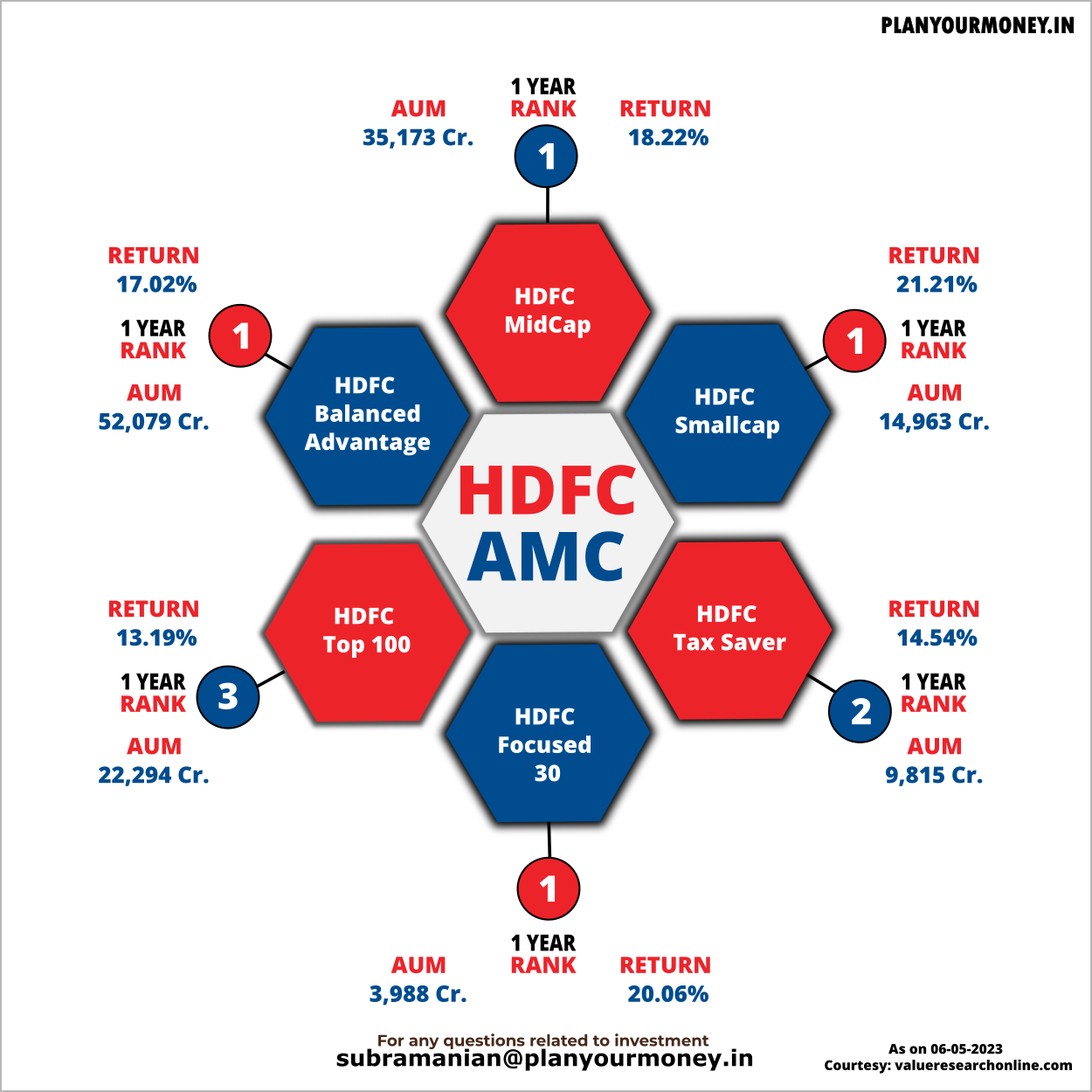

Top performing funds in HDFC AMC

Reshaping HDFC Mutual Fund: Insights and Remarkable Performance

HDFC Mutual Fund, a prominent player in the Indian asset management industry, has undergone a remarkable transformation in recent months. In this article, we explore the key factors behind HDFC Mutual Fund’s resurgence, as well as the insights shared by Navneet Munot, the Chief Investment Officer, regarding the company’s future direction. We also delve into the impressive performance of select HDFC funds and analyze the strategies employed to achieve such outstanding results.