Top performing funds in HDFC AMC

Reshaping HDFC Mutual Fund: Insights and Remarkable Performance

HDFC Mutual Fund, a prominent player in the Indian asset management industry, has undergone a remarkable transformation in recent months. In this article, we explore the key factors behind HDFC Mutual Fund’s resurgence, as well as the insights shared by Navneet Munot, the Chief Investment Officer, regarding the company’s future direction. We also delve into the impressive performance of select HDFC funds and analyze the strategies employed to achieve such outstanding results.

Expanding the Investor Base

He emphasizes the importance of increasing the number of unique investors in the mutual fund industry. In his interview, he articulates his vision to grow the investor base tenfold in the next decade. HDFC Mutual Fund are putting across strategies which can attract a wider range of investors, thereby ensuring sustainable growth and reducing dependence on a few large investors.

Managing Leadership Transition

With Prashant Jain stepping down, a renowned fund manager, from HDFC Mutual Fund raised concerns among investors. Munot’s ability to effectively manage the leadership transition and maintain continuity in investment strategies is critical for preserving investor confidence and fund performance. I believe that the fund performance is already showing the results and the efforts that have been put in the last 1 year.

Driving Domestic Equity Flows

The new CIO of HDFC AMC, an advocate of India’s economic self-reliance, emphasizes the significance of boosting domestic equity flows. He believes that necessary regulatory reforms and investor education initiatives are required to achieve this objective. By strengthening the domestic equity market, HDFC Mutual Fund can play a pivotal role in supporting India’s economic growth.

Remarkable Performance of HDFC Funds

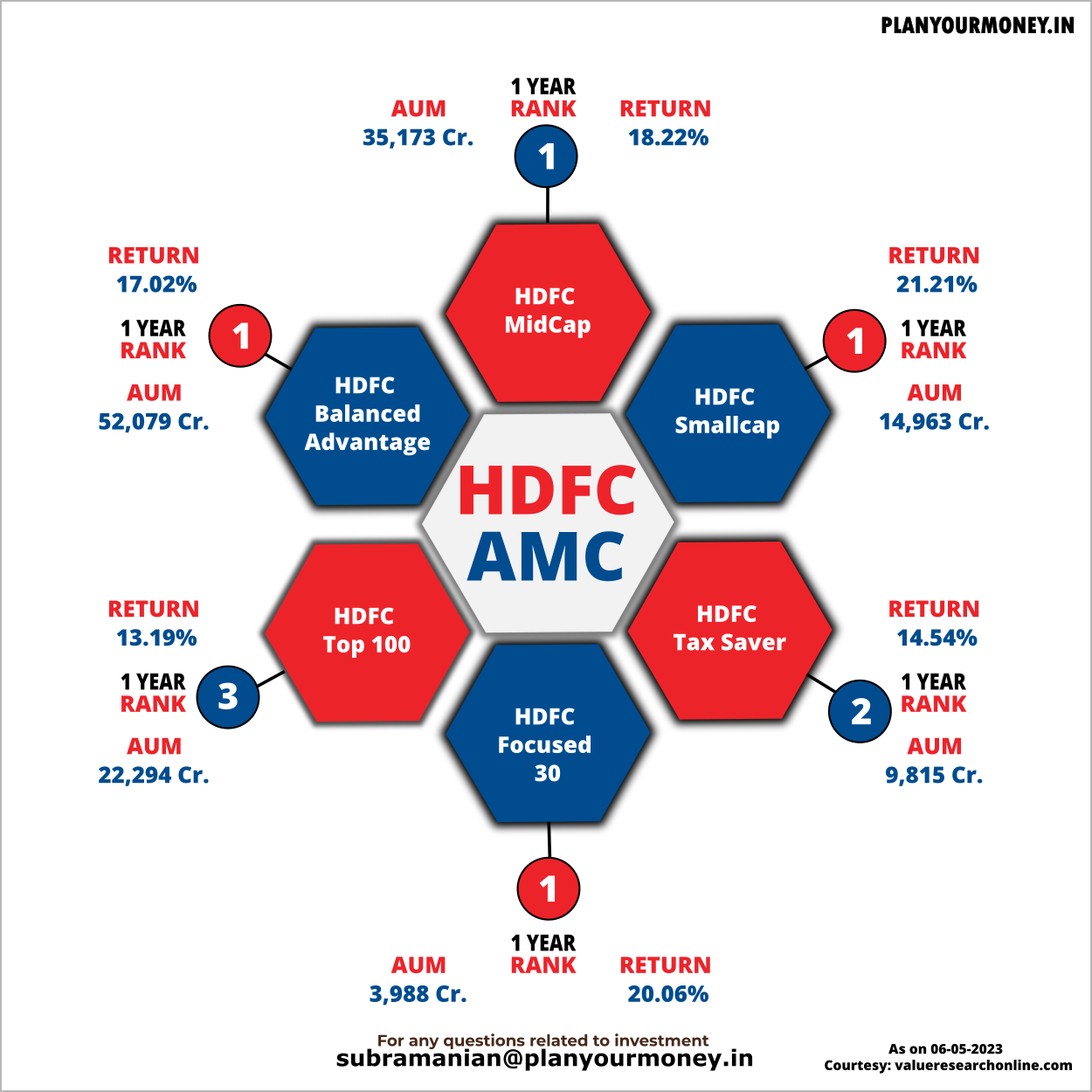

Several HDFC funds have demonstrated exceptional performance. We highlight some of these funds, including HDFC Top 100, HDFC Focused 30, HDFC Tax Saver, HDFC Smallcap, HDFC Midcap, and HDFC Balanced Advantage Fund.

- HDFC MidCap has been a top performer with a 1-year return of 18.22% and with an AUM of 35173 cr.

- HDFC Smallcap has been a top performer with a 1-year return of 21.21% and with an AUM of 14963 cr.

- HDFC Balanced Advantage again doing really well with a 1-year return of 17.02% and with an AUM of 52079 cr.

- HDFC Top 100 which has been a huge hit in the early 2000-2010 is once again doing well in the large-cap space with a return of 13.19% and an AUM of 22,294 cr

- HDFC Focused 30 with an AUM of close to 4000 crores has given a return of 20%

- HDFC Tax Saver which has seen changes in their fund manager has also performed really well and has given a return of 14.54% with an overall AUM of 9815 cr.

Reinforcing Trust: Customer Recommendations

About 6 to 8 months back, when I had recommended HDFC Funds to customers they were initially skeptical. However, the recent performance of HDFC Mutual Fund’s has changed customer perceptions and the significance of building trust in the industry. To achieve impressive performance, HDFC Mutual Fund has adopted an aggressive approach, taking calculated risks and demonstrating conviction in the economy and various industries. Some of their good picks in stocks include ITC, Indian Hotels, ICICI Bank, Axis Bank, Infosys etc…

Conclusion

The recent turnaround of HDFC Mutual Fund, coupled with the insights shared by Navneet Munot, present a promising path forward for the organization. By expanding the investor base, managing leadership transitions effectively, and driving domestic equity flows, HDFC Mutual Fund can further strengthen its position in the market. Additionally, the exceptional performance of select HDFC funds highlights the fund’s potential to deliver consistent returns. With an unwavering commitment to strategic growth and innovative investment approaches, HDFC Mutual Fund is poised for continued success in the Indian asset management landscape