2nd year of Personal Finance

Celebrating 2 years of Personal Finance

It has been 2 years of personal finance, since I first began in October 2020. I completed my MBA finance which I talked about in my last year post. Studying for more than a year was quite exhausting and I quite happy and pleased about my result.

How did I do on my roadmap ?

-

AMFI publishes a lot of data on a regular basis which gives insights in trends of mutual fund industry. I plan to showcase some of these trends.

Comments - I have this on my radar and surely by the new year will be publishing this

-

I also plan to provide a portal for investors to see a

- consolidated view of their investments

- provide alerts to investors

Comments - This is a work in progress. There are many changes that is required to be made in portal and would approximately take another 1 year before it takes off

-

The next year would bring a lot of changes to the economic situation, unless COVID decides to elongate its stay. Government would be quite active in bringing lot of policy level changes. This could make certain other asset classes interesting.

-

Comments - As predicted - RBI kicked off interest rate hikes - 40bps in May, 50bps in June, August and September. There is one more meeting scheduled and need to wait and see how much more RBI will increase the interest rates.

-

Government announced excise tax cut of Rs 8 per litre on petrol and Rs 6 per litre on diesel

-

Government reduced import duty on key raw materials and inputs for steel and plastic industry

-

Duty free import of crude soyabean and sunflower oil

-

-

Articles on Insurance and Wills are long pending and this should guide some of the investors / readers to ask the right questions

- In fact, I can quote some instance including my own work with wills which helped me complete a transaction.

- Insurance is a must in this day and age including both life and health. I defintely plan to put pen to paper on these topics.

-

Workshops on financial planning

- Presentations are ready and workshops should happen before December 2022

How has market played out ?

