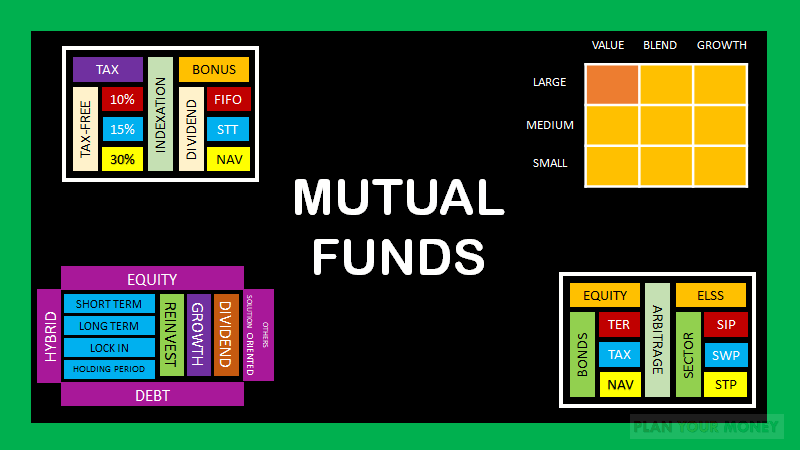

Mutual Fund - Equity - Taxation

How are mutual funds taxed ?

Taxation of mutual funds is important for filing of income taxes . There are few things one needs to understand before filing taxes for mutual funds:

- Identify type of mutual fund

- How long have you been holding the mutual fund ?

- What is the prevailing tax structure for the given mutual fund ?

1. Identify type of mutual fund

First step is to identify whether the mutual fund is equity oriented. This can be found out from the Key Information Memorandum (KIM) from the Asset Managing Company (AMC) website or through various websites including valueresearchonline.com and sundry.

2. Holding Period

Holding period is determined by calculating the difference between the date of purchase and the date of selling the unit. If the holding period is 12 months or more , it is called as long term holding period. Otherwise, it is termed as Short-Term holding period.

2.1 Short Term Capital Gains Tax

In case your mutual fund comes under Short Term Holding period, short term capital gain tax is applicable to you and currently gain is taxed at 15% .

Example : If you have bought a Mirae Asset Large Cap - Equity Fund on 01-Oct-2019 and you have sold it on 01-Jan-2020, you have held the mutual fund for only 3 months.

Holding period is 3 months and therefore on the capital gain, you will be taxed 15% .

2.2 Long Term Capital Gains Tax

In case your mutual fund comes under Long Term Holding Period, long term capital gain tax is applicable to you. Long term capital gain tax has been introduced in 2018 Budget. Long Term Capital Gains (LTCG) arising on sale of Equity Shares or Units of an Equity Oriented Mutual Fund on which Securities Transaction Tax (STT) is paid. Long term capital gain tax is applicable only if your gains exceed 1 lakh . Currently there is no benefit of indexation.

Example : If you have bought an equity oriented mutual fund on 01-Jan-2019 and you have sold it on 25-Jan-2020, holding period is for more than 1 year.

Who should go for such types of funds ?

If you are not comfortable with the risk of small cap, mid cap and large cap funds but still need equity exposure so that your returns are higher than debt funds, this is the fund for you.