Equity Savings

What are equity savings ?

Mutual Funds began in 1963 in India. Private mutual funds came into being in 1993. AMFI was established in 1995. Since then, there have been so many varieties of mutual funds. Based on your individual goals and risk profile, you would purchase a mutual fund. The question therefore begs to be asked is - is equity savings fund right for you ?

What are equity savings fund ?

- Mutual funds are defined by their structure and tax applicable on them.

- For an equity investment, a fund must invest at least 65% of their investment in equity .

- The purpose of equity savings fund is to give investors a flavor of balanced equity fund .

- In other words, lesser risk. The returns on equity savings fund hovers around 6 to 10% .

- As it takes contra positions , technically return will not be so high, but some funds have been able to give return of 12% .

How does the fund manager achieve this ?

There are gaps between stock price and future price. This is identified by the fund manager. He takes opposite positions in equity and derivative market and hedges his risks. So ideally fund manager can invest 33% in equity and 33% in arbitrage and still be over 65% which is required to designate as equity fund. As it is determined as equity fund, you have all the benefits of equity funds as in :

- Capital Gain over 1 lakh is taxable

- Holding Period is 1 year for Long Term Capital Gain

What funds are available in this category ?

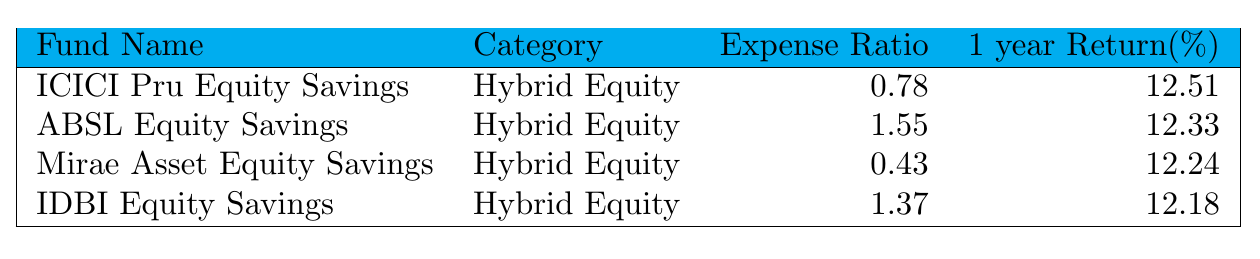

Some of the funds available in Valueresearchonline are shown below :

Equity Savings

Who should go for such types of funds ?

If you are not comfortable with the risk of small cap, mid cap and large cap funds but still need equity exposure so that your returns are higher than debt funds, this is the fund for you.