Monthly RoundUp - December 2020

RoundUp of mutual funds

Let us look at what have transpired in December 2020

-

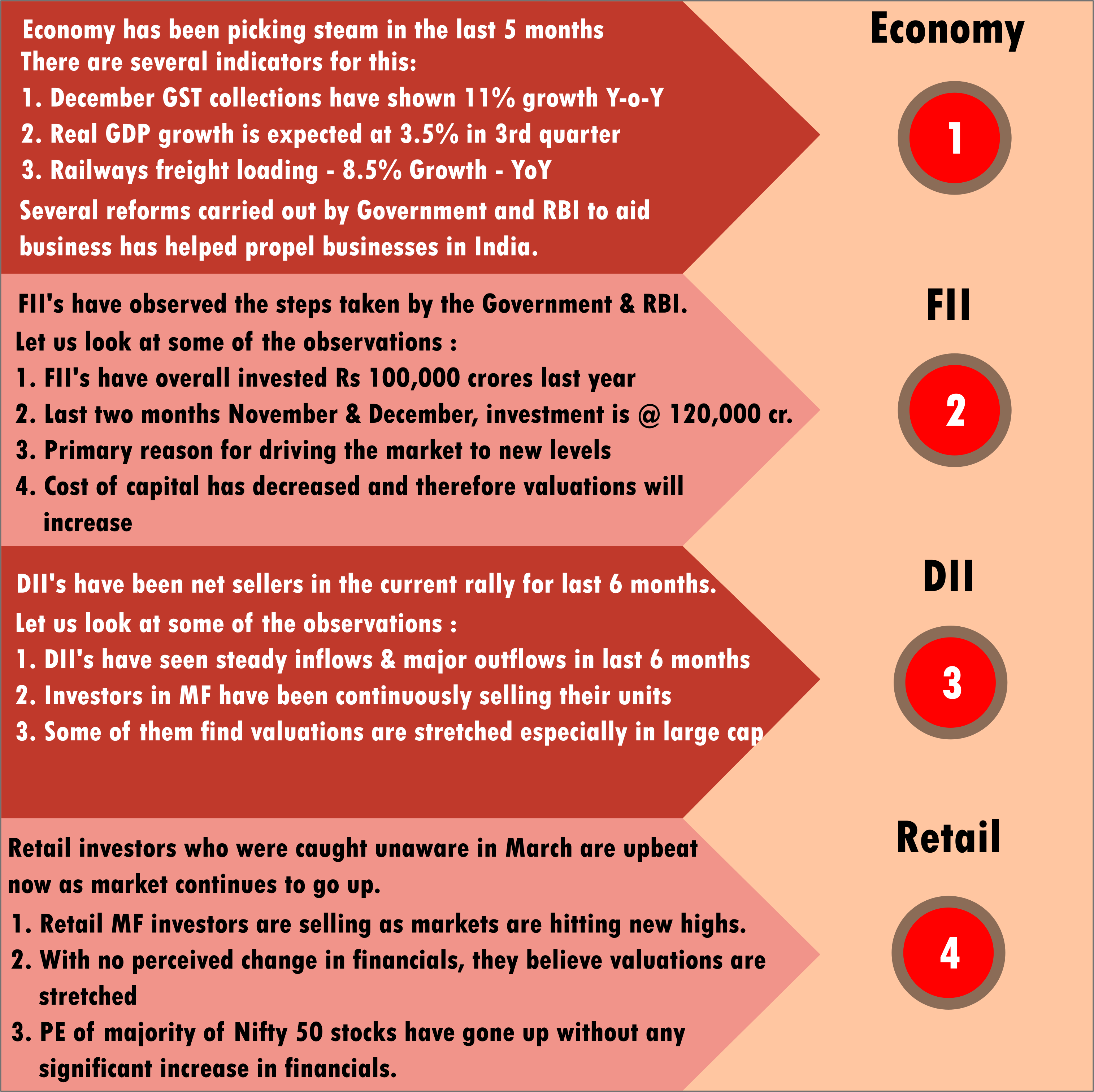

In December 2020, markets have risen by 6.66% overall.

-

GST collection in December at all time high

-

FII’s have invested Rs 103,156 crores in calendar year 2020. They continue to pump money in 2021 (11000+crores already added).

-

DII’s have been net sellers in calendar year 2020. They sold 35,663 crores . In fact, DII continue to be net sellers as of today. One of the reasons, DII are net sellers is that retail investors are booking profits given that the stock market is reaching new pinnacles on a daily basis.

-

However, there has been a net outflow of 10,000+ crores in equity funds. Surprisingly, sectoral funds have seen close to 3,400 crores of inflow.

-

In December 2020, there has been a net inflow of 13,000+ crores in debt funds . Overnight and Corporate Bond Funds have seen the maximum inflows in debt funds.

-

PE Ratio for many large cap stocks have gone very high :

- For example, Infosys - PE was around 15-20, however since July, it has increased and now at 32.

- Hero Motocorp, PE was around 15, however since July, it has now increased to 27

- Wipro, PE around 15 , however since August, it has increased to 27

- Eicher Motors, PE hovering at 26, since August, jumped to a high of 64 , currently at 60

- JSW Steel, PE hovering between 10 to 15, has been rising since June and is now at 66

PE Ratio is the ratio of price per share to earnings per share .

The same cannot be said for Government owned entities in largecap.

December 2020 - Economy

Winners

Infrastructure Fund and Consumption Opportunities Fund are the two sectors which have been doing really well.

Infrastructure

| December 2020 | Open | End | Return | High |

|---|---|---|---|---|

| S&P BSE India Infra | 166.43 | 186.26 | 11.91% | 186.26 |

Some of these funds have :

- SBI Consumption Opportunities Fund - 13.80%

- HDFC Infrastructure Fund 13.80%

- Quant Consumption Fund - 11.3%

Losers

Once again this month, we have NO losers , all mutual funds have gained this month. This gives you the kind of broad based rally that has taken place in the stock market.

Disclaimer: Sectoral funds are quite risky and therefore based on your risk appetite make a wise decision.