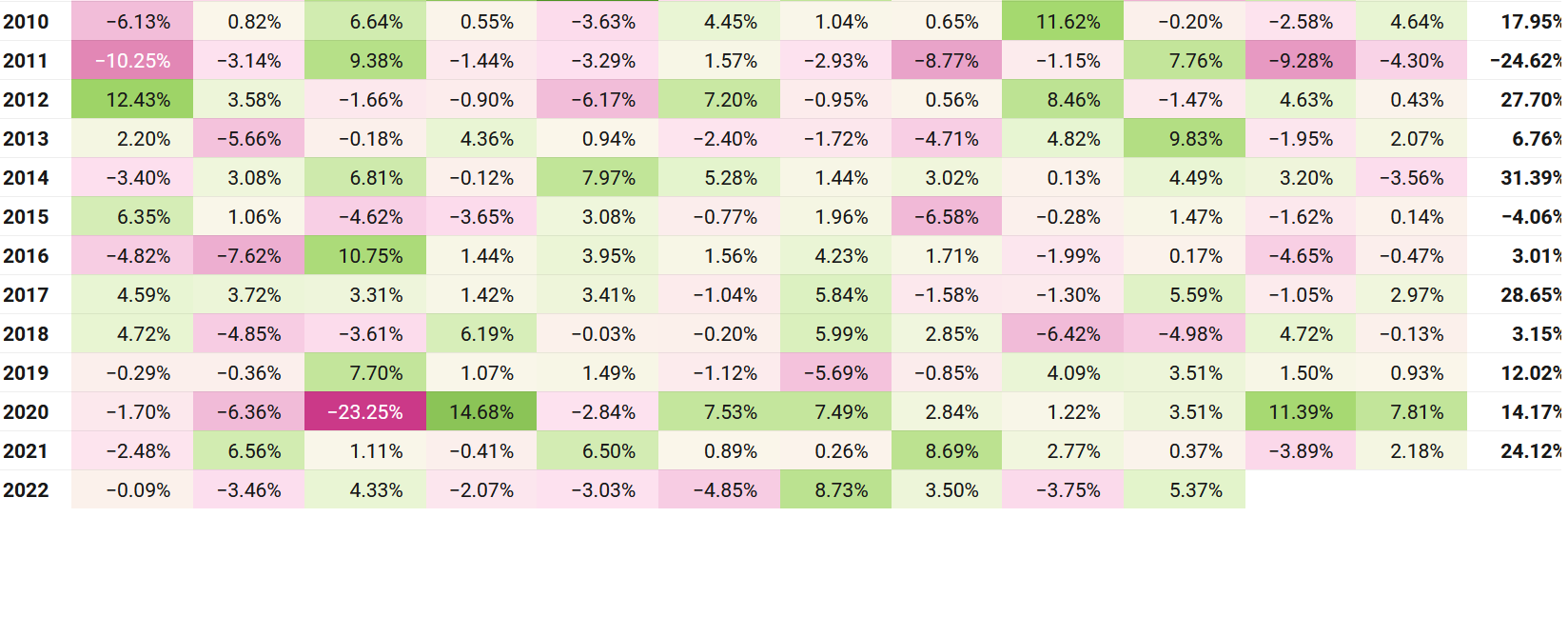

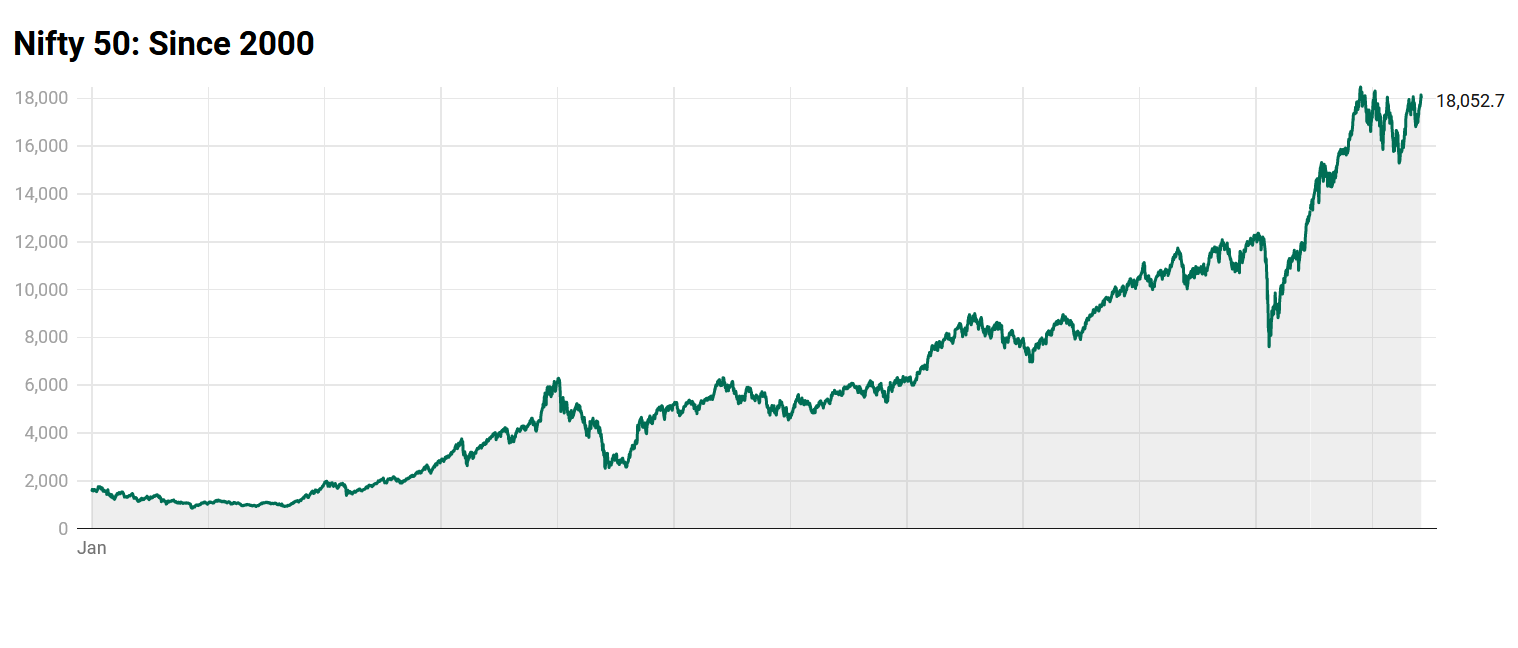

Courtesy: Primeinvestor.in

From the above two charts, you can clearly see that the investors who have stayed invested without looking at the daily news have become richer over the period of time. Interest rates have risen, inflation has gone up, but so have the stocks. Goal Planning has worked and will work in the future as well. Money needs to be pulled out gradually only when you reach near your goal.

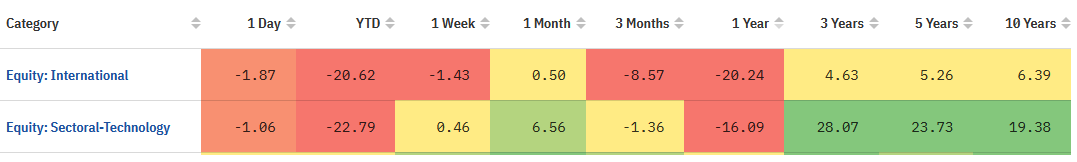

All said and done, not all mutual funds are right for you and the right mutual fund needs to be chosen based on the risks that you are willing to take and based on your risk profile. Similar to any process, this needs to be reviewed on a yearly basis. In fact, the international funds and technology funds have done remarkably poor. I am quite positive that technology funds would do a come back but international funds have geopolitical risks and though they could potentially come back but would take more time than technology funds.

In case you would like to understand more about my services , please go through this document or you could email me.