Biases

How biases affect our decision ?

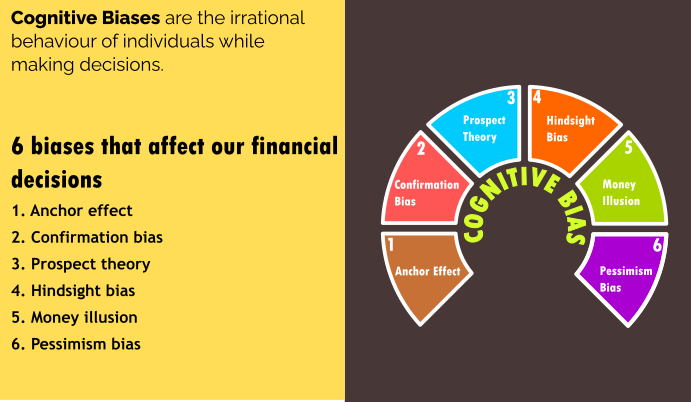

A cognitive bias is a systematic error in thinking that occurs when people are processing and interpreting information in the world around them and affects their decisions and judgements.

The concept of cognitive bias has been introduced by Daniel Kahnemann and Amos Taversky in 1972. I strongly recommend to read the book Thinking Fast and Slow which details the working of our brain.

There are several biases that we should be aware of whenever we are making decisions :

- Anchor effect

- This is a tendency to anchor yourself or stick to an information and are unwilling to accept any new information that deviates from it.

Example you are researching on a stock say Infosys , and you have seen that the 52 week low is Rs 509 and assume the current price is Rs 1200 , you would think that you are paying too much for this stock. You have anchored on to the 52 week low and unable to make the purchase.

- Confirmation Bias

- In this bias, you would discount all the evidences that goes against your belief and would only gather statements that works in your favour.

Example You have found out that a stock is doing well and your friends have made money in it. You are reading articles where everything seems to be positive about the stock. You bought the stock. Few days before, you dismissed the article on tax notice on the company. The stock is now going down.

- Prospect Theory

- Prospect Theory says that people react differently to potential gains or potential losses from a reference point rather than in absolute terms.

Example : If you were given a choice that you could win Rs 500 for sure or you have a 50% chance that you could win Rs 1000/-, you would choose the former. However, if you were given a choice of losing Rs 500 for sure or a 50% chance of losing Rs 1000/-, people would chose the latter.

- Hindsight Bias

- I-told-you-so effect. You predict that a stock will fall and the stock fell which reinforces the thought that you can predict anything . Hindsight vision is 20-20.

- Money illusion

- In this case, we are unable to think money in its real value but think of money in its nominal value .

Example Price of petrol was Rs 10 per liter in 1990 and now it is Rs 85. Price of tur dal was Rs 55 per kg in 2011 and now it is Rs 120. Therefore the same money is unable to buy enough food for the same family. Real value of money (purchasing power) is important than nominal value.

- Pessimism bias

- It is a cognitive bias that causes one to overestimate the effect of negative things .

Example You have been investing in SIP's till March 2020, however, after 20th March 2020, you have seen the steep fall. You have seen market fall from 40K to 28K and believe this will fall further. To stem your losses, you withdrew. If you did, this would have been a disaster.