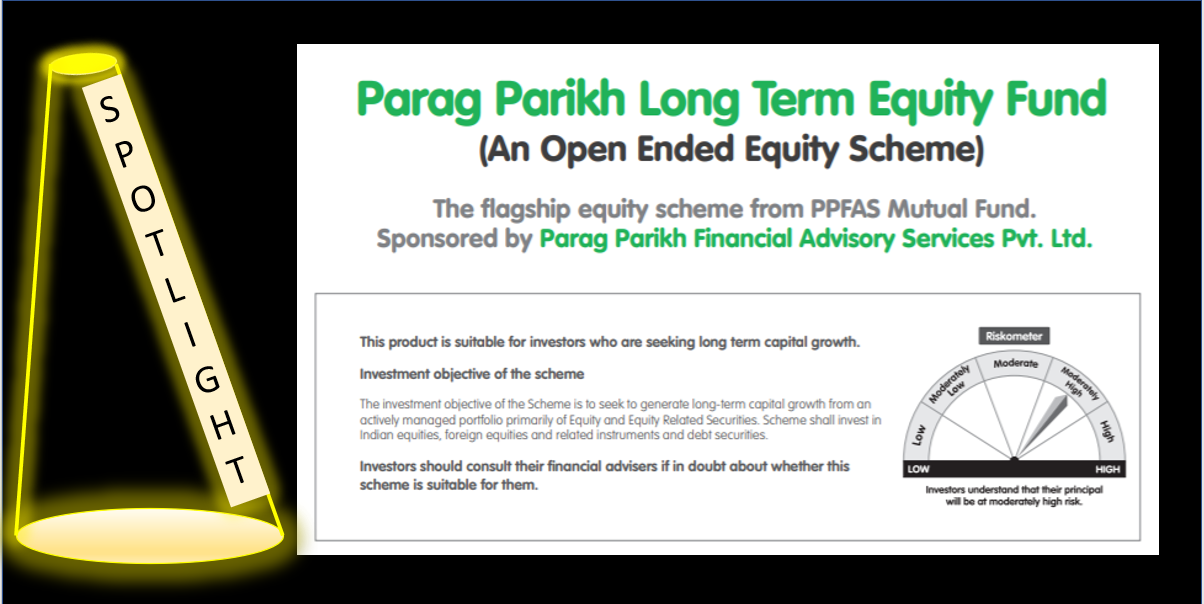

Parag Parikh Long Term Equity Fund

Spotlight - Reviewing the parameters of the fund

Parag Parikh Long Term Equity Fund is unique in many ways and is quite interesting as well. PPFAS was established in 2012. PPFAS has only three funds , unlike , many AMC’s. Shri Parag Parikh who pioneered Value Investing is the founder of PPFAS. There are multiple reasons why I find PPFAS quite intriguing and you get a feeling of comfort when investing in their funds.

Let us start with the concepts:

-

Value Investing

Value investing is a strategy which involves picking stocks lesser than the intrinsic value -

Hammurabi code

I am quite enthused about Hammurabi code which basically says they have their own skin in the game .

Introduction

Parag Parikh Long Term Equity Fund is a very interesting mutualfund. It tracks the Nifty 500 ( Equity Multicap fund ) and also has exposure to international funds .

It has about 8% exposure to Amazon and given the recent run of Amazon giving more than 50% in the last 6 months has really boosted this mutual fund return as well.

Expense ratio is on the higher side but given the returns this fund has been giving, I wouldn’t worry too much about it.

Indicators

Jan 2020 - 2783.54cr

1% < 730 days

Many investors are seeing quite positive intent with this mutual fund. Let us go through some of the indicators which will help you decide with this fund

- Assets Under Management (AUM) of this mutual fund has increased by 44% in 6 months .

- Scheme makes it very clear that invest this in fund if you would like to stay invested for 5 years or more

- It has invested in quality stocks which are yielding positive performance and giving a very good return for e.g.

- Amazon - (~9% - AUM) - 74% rise in 6 months

- Alphabet - (7% - AUM) - 18% rise in 6 months

- Persistent - (6% - AUM) - 46% rise in 6 months

Performance

- From 01-Jan-2020 to now , PPLTE fund has given a return of 18.30%

- From 01-Apr-2020 to now , PPLTE fund has given a return of 50.46%

- Since inception , PPLTE fund has given a return of 17.06%

Conclusion

It is quite clear that this fund is a must have for your long term financial goals . The fund manager has been doing exceptionally well and selecting the right stocks and ensuring value for its investors.