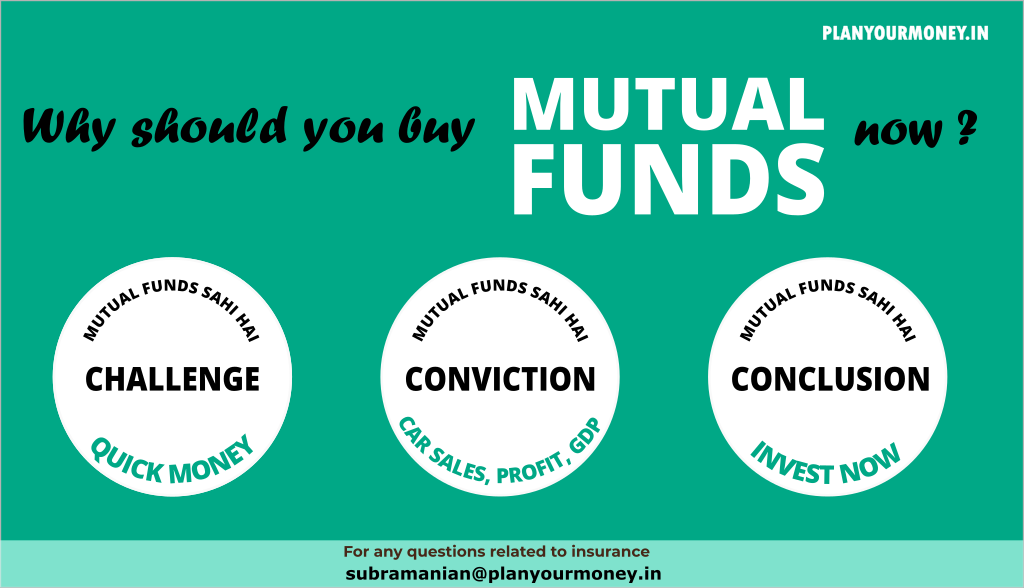

Unveiling the Untapped Potential: Why Investors Must Embrace Mutual Funds Now

Compelling reasons to invest in mutual fund !

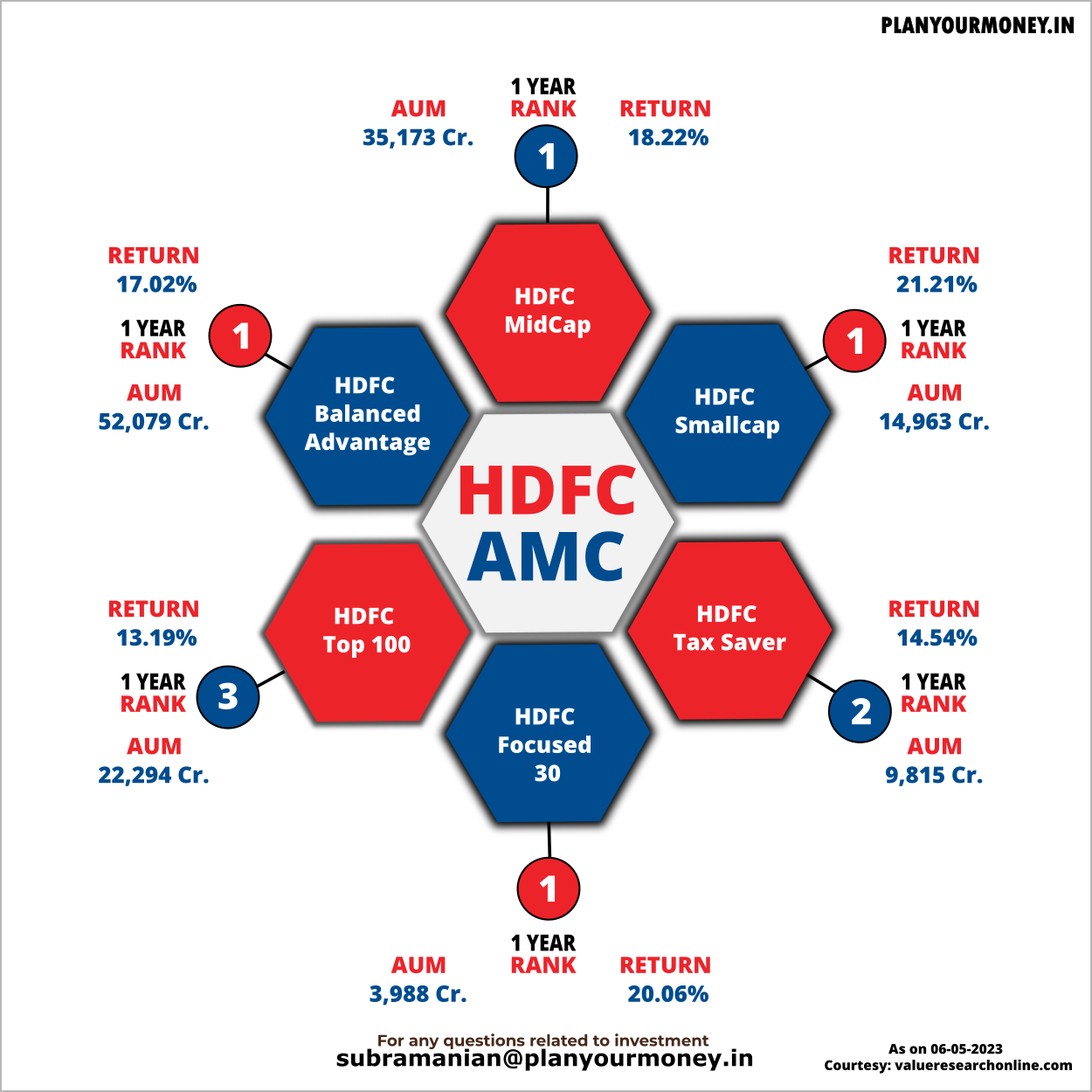

In the vast realm of investment opportunities, there is one that stands out but often goes noticed but sometimes overlooked by investors: mutual funds. It is high time to explore the compelling reasons why you, as an investor, should seriously consider embracing mutual funds. By thoroughly examining data related to passports, mutual fund holders, car sales, GDP, and more, we can present a vivid picture of the immense potential waiting to be seized. Recently, I had the privilege of attending a meeting hosted by HDFC Mutual Fund where they shared impressive data emphasizing the untapped opportunity for investors to engage with mutual funds. With this message, I aim to reach potential investors like you and encourage you to seriously consider investing in mutual funds.