Credit Risk Funds

What is Credit Risk Fund ?

Credit Risk funds - the name itself - conjures a mental image that one should not “risk” their money in such funds. When the name itself has “risk” , then the fund itself must be “very risky” . Such kind of imagination and biases will drive us away from the fund, despite the fact that they may give very good returns. However, one needs to check whether , such funds are a “true fit” for an individual .

What are Credit Risk Funds ?

Credit risk funds are debt funds which invest in securities which have low credit score. It is important to understand what we mean by low credit score.

For example,

TN Power Finance gives a return of 8.00% over a period of 5 years. This is a Government institution. Given the returns in FD, this would be really a good place to invest your money. Juxtapose this with any Credit Risk Mutual Fund and with all the bias, more often than not, you would choose to invest in TN Power Finance . However, the rating of TN Power Finance is given as A-. You would be surprised that credit risk funds may not even invest in “risky funds” like TN Power Finance. Generally the average credit rating of funds would be AA.

What are the risks in debt funds ?

There are three types of risks mainly in debt funds:

Interest Rate Risk

The price of bonds vary based on the interest rate. In the last 1 year , we have seen a huge interest rate drop due to COVID. Due to interest rate drop, generally, we tend to see bond prices go up. NAV of debt mutual fund is also dependent upon coupon rate and maturity of the security.

Liquidity Risk

Liquidity of bonds is comparatively poorer than equity. However the size of bond market is massive. Equity markets haven’t reached the size of bond markets yet. However, trading of bond papers is more common among institutions and their liquidity sometimes could be poor. Liquidity risk is basically the risk of being unable to convert your asset into cash.

Re-investment Risk

You have invested money in FD and received interest, but the interest rates have gone down. The interest that you have now received will yield a lesser interest. This is known as re-investment risk.

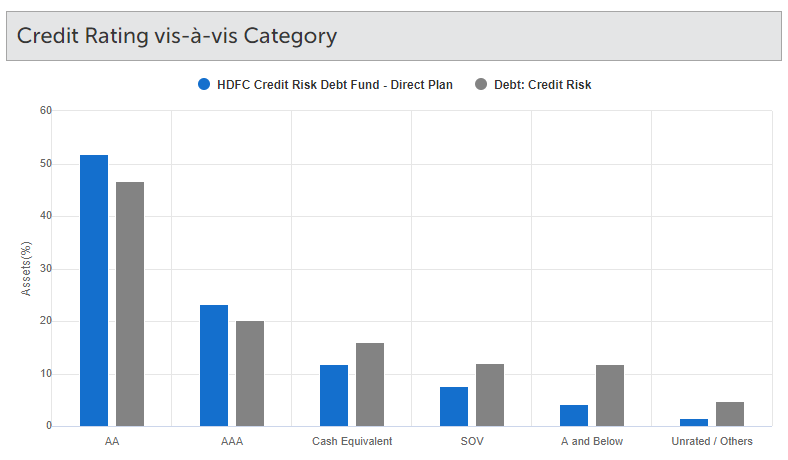

Where do credit risk funds invest ?

Below is an example of HDFC Credit risk fund and the classification of the credit rating of companies. Overall less than 5% of the AUM goes into companies which are A and unrated. You can see more details of the companies here

HDFC Credit Risk

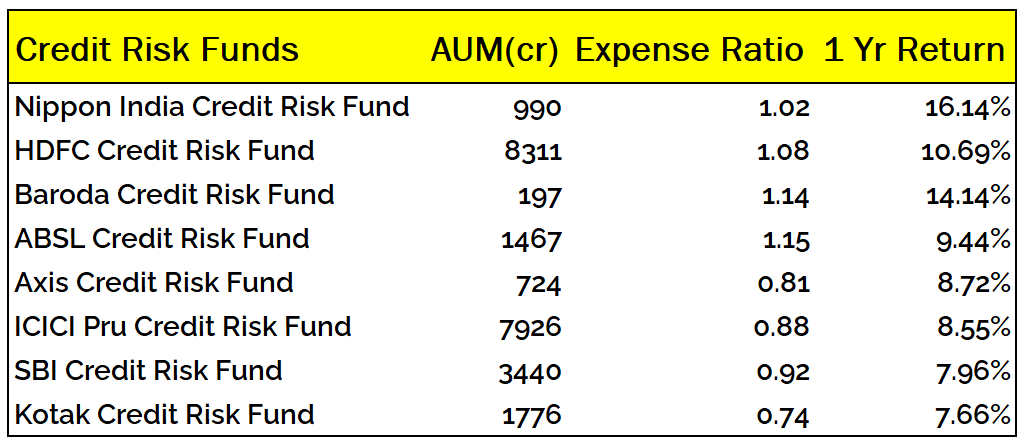

What credit risk funds are available ?

I have listed few credit risk funds and as you can see the returns vary from 7 to 17%. Return is based on the risk each fund manager is willing to take.

Credit Risk Funds

Positives

There are positives in Credit Risk Fund as follows :

- Average rating of credit risk funds are generally AA or higher

- Returns from credit riks funds could be in double digits or higher when interest rates are higher

- Fund manager is able to choose good quality companies offering attractive returns

Naysayers

Many do not consider credit risk funds as part of their portfolio. Their arguments are as follows :

- If you plan to take so much risk, why not invest in equity funds !

- Chances of default of paying bond interest are higher

- Reward received is not commensurate to risk taken

Risk is definitely high as compared to other debt funds.

Conclusion

Credit risk funds are riskier than other debt funds but at the same time provides a better return as well. If your risk tolerance allows you, you should constitute a small portion of your money towards such funds. This improves your return in your debt portfolio. If you invest in debt mutual funds , I would suggest not more than 5% of your overall portfolio to be distributed in such funds. However, this also depends on your risk profile.